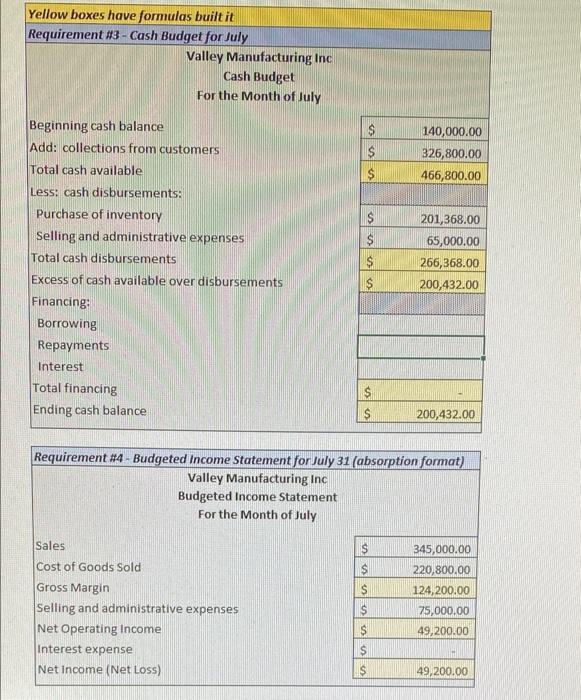

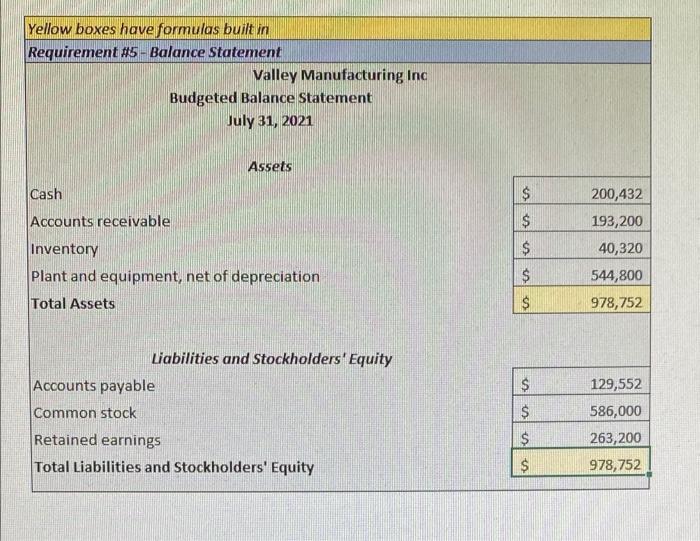

Question: please help with what i am doing wrong the cash budget ending balance should be $206,960 #4 Net operating income should be $63,000 #5 budgeted

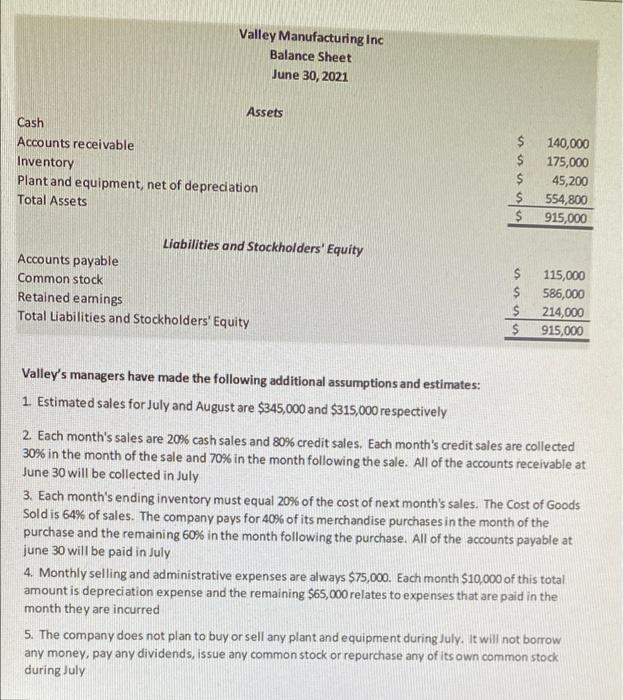

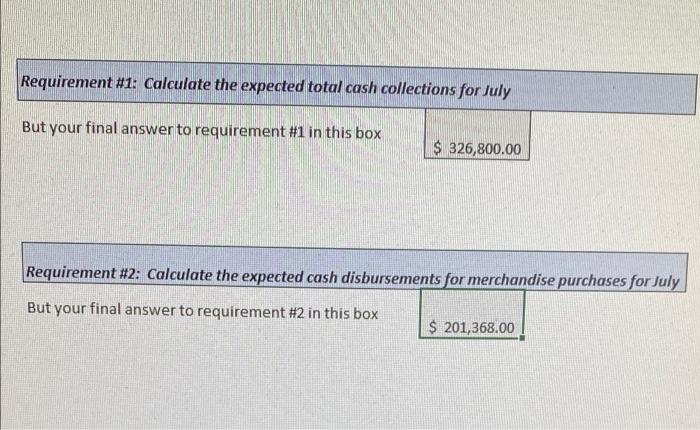

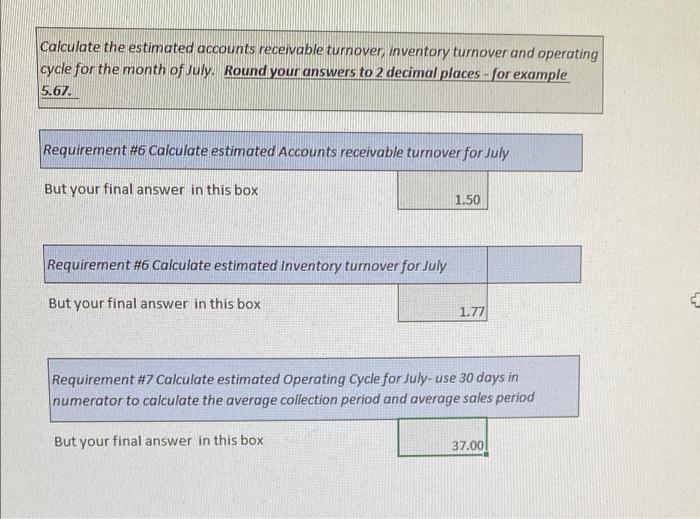

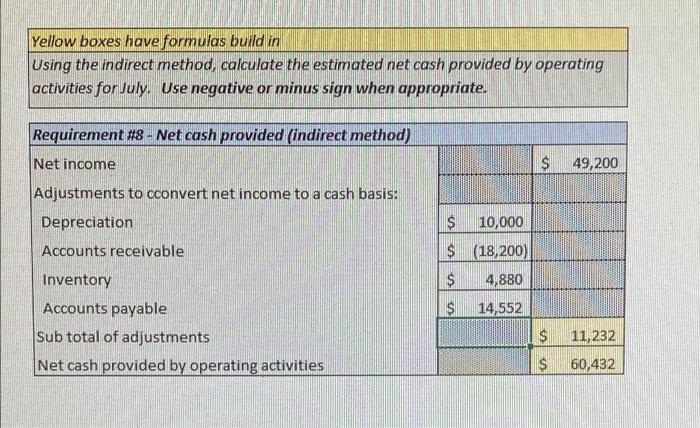

Valley Manufacturing Inc Balance Sheet June 30, 2021 $ Assets Cash Accounts receivable Inventory Plant and equipment, net of depreciation Total Assets 140,000 175,000 45,200 554,800 915,000 $ $ Liabilities and Stockholders' Equity Accounts payable Common stock Retained eamings Total Liabilities and Stockholders' Equity $ $ $ $ 115,000 586,000 214,000 915,000 Valley's managers have made the following additional assumptions and estimates: 1. Estimated sales for July and August are $345,000 and $315,000 respectively 2. Each month's sales are 20% cash sales and 80% credit sales. Each month's credit sales are collected 30% in the month of the sale and 70% in the month following the sale. All of the accounts receivable at June 30 will be collected in July 3. Each month's ending inventory must equal 20% of the cost of next month's sales. The cost of Goods Sold is 64% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of the accounts payable at june 30 will be paid in July 4. Monthly selling and administrative expenses are always $75,000. Each month $10,000 of this total amount is depreciation expense and the remaining $65,000 relates to expenses that are paid in the month they are incurred 5. The company does not plan to buy or sell any plant and equipment during July. It will not borrow any money, pay any dividends, issue any common stock or repurchase any of its own common stock during July Requirement #1: Calculate the expected total cash collections for July But your final answer to requirement #1 in this box 326,800.00 Requirement #2: Calculate the expected cash disbursements for merchandise purchases for July But your final answer to requirement #2 in this box $ 201,368.00 Yellow boxes have formulas built it Requirement #3 - Cash Budget for July Valley Manufacturing Inc Cash Budget For the Month of July $ S $ 140,000.00 326,800.00 466,800.00 Beginning cash balance Add: collections from customers Total cash available Less: cash disbursements: Purchase of inventory Selling and administrative expenses Total cash disbursements Excess of cash available over disbursements Financing: Borrowing Repayments Interest Total financing Ending cash balance $ $ S 201,368.00 65,000.00 266,368.00 200,432.00 $ $ 200,432.00 Requirement #4 - Budgeted Income Statement for July 31 (absorption format) Valley Manufacturing Inc Budgeted Income Statement For the Month of July $ $ S Sales Cost of Goods Sold Gross Margin Selling and administrative expenses Net Operating Income Interest expense Net Income (Net Loss) 345,000.00 220,800.00 124,200.00 75,000.00 49,200.00 S $ $ 49,200.00 Yellow boxes have formulas built in Requirement #5 - Balance Statement Valley Manufacturing Inc Budgeted Balance Statement July 31, 2021 Assets Cash $ Accounts receivable $ $ Inventory Plant and equipment, net of depreciation 200,432 193,200 40,320 544,800 978,752 $ $ Total Assets $ Liabilities and Stockholders' Equity Accounts payable Common stock $ 129,552 $ Retained earnings Total Liabilities and Stockholders' Equity $ $ 586,000 263,200 978,752 Calculate the estimated accounts receivable turnover, inventory turnover and operating cycle for the month of July. Round your answers to 2 decimal places-for example 5.67. Requirement #6 Calculate estimated Accounts receivable turnover for July But your final answer in this box 1.50 Requirement #6 Calculate estimated Inventory turnover for July But your final answer in this box E 1.77 Requirement #7 Calculate estimated Operating Cycle for July-use 30 days in numerator to calculate the average collection period and average sales period But your final answer in this box 37.00 Yellow boxes have formulas build in Using the indirect method, calculate the estimated net cash provided by operating activities for July. Use negative or minus sign when appropriate. $ 49,200 $ 10,000 Requirement #8 - Net cash provided (indirect method) Net income Adjustments to convert net income to a cash basis: Depreciation Accounts receivable Inventory Accounts payable Sub total of adjustments Net cash provided by operating activities $ (18,200) $ 4,880 $ 14,552 $ 11,232 $ 60,432 Required: 1. Calculate the expected cash collections for July 2. Calculate the expected cash disbursements for merchandise purchases for July 3. Prepare a cash budget for July 4. Prepare a budgeted Income Statement for the month ended J 31. Use an absorption format. 5. Prepare a budgeted Balance Sheet as of July 31 6. Calculate the estimated accounts receivable turnover and inventory turnover for the month of July

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts