Question: Please help with this question and provide explanation to how you come to the answers as well! thank you Dobson Manufacturing Company uses a job

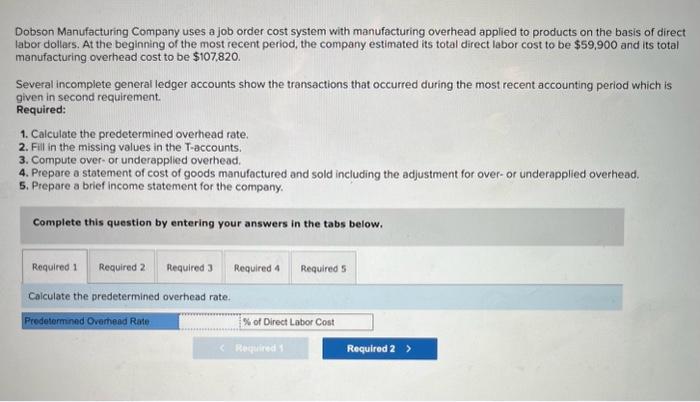

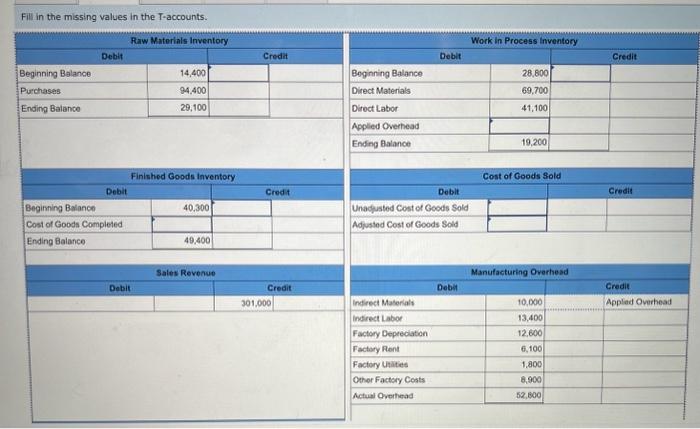

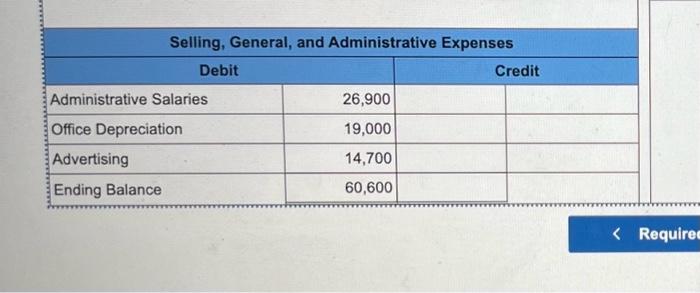

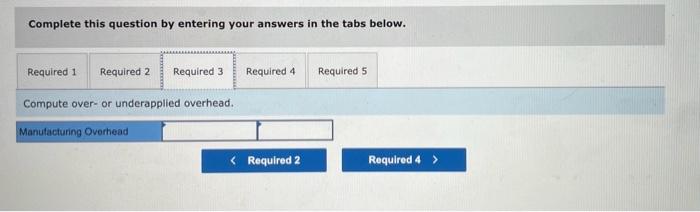

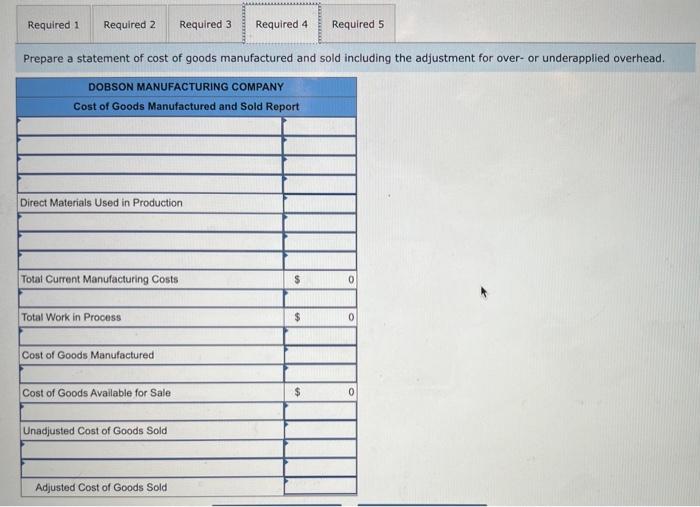

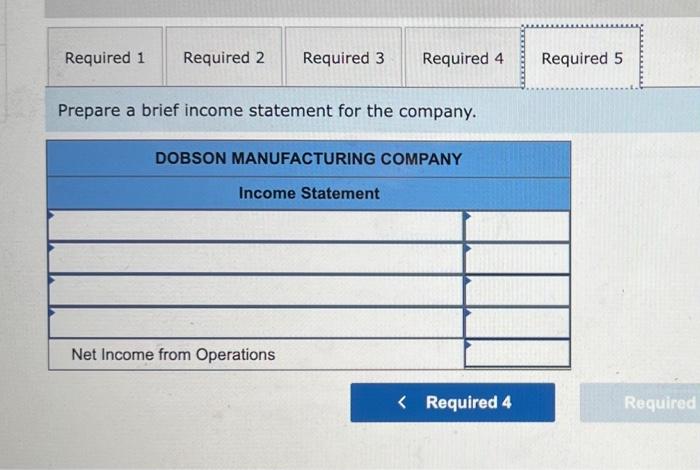

Dobson Manufacturing Company uses a job order cost system with manufacturing overhead applied to products on the basis of direct labor dollars. At the beginning of the most recent period, the company estimated its total direct labor cost to be $59,900 and its total manufacturing overhead cost to be $107,820. Several incomplete general ledger accounts show the transactions that occurred during the most recent accounting period which is given in second requirement. Required: 1. Calculate the predetermined overhead rate. 2. Fill in the missing values in the T-accounts. 3. Compute over- or underapplied overhead. 4. Prepare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. 5. Prepare a brief income statement for the company. Complete this question by entering your answers in the tabs below. Calculate the predetermined overhead rate. Fill in the missing values in the T-accounts. Selling, General, and Administrative Expenses \begin{tabular}{|l|r|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Administrative Salaries & 26,900 & \\ \hline Office Depreciation & 19,000 & \\ \hline Advertising & 14,700 & \\ \hline Ending Balance & 60,600 & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Compute over- or underapplied overhead. epare a statement of cost of goods manufactured and sold including the adjustment for over-or underapplied overhead. Prepare a brief income statement for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts