Question: please help with this question. please also include the formulas and deep explanations On 1 January 2019, Makhumalo bought a new Toyota Auris Hybrid at

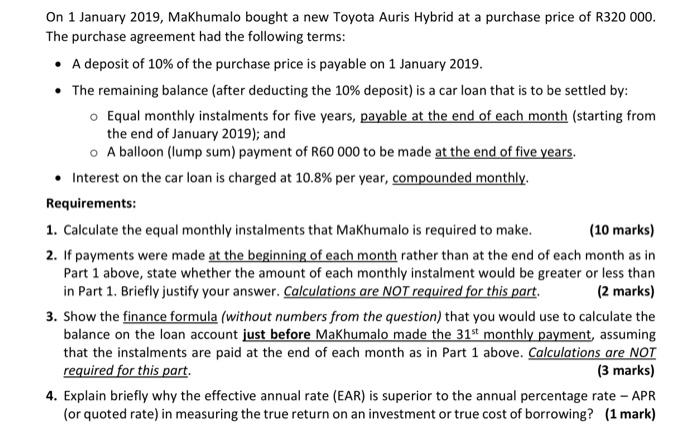

On 1 January 2019, Makhumalo bought a new Toyota Auris Hybrid at a purchase price of R320 000. The purchase agreement had the following terms: A deposit of 10% of the purchase price is payable on 1 January 2019. The remaining balance (after deducting the 10% deposit) is a car loan that is to be settled by: o Equal monthly instalments for five years, payable at the end of each month (starting from the end of January 2019); and o A balloon (lump sum) payment of R60 000 to be made at the end of five years. Interest on the car loan is charged at 10.8% per year, compounded monthly Requirements: 1. Calculate the equal monthly instalments that Makhumalo is required to make. (10 marks) 2. If payments were made at the beginning of each month rather than at the end of each month as in Part 1 above, state whether the amount of each monthly instalment would be greater or less than in Part 1. Briefly justify your answer. Calculations are NOT required for this part. (2 marks) 3. Show the finance formula (without numbers from the question) that you would use to calculate the balance on the loan account just before Makhumalo made the 31st monthly payment, assuming that the instalments are paid at the end of each month as in Part 1 above. Calculations are NOT required for this part (3 marks) 4. Explain briefly why the effective annual rate (EAR) is superior to the annual percentage rate - APR (or quoted rate) in measuring the true return on an investment or true cost of borrowing? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts