Question: Please help with this question, thank you so much! During 2020, Fascom Inc. had several transactions relating to common stock. January 15: Declared a property

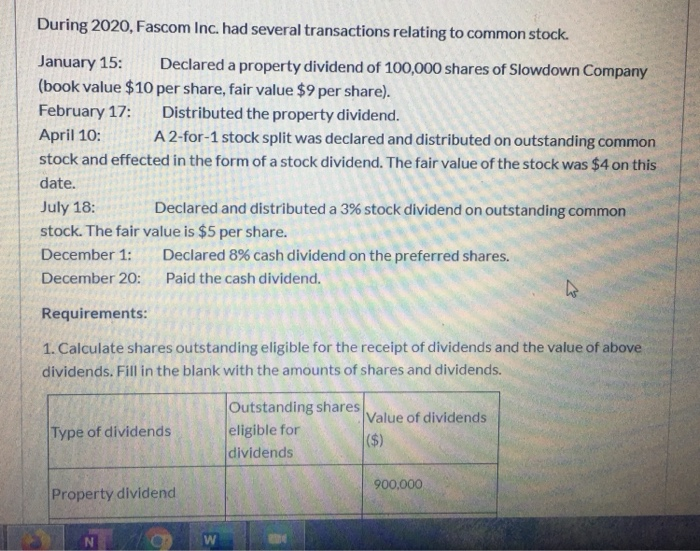

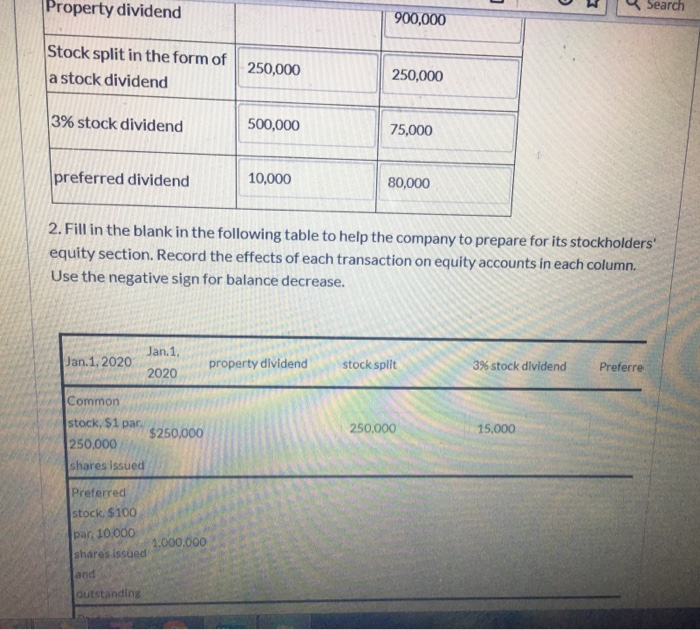

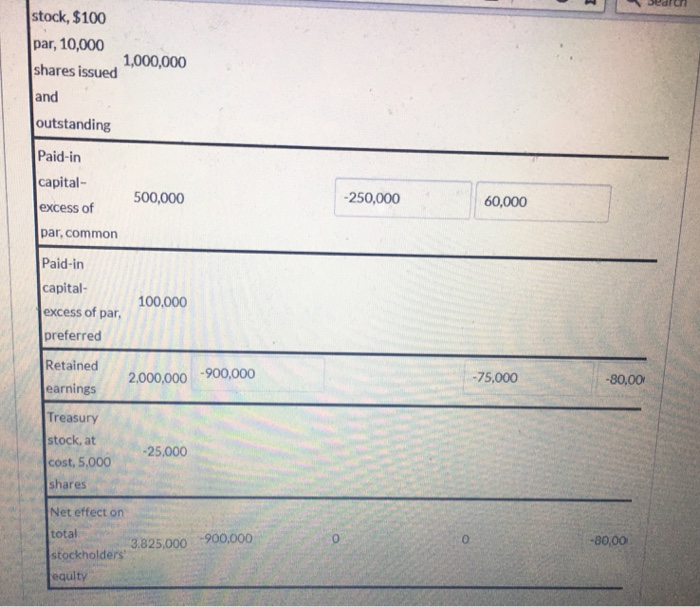

During 2020, Fascom Inc. had several transactions relating to common stock. January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $10 per share, fair value $9 per share). February 17: Distributed the property dividend. April 10: A2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair value of the stock was $4 on this date. July 18: Declared and distributed a 3% stock dividend on outstanding common stock. The fair value is $5 per share. December 1: Declared 8% cash dividend on the preferred shares. December 20: Paid the cash dividend. Requirements: 1. Calculate shares outstanding eligible for the receipt of dividends and the value of above dividends. Fill in the blank with the amounts of shares and dividends. Outstanding shares Value of dividends Type of dividends eligible for ($) dividends 900.000 Property dividend N W Property dividend Search 900,000 Stock split in the form of a stock dividend 250,000 250,000 3% stock dividend 500,000 75,000 preferred dividend 10,000 80,000 2. Fill in the blank in the following table to help the company to prepare for its stockholders' equity section. Record the effects of each transaction on equity accounts in each column. Use the negative sign for balance decrease. Jan.1,2020 Jan. 1. 2020 property dividend stock split 3% stock dividend Preferre Common stock, $1 par $250,000 250,000 shares issued 250,000 15,000 Preferred stock. $100 par 10.000 1.000.000 shares issued and outstanding 1,000,000 stock, $100 par, 10,000 shares issued and outstanding Paid-in capital- excess of 500,000 -250,000 60,000 par, common Paid-in capital- excess of par preferred 100,000 Retained earnings 2,000,000 -900,000 -75,000 -80,00 Treasury stock, at cost, 5.000 shares -25.000 Net effect on total stockholders equity 3.825,000 -900,000 -80,00 During 2020, Fascom Inc. had several transactions relating to common stock. January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $10 per share, fair value $9 per share). February 17: Distributed the property dividend. April 10: A2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair value of the stock was $4 on this date. July 18: Declared and distributed a 3% stock dividend on outstanding common stock. The fair value is $5 per share. December 1: Declared 8% cash dividend on the preferred shares. December 20: Paid the cash dividend. Requirements: 1. Calculate shares outstanding eligible for the receipt of dividends and the value of above dividends. Fill in the blank with the amounts of shares and dividends. Outstanding shares Value of dividends Type of dividends eligible for ($) dividends 900.000 Property dividend N W Property dividend Search 900,000 Stock split in the form of a stock dividend 250,000 250,000 3% stock dividend 500,000 75,000 preferred dividend 10,000 80,000 2. Fill in the blank in the following table to help the company to prepare for its stockholders' equity section. Record the effects of each transaction on equity accounts in each column. Use the negative sign for balance decrease. Jan.1,2020 Jan. 1. 2020 property dividend stock split 3% stock dividend Preferre Common stock, $1 par $250,000 250,000 shares issued 250,000 15,000 Preferred stock. $100 par 10.000 1.000.000 shares issued and outstanding 1,000,000 stock, $100 par, 10,000 shares issued and outstanding Paid-in capital- excess of 500,000 -250,000 60,000 par, common Paid-in capital- excess of par preferred 100,000 Retained earnings 2,000,000 -900,000 -75,000 -80,00 Treasury stock, at cost, 5.000 shares -25.000 Net effect on total stockholders equity 3.825,000 -900,000 -80,00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts