Question: Please help with this question a. Explain how Cynthia Bui can profit in each of the following cases. Demonstrate that she would have no future

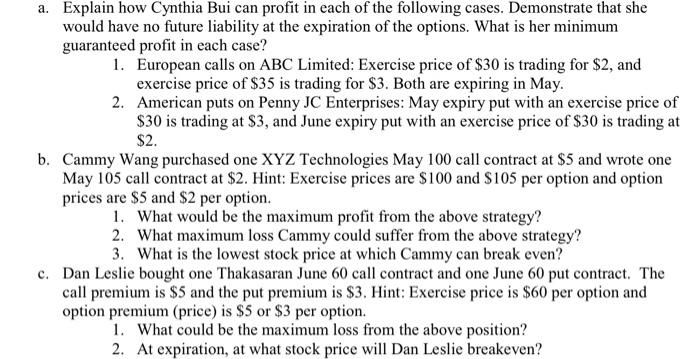

a. Explain how Cynthia Bui can profit in each of the following cases. Demonstrate that she would have no future liability at the expiration of the options. What is her minimum guaranteed profit in each case? 1. European calls on ABC Limited: Exercise price of $30 is trading for $2, and exercise price of $35 is trading for $3. Both are expiring in May. 2. American puts on Penny JC Enterprises: May expiry put with an exercise price of $30 is trading at $3, and June expiry put with an exercise price of $30 is trading at $2. b. Cammy Wang purchased one XYZ Technologies May 100 call contract at $5 and wrote one May 105 call contract at $2. Hint: Exercise prices are $100 and $105 per option and option prices are $5 and $2 per option. 1. What would be the maximum profit from the above strategy? 2. What maximum loss Cammy could suffer from the above strategy? 3. What is the lowest stock price at which Cammy can break even? c. Dan Leslie bought one Thakasaran June 60 call contract and one June 60 put contract. The call premium is $5 and the put premium is $3. Hint: Exercise price is $60 per option and option premium (price) is $5 or $3 per option. 1. What could be the maximum loss from the above position? 2. At expiration, at what stock price will Dan Leslie breakeven

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts