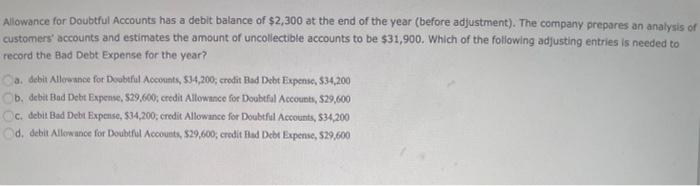

Question: Please help with this question! Allowance for Doubtful Accounts has a debit balance of $2,300 at the end of the year (before adjustment). The company

Allowance for Doubtful Accounts has a debit balance of $2,300 at the end of the year (before adjustment). The company prepares an analysis of customers' accounts and estimates the amount of uncollectible accounts to be $31,900. Which of the following adjusting entries is needed to record the Bad Debt Expense for the year? Ca debit Allowance for Doubtful Accounts, $34,200, credit Bad Doht Expenso, $34,200 D. debit ad Debt Expense, $29,600 credit Allowance for Doubtful Accounts, $29,600 C. debit Bad Debt Expense, $34,200, credit Allowance for Doubtful Accounts, 534,200 d. debit Allowance for Doubtful Accounts, $29,600, credit Bed Debt Expense, 529,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts