Question: Please help with this TAX question! Thanks Problem 22-49 (LO 22-3) [The following information applies to the questions displayed below.) Winkin, Blinkin, and Nod are

Please help with this TAX question!

Thanks

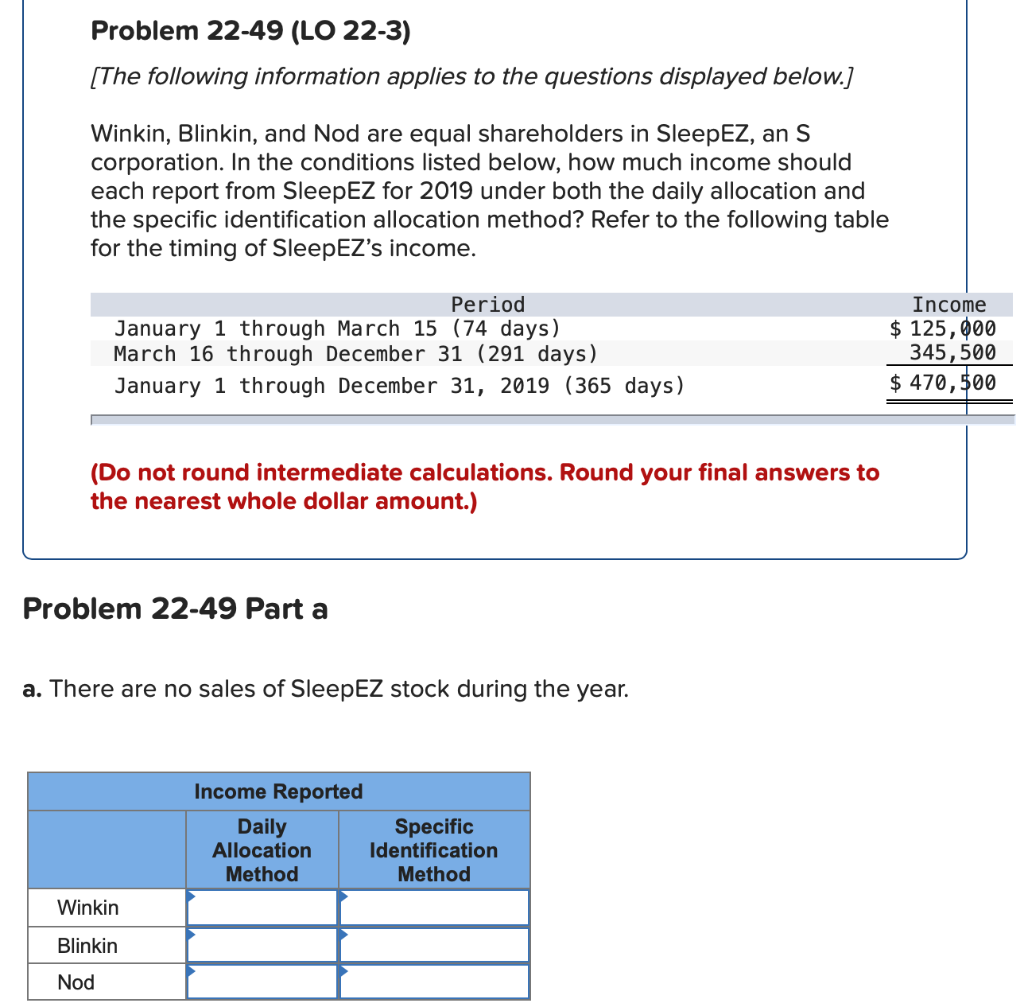

Problem 22-49 (LO 22-3) [The following information applies to the questions displayed below.) Winkin, Blinkin, and Nod are equal shareholders in SleepEZ, an S corporation. In the conditions listed below, how much income should each report from SleepEZ for 2019 under both the daily allocation and the specific identification allocation method? Refer to the following table for the timing of SleepEZs income. Period January 1 through March 15 (74 days) March 16 through December 31 (291 days) January 1 through December 31, 2019 (365 days) Income $ 125,000 345,500 $ 470,500 (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Problem 22-49 Part a a. There are no sales of SleepEZ stock during the year. Income Reported Daily Specific Allocation Identification Method Method Winkin Blinkin Nod Problem 22-49 Part b b. On March 15, 2019, Blinkin sells his shares to Nod. This is a numeric cell, so please enter numbers only. Wvu MGva Winkin Blinkin Nod

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts