Question: Please help with this question, detail explanation would be great as this exercise doesn't have answer for me to check. Thank you! Question Three: Wyken

Please help with this question, detail explanation would be great as this exercise doesn't have answer for me to check. Thank you!

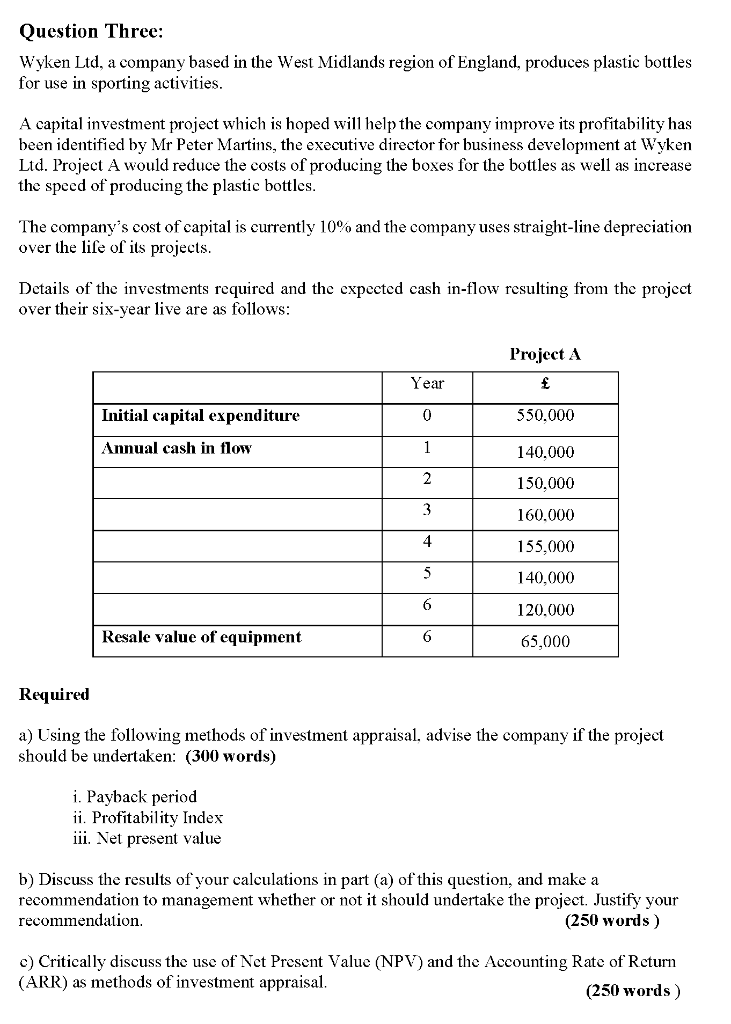

Question Three: Wyken Ltd, a company based in the West Midlands region of England, produces plastic bottles for use in sporting activities. A capital investment project which is hoped will help the company improve its profitability has been identified by Mr Peter Martins, the executive director for business development at Wyken Ltd. Project A would reduce the costs of producing the boxes for the bottles as well as increase the speed of producing the plastic bottles. The company's cost of capital is currently 10% and the company uses straight-line depreciation over the life of its projects. Details of the investments required and the expected cash in-flow resulting from the project over their six-year live are as follows: Project A Year Initial capital expenditure 0 550.000 Annual cash in flow 140.000 2 150,000 3 160.000 4 155,000 5 140,000 6 120.000 Resale value of equipment 6 65,000 Required a) Using the following methods of investment appraisal, advise the company if the project should be undertaken: (300 words) i. Payback period ii. Profitability Index iii. Net present value b) Discuss the results of your calculations in part (a) of this question, and make a recommendation to management whether or not it should undertake the project. Justify your recommendation. (250 words ) c) Critically discuss the use of Net Present Value (NPV) and the Accounting Rate of Return (ARR) as methods of investment appraisal. (250 words )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts