Question: Please help with this question, all information needed is given. B. Interpretation of the subsurface model Once you have drawn both cross sections, try to

Please help with this question, all information needed is given.

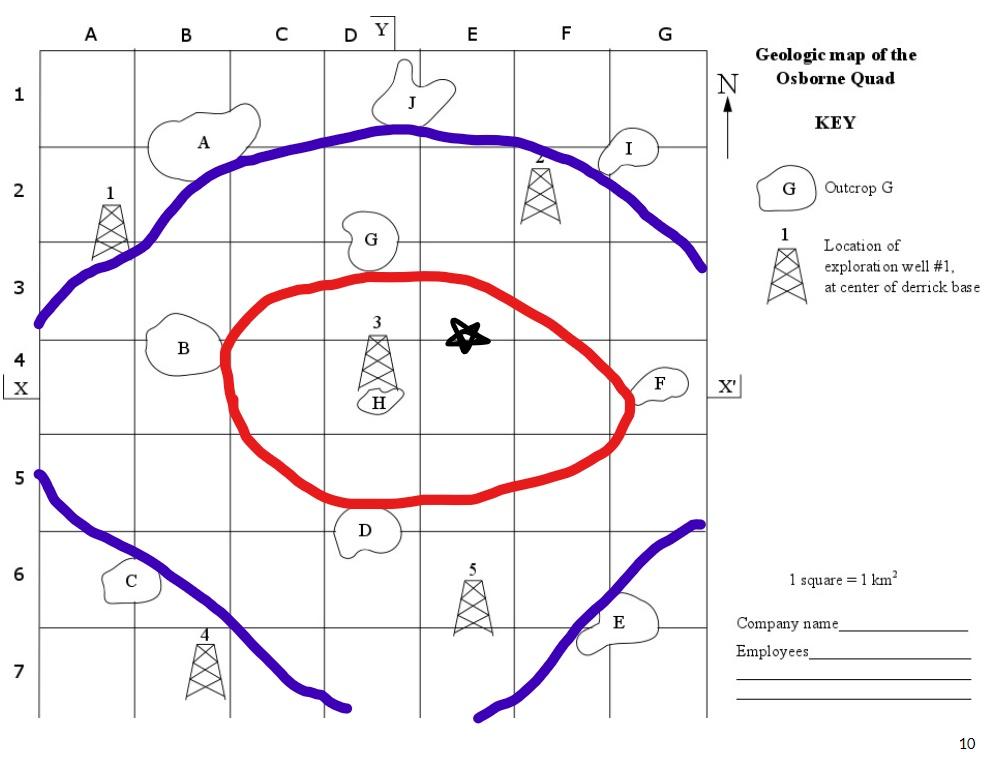

B. Interpretation of the subsurface model Once you have drawn both cross sections, try to visualize what the subsurface geology looks like in three dimensions by combining both cross sections. When you have done this, try to figure out where a potential oil trap is likely to be. It is now a simple matter of figuring out which of the available wells (shown as oil derricks that are numbered 1 to 5) you would like to drill to prove your geologic model of the Osborn Quadrangle. Select a well to drill, your TA will tell you if you discovered oil! Remember that only 30% of the exploration wells that are drilled are successful. (1pt) Oil well #. C. Oil Reservoir Your oil reservoir is approximately 100 meters thick. Indicate where the oil is trapped on your cross sections. Make sure to add the oil to your legend. (3pts) Part 3: Economics (28 pts) Note: for necessary calculations in the part of the assignment, assume that the current price of oil is $120 a barrel. If you have chosen an exploration well that has discovered oil, you now want to determine if it is economical to proceed to develop the prospect. In other words, will you make money by drilling the required additional "production" wells? These production wells are used to extract as much oil as possible from the ground, typical oil industry recovery factor is 30 A. Income calculation In order to determine the total amount of income that will be generated from the oil field, the amount of oil that can be recovered at the surface must be calculated. The volume of oil in the ground must first be determined, by multiplying the (thickness of the reservoir (you have been given this)) X (the area of the oil reservoir) X (a recovery factor (RF)). Show your work in the questions below. 1. To determine the area of the oil reservoir, assume that it is the same area that you have mapped lithology H on your geologic map. Count the number of squares covered by lithology H(+/1/2 square), and that will provide an estimate of the area of the oil reservoir in km2. (2pts) 2. Determine the volume of the reservoir by multiplying the area you just determined by the thickness of the reservoir (you will need to convert m to km, there are 1000000m2 in 1km2 ). Then convert m3 to barrels of oil. (3pts) 3.5=350,000,000 3. It is never possible to retrieve all of the oil in the reservoir, so we must calculate the recoverable amount of oil. To do this multiply the volume of the reservoir by the recovery factor. A typical recovery factor that is used by a real oil company is 30% of the oil in place. (2pts) 4. The income generated is then calculated by multiplying the amount of recoverable oil (in barrels) times the current price (\$) per barrel. Assume that the current price of oil is $120/ barrel (2pts) B. Recommendation Cost of exploration and production: a) Exploration costs: The exploration well(s) that you drilled cost $2 million each. You used 10 kilometers of seismic data @ $100,000 per km. You sent a team of field geologists to the Osborn Quad, at a cost of $150,000. Your salaries, as highly qualified geologists scaled to the time that you spent working on this activity, are $75,000 per person in your company. What are your total exploration costs? (4pts) b) Production costs: For every 200,000 barrels of oil in the ground, you will need to drill one production well, which will cost $3 million each. You will need to pay for environmental protection services and equipment, costing $2 per barrel of oil produced. You will need to ship the oil to refineries, costing $4 per barrel. It will take 5 years to produce all the oil in the field, so you will have to pay for leasing the land, at $100,000 per year for 5 years. Additional pumping and maintenance costs of $50,000 per year for the five year life of the field need to be accounted for. What are your total exploration costs? (4pt) 7 c) Calculate a break-even cost. The break-even cost is the minimum amount of income - and therefore the minimum amount of oil recovered at the current price - that is required to cover total costs, consisting of both fixed and variable costs to the company. This will you to evaluate the risk of this oil play. (1pts) Minimum income needed: d) Compare the total expected costs for producing the field to the total expected income. Would you recommend to management that the field should be developed? Think about how things change if the Osborn Quadrangle was in Canada vs. being in the middle east? How do world affairs affect oil price and the costs for development and shipping? Submit your recommendation to your manager (a,k,a. your TA). (10pts) 1 square =1km2 mpany name iployees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts