Question: please help with this question Sena works for S Jay Inc. in Alberta. He earns $36,400.00 per year and is paid bi-weekly. His federal and

please help with this question

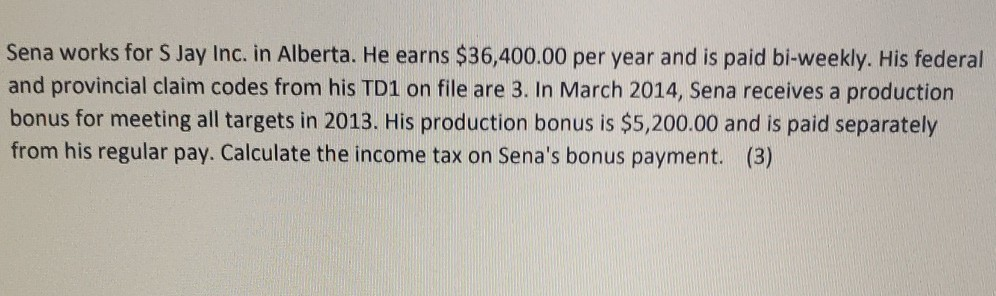

Sena works for S Jay Inc. in Alberta. He earns $36,400.00 per year and is paid bi-weekly. His federal and provincial claim codes from his TD1 on file are 3. In March 2014, Sena receives a production bonus for meeting all targets in 2013. His production bonus is $5,200.00 and is paid separately from his regular pay. Calculate the income tax on Sena's bonus payment. (3) Sena works for S Jay Inc. in Alberta. He earns $36,400.00 per year and is paid bi-weekly. His federal and provincial claim codes from his TD1 on file are 3. In March 2014, Sena receives a production bonus for meeting all targets in 2013. His production bonus is $5,200.00 and is paid separately from his regular pay. Calculate the income tax on Sena's bonus payment. (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts