Question: please help with this question with journal enteries and retained earnings Question 3 Selected year-end account balances from the adjusted trial balance as of December

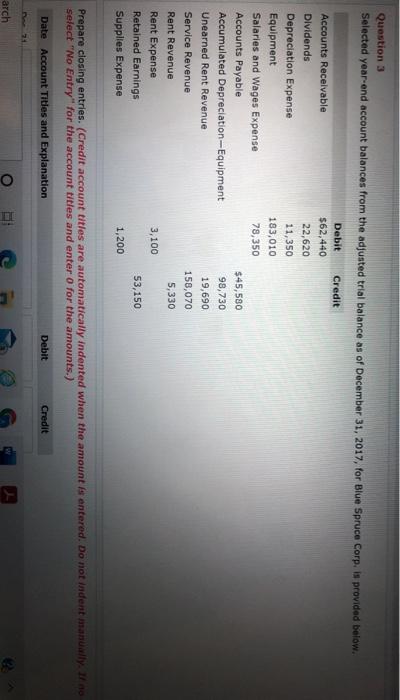

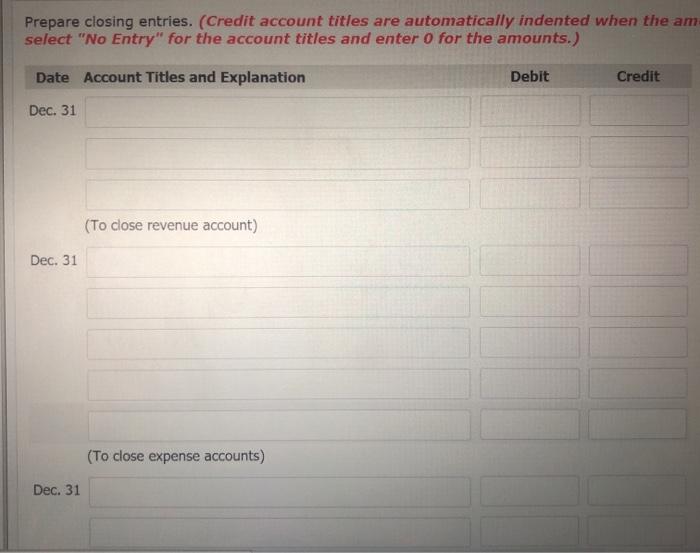

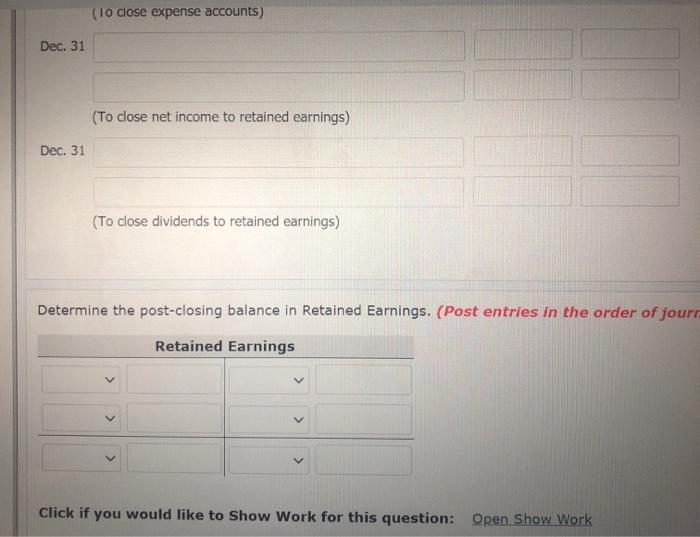

Question 3 Selected year-end account balances from the adjusted trial balance as of December 31, 2017, for Blue Spruce Corp. is provided below. Debit Credit Accounts Recelvable $62,440 Dividends 22,620 Depreciation Expense 11,350 Equipment 183,010 Salaries and Wages Expense 78,350 Accounts Payable $45,580 Accumulated Depreciation Equipment 98,730 Unearned Rent Revenue 19,690 Service Revenue 158,070 Rent Revenue 5,330 Rent Expense 3,100 Retained Earnings 53,150 Supplies Expense 1,200 Prepare closing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit arch O Prepare closing entries. (Credit account titles are automatically indented when the am select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 (To close revenue account) Dec. 31 (To close expense accounts) Dec. 31 (1o close expense accounts) Dec. 31 (To close net income to retained earnings) Dec. 31 (To close dividends to retained earnings) Determine the post-closing balance in Retained Earnings. (Post entries in the order of jour Retained Earnings Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts