Question: please help with Variable Manufacturing Overhead Variance and Fixed Manufacturing Variance. Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses

please help with Variable Manufacturing Overhead Variance and Fixed Manufacturing Variance.

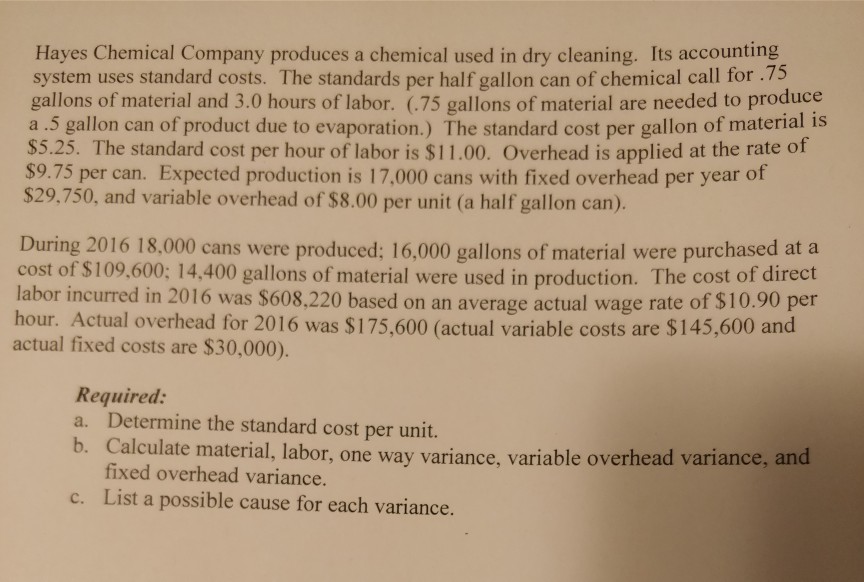

Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses standard costs. The standards per half gallon can of chemical call for .75 gallons of material and 3.0 hours of labor. (.75 gallons of material are needed to produce a .5 gallon can of product due to evaporation.) The standard cost per gallon of material is S5.25. The standard cost per hour of labor is $11.00. Overhead is applied at the rate of $9.75 per can. Expected production is 17,000 cans with fixed overhead per year of $29,750, and variable overhead of $8.00 per unit (a half gallon can). During 2016 18,000 cans were produced; 16,000 gallons of material were purchased at a cost of $109,600: 14,400 gallons of material were used in production. The cost of direct labor incurred in 2016 was s608,220 based on an average actual wage rate of $10.90 per hour. Actual overhead for 2016 was $175,600 (actual variable costs are $145,600 and actual fixed costs are $30,000). Required: a. Determine the standard cost per unit. b. Calculate material, labor, one way variance, variable overhead variance, and fixed overhead variance. c. List a possible cause for each variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts