Question: Please help with this question (a) and (b). 2. Suppose there are two independent risk factors governing securities returns according to the two factor APT.

Please help with this question (a) and (b).

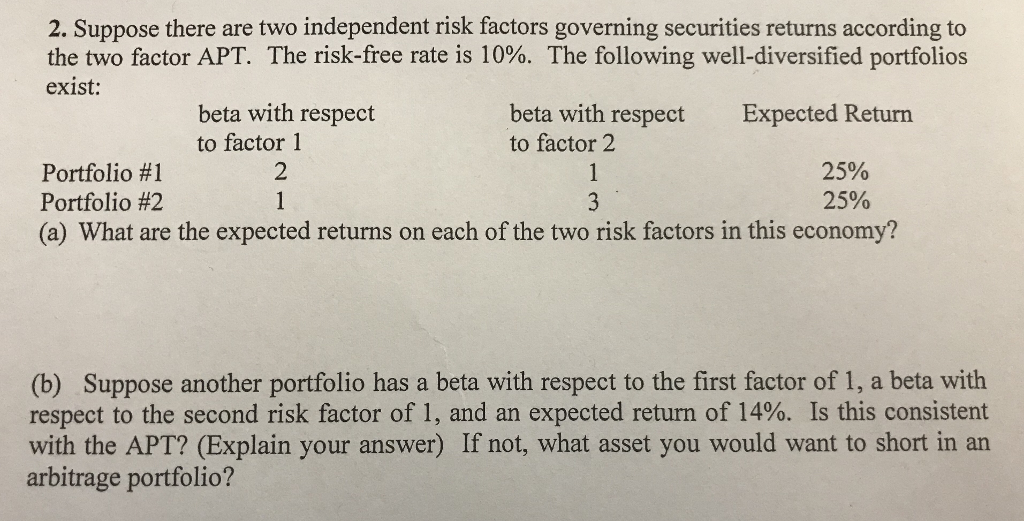

2. Suppose there are two independent risk factors governing securities returns according to the two factor APT. The risk-free rate is 10%. The following well-diversified portfolios exist: beta with respect to factor1 beta with respect to factor 2 Expected Return Portfolio #1 Portfolio #2 (a) What are the expected returns on each of the two risk factors in this economy? 25% 25% 2 (b) Suppose another portfolio has a beta with respect to the first factor of 1, a beta with respect to the second risk factor of 1, and an expected return of 14%. Is this consistent with the APT? (Explain your answer) If not, what asset you would want to short in an arbitrage portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts