Question: Please help with what you can :-) ASSIGNMENT #2 The purpose of this assignment is to solidify your understanding on the applications of the risk

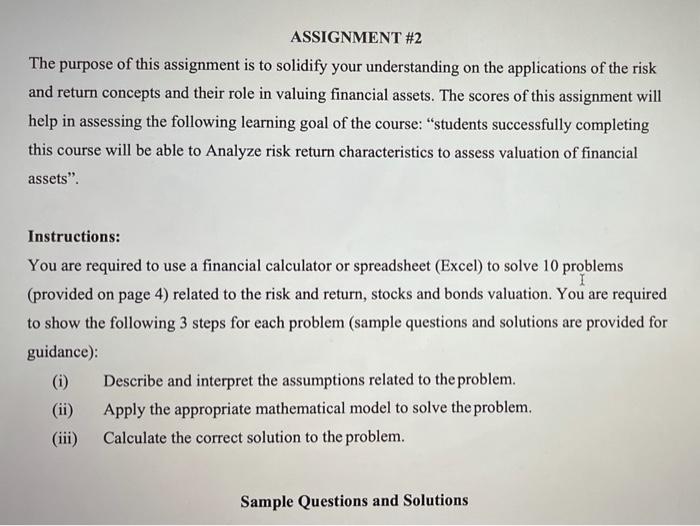

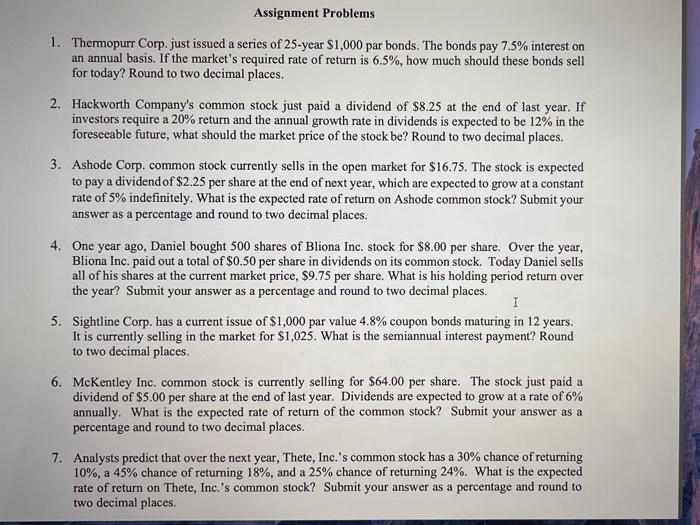

ASSIGNMENT #2 The purpose of this assignment is to solidify your understanding on the applications of the risk and return concepts and their role in valuing financial assets. The scores of this assignment will help in assessing the following learning goal of the course: "students successfully completing this course will be able to analyze risk return characteristics to assess valuation of financial assets". Instructions: You are required to use a financial calculator or spreadsheet (Excel) to solve 10 problems (provided on page 4) related to the risk and return, stocks and bonds valuation. You are required to show the following 3 steps for each problem (sample questions and solutions are provided for guidance): (i) Describe and interpret the assumptions related to the problem. (ii) Apply the appropriate mathematical model to solve the problem. (iii) Calculate the correct solution to the problem. Sample Questions and Solutions Assignment Problems 1. Thermopurr Corp.just issued a series of 25-year $1,000 par bonds. The bonds pay 7.5% interest on an annual basis. If the market's required rate of return is 6.5%, how much should these bonds sell for today? Round to two decimal places. 2. Hackworth Company's common stock just paid a dividend of $8.25 at the end of last year. If investors require a 20% return and the annual growth rate in dividends is expected to be 12% in the foreseeable future, what should the market price of the stock be? Round to two decimal places. 3. Ashode Corp. common stock currently sells in the open market for $16.75. The stock is expected to pay a dividend of $2.25 per share at the end of next year, which are expected to grow at a constant rate of 5% indefinitely. What is the expected rate of return on Ashode common stock? Submit your answer as a percentage and round to two decimal places. 4. One year ago, Daniel bought 500 shares of Bliona Inc. stock for $8.00 per share. Over the year, Bliona Inc. paid out a total of $0.50 per share in dividends on its common stock. Today Daniel sells all of his shares at the current market price, $9.75 per share. What is his holding period return over the year? Submit your answer as a percentage and round to two decimal places. 1 5. Sightline Corp. has a current issue of $1,000 par value 4.8% coupon bonds maturing in 12 years. It is currently selling in the market for $1,025. What is the semiannual interest payment? Round to two decimal places. 6. McKentley Inc. common stock is currently selling for $64.00 per share. The stock just paid a dividend of $5.00 per share at the end of last year. Dividends are expected to grow at a rate of 6% annually. What is the expected rate of return of the common stock? Submit your answer as a percentage and round to two decimal places. 7. Analysts predict that over the next year, Thete, Inc.'s common stock has a 30% chance of returning 10%, a 45% chance of returning 18%, and a 25% chance of returning 24%. What is the expected rate of return on Thete, Inc.'s common stock? Submit your answer as a percentage and round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts