Question: Please help with this: The Assessment Please complete the full accounting cycle for: Cityscape Photography Studio is a small photography business located in a metropolitan

Please help with this:

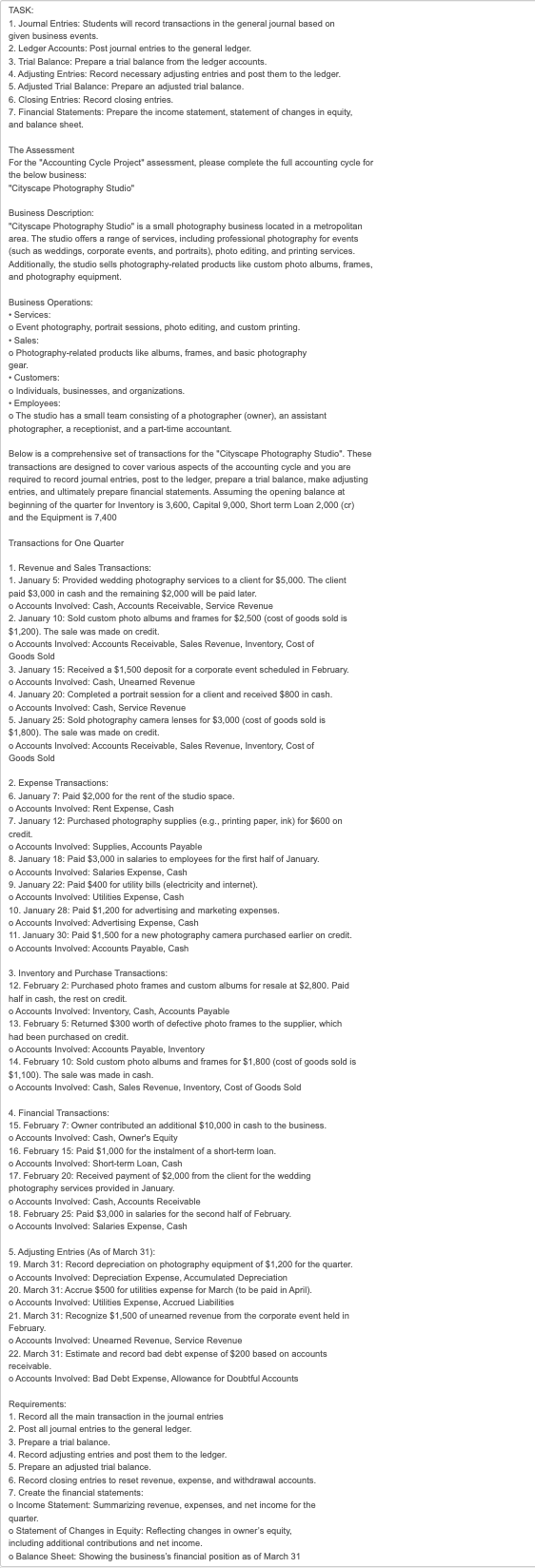

The Assessment

Please complete the full accounting cycle for:

"Cityscape Photography Studio" is a small photography business located in a metropolitan

area. The studio offers a range of services, including professional photography for events

such as weddings, corporate events, and portraits photo editing, and printing services.

Services:

o Event photography, portrait sessions, photo editing, and custom printing.

Sales:

o Photographyrelated products like albums, frames, and basic photography

gear.

Customers:

o Individuals, businesses, and organizations.

Employees:

o The studio has a small team consisting of a photographer owner an assistant

photographer, a receptionist, and a parttime accountant.

Below is a comprehensive set of transactions for the "Cityscape Photography Studio". Assuming the opening balance at

beginning of the quarter for Inventory is Capital Short term Loan cr

and the Equipment is

Transactions for One Quarter

Revenue and Sales Transactions:

January : Provided wedding photography services to a client for $ The client

paid $ in cash and the remaining $ will be paid later.

o Accounts Involved: Cash, Accounts Receivable, Service Revenue

January : Sold custom photo albums and frames for $cost of goods sold is

$ The sale was made on credit.

o Accounts Involved: Accounts Receivable, Sales Revenue, Inventory, Cost of

Goods Sold

January : Received a $ deposit for a corporate event scheduled in February.

o Accounts Involved: Cash, Unearned Revenue

January : Completed a portrait session for a client and received $ in cash.

o Accounts Involved: Cash, Service Revenue

January : Sold photography camera lenses for $cost of goods sold is

$ The sale was made on credit.

o Accounts Involved: Accounts Receivable, Sales Revenue, Inventory, Cost of

Goods Sold

Expense Transactions:

January : Paid $ for the rent of the studio space.

o Accounts Involved: Rent Expense, Cash

January : Purchased photography supplies eg printing paper, ink for $ on

credit.

o Accounts Involved: Supplies, Accounts Payable

January : Paid $ in salaries to employees for the first half of January.

o Accounts Involved: Salaries Expense, Cash

January : Paid $ for utility bills electricity and internet

o Accounts Involved: Utilities Expense, Cash

January : Paid $ for advertising and marketing expenses.

o Accounts Involved: Advertising Expense, Cash

January : Paid $ for a new photography camera purchased earlier on credit.

o Accounts Involved: Accounts Payable, Cash

Inventory and Purchase Transactions:

February : Purchased photo frames and custom albums for resale at $ Paid

half in cash, the rest on credit.

o Accounts Involved: Inventory, Cash, Accounts Payable

February : Returned $ worth of defective photo frames to the supplier, which

had been purchased on credit.

o Accounts Involved: Accounts Payable, Inventory

February : Sold custom photo albums and frames for $cost of goods sold is

$ The sale was made in cash.

o Accounts Involved: Cash, Sales Revenue, Inventory, Cost of Goods Sold

Financial Transactions:

February : Owner contributed an additional $ in cash to the business.

o Accounts Involved: Cash, Owner's Equity

February : Paid $ for the instalment of a shortterm loan.

o Accounts Involved: Shortterm Loan, Cash

February : Received payment of $ from the client for the wedding

photography services provided in January.

o Accounts Involved: Cash, Accounts Receivable

February : Paid $ in salaries for the second half of February.

o Accounts Involved: Salaries Expense, Cash

Adjusting Entries As of March :

March : Record depreciation on photography equipment of $ for the quarter.

o Accounts Involved: Depreciation Expense, Accumulated Depreciation

March : Accrue $ for utilities expense for March to be paid in April

o Accounts Involved: Utilities Expense, Accrued Liabilities

March : Recognize $ of unearned revenue from the corporate event held in

February.

o Accounts Involved: Unearned Revenue, Service Revenue

March : Estimate and record bad debt expense of $ based on accounts

receivable.

o Accounts Involved: Bad Debt Expense, Allowance for Doubtful Accounts

Requirements:

Record all the main transaction in the journal entries

Post all journal entries to the general ledger.

Prepare a trial balance.

Record adjusting entries and post them to the ledger.

Prepare an adjusted trial balance.

Record closing entries to reset revenue, expense, and withdrawal accounts.

Create the financial statements:

o Income Statement: Summarizing revenue, expenses, and net income for the

quarter.

o Statement of Changes in Equity: Reflecting changes in owners equity,

including additional contributions and net income.

o Balance Sheet: Showing the businesss financial position as of March

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock