Question: Please help with this question. I have provided the drop down options for the statement. Thank you. Concord Company Limited reported the following for 2023:

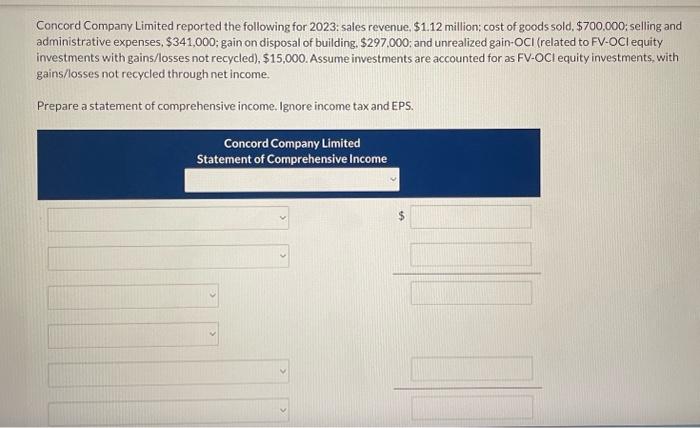

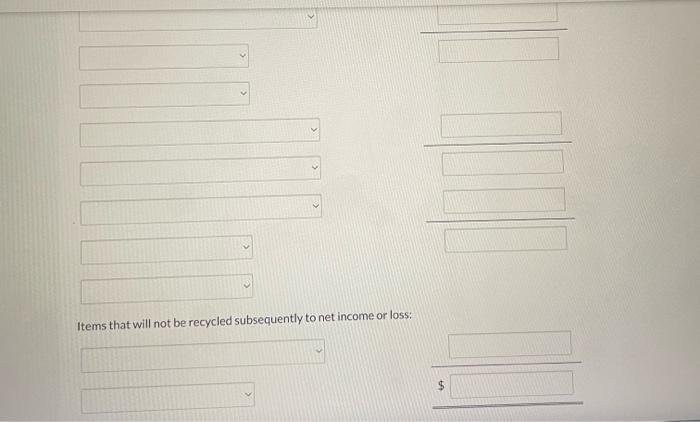

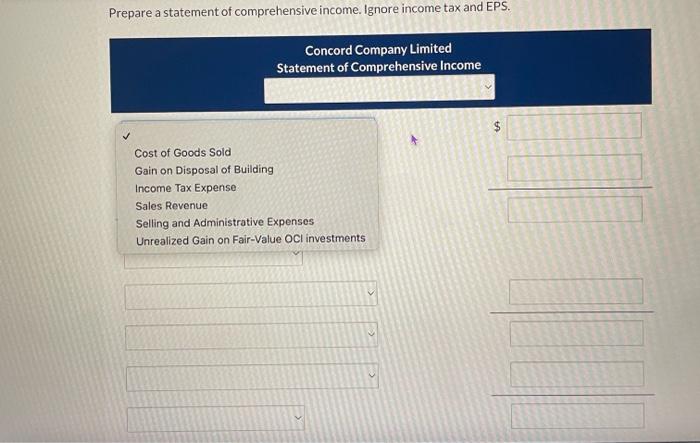

Concord Company Limited reported the following for 2023: sales revenue, $1.12 million; cost of goods sold, $700.000; selling and administrative expenses, $341,000; gain on disposal of building, $297,000; and unrealized gain-OCl (related to FV-OCl equity investments with gains/losses not recycled), $15,000. Assume investments are accounted for as FV-OCl equity investments, with gains/losses not recycled through net income. Prepare a statement of comprehensive income. Ignore income tax and EPS. Items that will not be recycled subsequently to net income or loss: Prepare a statement of comprehensive income. Ignore income tax and EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts