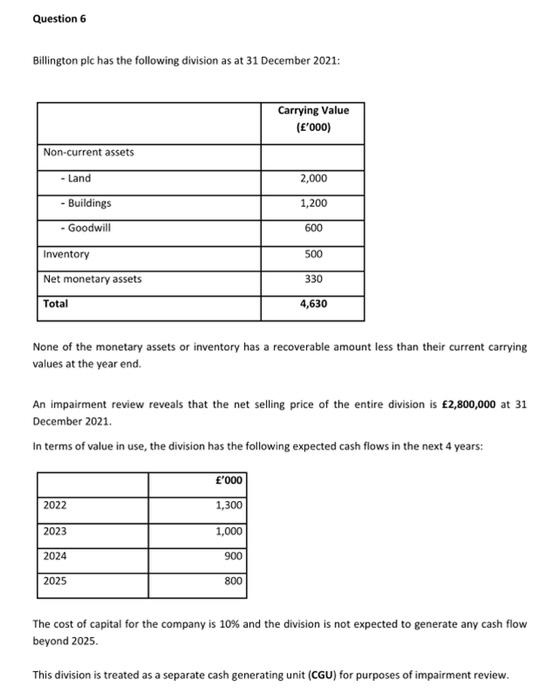

Question: Please help with this question :) Question 6 Billington plc has the following division as at 31 December 2021: Carrying Value ('000) 2,000 Non-current assets

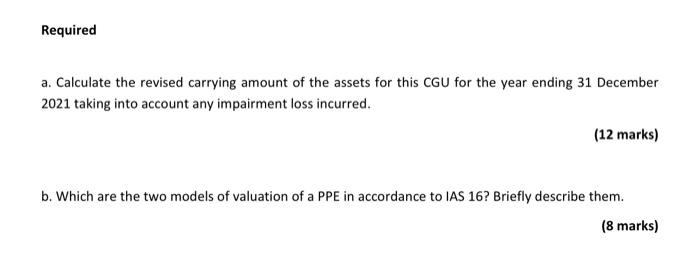

Question 6 Billington plc has the following division as at 31 December 2021: Carrying Value ('000) 2,000 Non-current assets - Land - Buildings - Goodwill 1,200 600 Inventory 500 Net monetary assets 330 Total 4,630 None of the monetary assets or inventory has a recoverable amount less than their current carrying values at the year end. An impairment review reveals that the net selling price of the entire division is 2,800,000 at 31 December 2021. In terms of value in use, the division has the following expected cash flows in the next 4 years: '000 2022 1,300 2023 1,000 2024 900 2025 800 The cost of capital for the company is 10% and the division is not expected to generate any cash flow beyond 2025 This division is treated as a separate cash generating unit (CGU) for purposes of impairment review. Required a. Calculate the revised carrying amount of the assets for this CGU for the year ending 31 December 2021 taking into account any impairment loss incurred. (12 marks) b. Which are the two models of valuation of a PP in accordance to IAS 16? Briefly describe them. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts