Question: please help with this question 3-30 Shortly after Murray began working in the tax department of the public accounting firm of Dewey, Cheatham, and Howe,

please help with this question

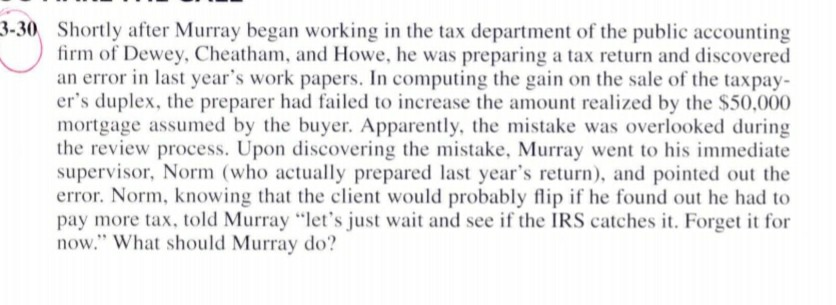

3-30 Shortly after Murray began working in the tax department of the public accounting firm of Dewey, Cheatham, and Howe, he was preparing a tax return and discovered an error in last year's work papers. In computing the gain on the sale of the taxpay- er's duplex, the preparer had failed to increase the amount realized by the $50,000 mortgage assumed by the buyer. Apparently, the mistake was overlooked during the review process. Upon discovering the mistake, Murray went to his immediate supervisor, Norm (who actually prepared last year's return), and pointed out the error. Norm, knowing that the client would probably flip if he found out he had to pay more tax, told Murray "let's just wait and see if the IRS catches it. Forget it for now." What should Murray do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts