Question: Please help with this question!! 12. Renee Harris has a portfolio that includes both traditional and alternative assets. She is interested in adding farmland to

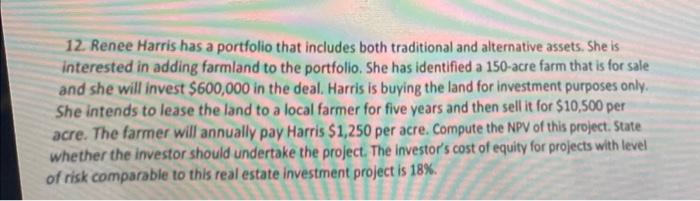

12. Renee Harris has a portfolio that includes both traditional and alternative assets. She is interested in adding farmland to the portfolio. She has identified a 150-acre farm that is for sale and she will invest $600,000 in the deal. Harris is buying the land for investment purposes only. She intends to lease the land to a local farmer for five years and then sell it for $10,500 per acre. The farmer will annually pay Harris $1,250 per acre. Compute the NPV of this project. State whether the investor should undertake the project. The investor's cost of equity for projects with level of risk comparable to this real estate investment project is 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts