Question: Please help with what I have gotten wrong so far. Hedge of Firm Commitment: Short in Commodity Futures On May 1, 2021, Keister, Inc., sells

Please help with what I have gotten wrong so far.

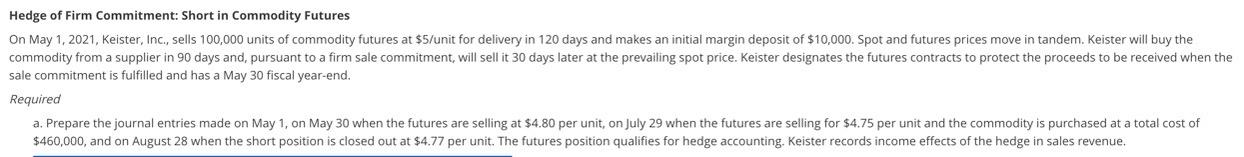

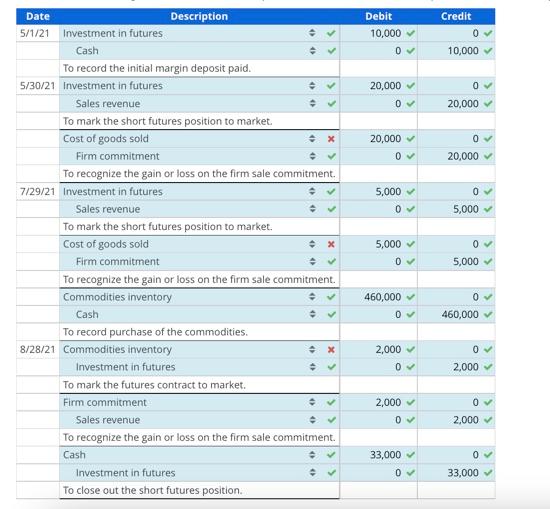

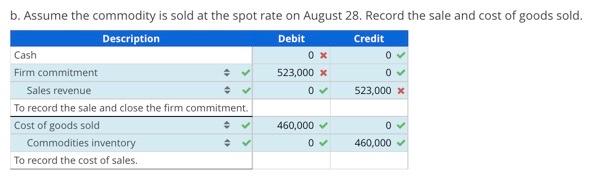

Hedge of Firm Commitment: Short in Commodity Futures On May 1, 2021, Keister, Inc., sells 100,000 units of commodity futures at $5/unit for delivery in 120 days and makes an initial margin deposit of $10,000. Spot and futures prices move in tandem. Keister will buy the commodity from a supplier in 90 days and pursuant to a firm sale commitment, will sell it 30 days later at the prevailing spot price. Keister designates the futures contracts to protect the proceeds to be received when the sale commitment is fulfilled and has a May 30 fiscal year-end. Required a. Prepare the journal entries made on May 1, on May 30 when the futures are selling at $4.80 per unit, on July 29 when the futures are selling for $4.75 per unit and the commodity is purchased at a total cost of $460,000, and on August 28 when the short position is closed out at $4.77 per unit. The futures position qualifies for hedge accounting. Keister records income effects of the hedge in sales revenue. Debit 10,000 0 Credit 0 10,000 e 20,000 0 20,000 20,000 O 0 20,000 > 0 5,000 0 5,000 0 Date Description 5/1/21 Investment in futures Cash To record the initial margin deposit paid. 5/30/21 Investment in futures Sales revenue To mark the short futures position to market. Cost of goods sold X Firm commitment To recognize the gain or loss on the firm sale commitment 7/29/21 Investment in futures Sales revenue To mark the short futures position to market. Cost of goods sold Firm commitment To recognize the gain or loss on the firm sale commitment. Commodities inventory Cash To record purchase of the commodities. 8/28/21 Commodities inventory X Investment in futures To mark the futures contract to market. Firm commitment Sales revenue To recognize the gain or loss on the firm sale commitment. Cash Investment in futures To close out the short futures position. 5,000 0 5,000 > > 460,000 0 0 460,000 2,000 0 0 2,000 2,000 0 > ) 2.000 33,000 0 33,000 0 b. Assume the commodity is sold at the spot rate on August 28. Record the sale and cost of goods sold. Description Debit Credit Cash OX Firm commitment 523,000 x Sales revenue 0 523,000 x To record the sale and close the firm commitment Cost of goods sold 460,000 Commodities inventory 0 460,000 To record the cost of sales. 0 Hedge of Firm Commitment: Short in Commodity Futures On May 1, 2021, Keister, Inc., sells 100,000 units of commodity futures at $5/unit for delivery in 120 days and makes an initial margin deposit of $10,000. Spot and futures prices move in tandem. Keister will buy the commodity from a supplier in 90 days and pursuant to a firm sale commitment, will sell it 30 days later at the prevailing spot price. Keister designates the futures contracts to protect the proceeds to be received when the sale commitment is fulfilled and has a May 30 fiscal year-end. Required a. Prepare the journal entries made on May 1, on May 30 when the futures are selling at $4.80 per unit, on July 29 when the futures are selling for $4.75 per unit and the commodity is purchased at a total cost of $460,000, and on August 28 when the short position is closed out at $4.77 per unit. The futures position qualifies for hedge accounting. Keister records income effects of the hedge in sales revenue. Debit 10,000 0 Credit 0 10,000 e 20,000 0 20,000 20,000 O 0 20,000 > 0 5,000 0 5,000 0 Date Description 5/1/21 Investment in futures Cash To record the initial margin deposit paid. 5/30/21 Investment in futures Sales revenue To mark the short futures position to market. Cost of goods sold X Firm commitment To recognize the gain or loss on the firm sale commitment 7/29/21 Investment in futures Sales revenue To mark the short futures position to market. Cost of goods sold Firm commitment To recognize the gain or loss on the firm sale commitment. Commodities inventory Cash To record purchase of the commodities. 8/28/21 Commodities inventory X Investment in futures To mark the futures contract to market. Firm commitment Sales revenue To recognize the gain or loss on the firm sale commitment. Cash Investment in futures To close out the short futures position. 5,000 0 5,000 > > 460,000 0 0 460,000 2,000 0 0 2,000 2,000 0 > ) 2.000 33,000 0 33,000 0 b. Assume the commodity is sold at the spot rate on August 28. Record the sale and cost of goods sold. Description Debit Credit Cash OX Firm commitment 523,000 x Sales revenue 0 523,000 x To record the sale and close the firm commitment Cost of goods sold 460,000 Commodities inventory 0 460,000 To record the cost of sales. 0

Step by Step Solution

There are 3 Steps involved in it

I will analyze the provided journal entries and compare them to the expected correct accounting treatment Analysis of the Given Journal Entries 1 May 1 2021 Initial Margin Deposit Entry Dr Investment ... View full answer

Get step-by-step solutions from verified subject matter experts