Question: Please help with this table, questions from a to n. urce/content/0/EMA%20QUESTION%20PAPER%20-%2031%20MAY%202022.pdf 3/9 | 100% + Text Craft Ltd is analysing a proposed project with the

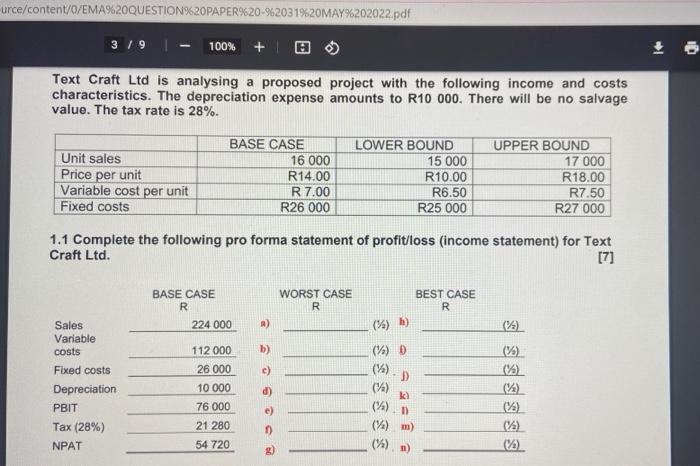

urce/content/0/EMA%20QUESTION%20PAPER%20-%2031%20MAY%202022.pdf 3/9 | 100% + Text Craft Ltd is analysing a proposed project with the following income and costs characteristics. The depreciation expense amounts to R10 000. There will be no salvage value. The tax rate is 28%. BASE CASE UPPER BOUND Unit sales Price per unit 16 000 R14.00 R 7.00 LOWER BOUND 15 000 R10.00 R6.50 17 000 R18.00 R7.50 Variable cost per unit Fixed costs R26 000 R25 000 R27 000 1.1 Complete the following pro forma statement of profit/loss (income statement) for Text Craft Ltd. [7] BASE CASE R WORST CASE R BEST CASE R (2) Sales Variable costs () Fixed costs () (1) Depreciation PBIT (1) Tax (28%) (1) NPAT (2) 224 000 112 000 26 000 10 000 76 000 21 280 54 720 a) b) c) d) e) 1) (3) h) (1) D (1) D) () k) (4). D) (1) m) (). B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts