Question: Please Help without using excel spreadsheets. Puccini Corporation is considering the acquisition of a new multicolor printing system at a cost of $300,000. The acquisition

Please Help without using excel spreadsheets.

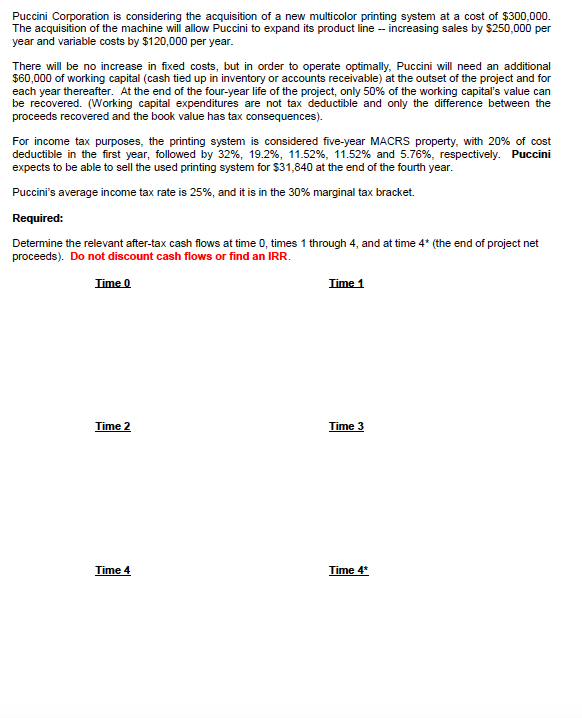

Puccini Corporation is considering the acquisition of a new multicolor printing system at a cost of $300,000. The acquisition of the machine will allow Puccini to expand its product line -- increasing sales by $250,000 per year and variable costs by $120,000 per year. There will be no increase in fixed costs, but in order to operate optimally, Puccini will need an additional $60,000 of working capital (cash tied up in inventory or accounts receivable) at the outset of the project and for each year thereafter. At the end of the four-year life of the project, only 50% of the working capital's value can be recovered. (Working capital expenditures are not tax deductible and only the difference between the proceeds recovered and the book value has tax consequences). For income tax purposes, the printing system is considered five-year MACRS property, with 20% of cost deductible in the first year, followed by 32%, 19.2%, 11.52%, 11.52% and 5.76%, respectively. Puccini expects to be able to sell the used printing system for $31,840 at the end of the fourth year. Puccini's average income tax rate is 25%, and it is in the 30% marginal tax bracket. Required: Determine the relevant after-tax cash flows at time 0, times 1 through 4, and at time 4* (the end of project net proceeds). Do not discount cash flows or find an IRR. Time I Time 1 Time 2 Time 3 Time 4 Time 4* Puccini Corporation is considering the acquisition of a new multicolor printing system at a cost of $300,000. The acquisition of the machine will allow Puccini to expand its product line -- increasing sales by $250,000 per year and variable costs by $120,000 per year. There will be no increase in fixed costs, but in order to operate optimally, Puccini will need an additional $60,000 of working capital (cash tied up in inventory or accounts receivable) at the outset of the project and for each year thereafter. At the end of the four-year life of the project, only 50% of the working capital's value can be recovered. (Working capital expenditures are not tax deductible and only the difference between the proceeds recovered and the book value has tax consequences). For income tax purposes, the printing system is considered five-year MACRS property, with 20% of cost deductible in the first year, followed by 32%, 19.2%, 11.52%, 11.52% and 5.76%, respectively. Puccini expects to be able to sell the used printing system for $31,840 at the end of the fourth year. Puccini's average income tax rate is 25%, and it is in the 30% marginal tax bracket. Required: Determine the relevant after-tax cash flows at time 0, times 1 through 4, and at time 4* (the end of project net proceeds). Do not discount cash flows or find an IRR. Time I Time 1 Time 2 Time 3 Time 4 Time 4*

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts