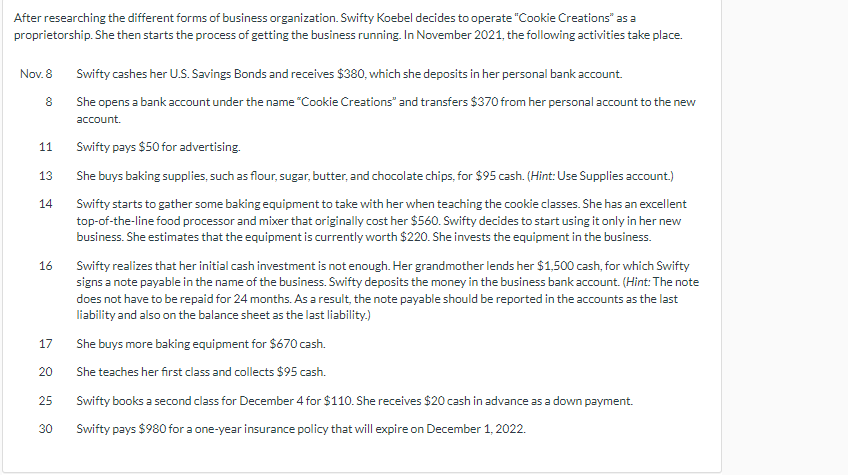

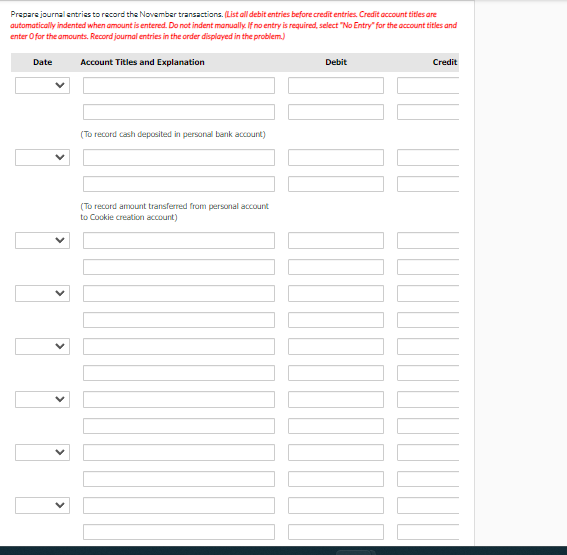

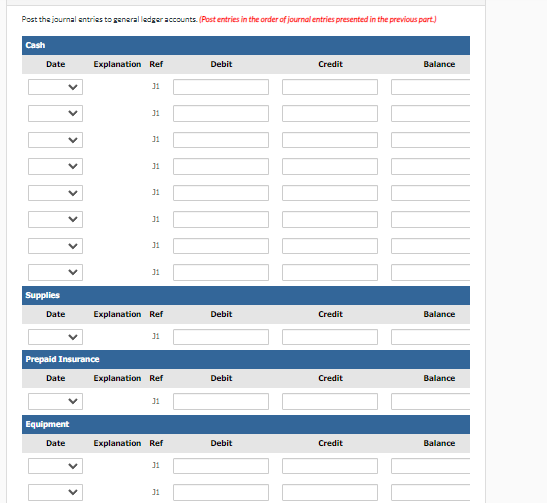

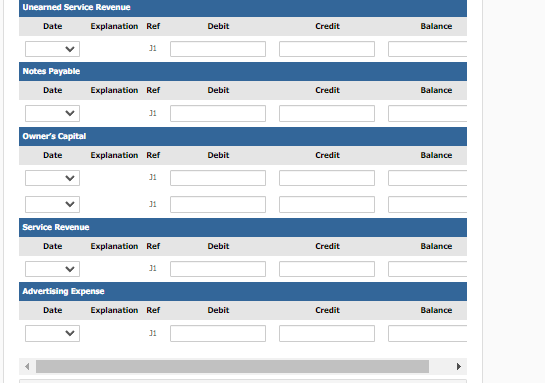

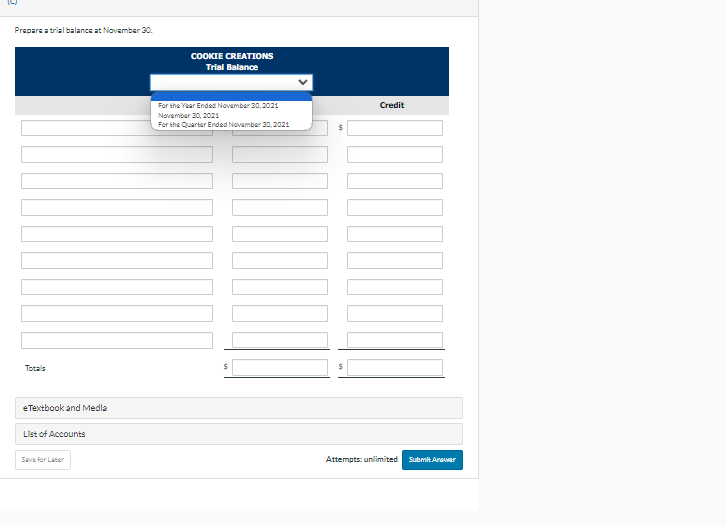

Question: PLease help with this. Thanks :) After researching the different forms of business organization. Swifty Koebel decides to operate Cookie Creations as a proprietorship. She

PLease help with this. Thanks :)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock