Question: Please help! Would prefer clear workings typed out compared to excel(Don't really understand)! Thanks! 5. [Capital Structure and Agency cost] The All-Mine Corporation is deciding

Please help! Would prefer clear workings typed out compared to excel(Don't really understand)!

Thanks!

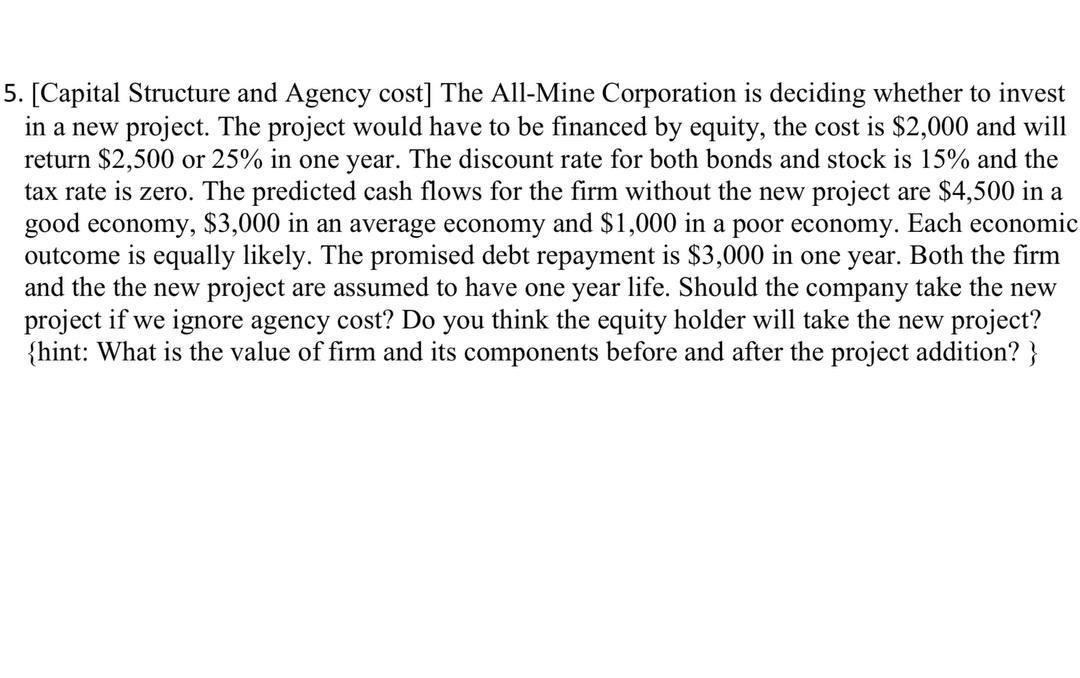

5. [Capital Structure and Agency cost] The All-Mine Corporation is deciding whether to invest in a new project. The project would have to be financed by equity, the cost is $2,000 and will return $2,500 or 25% in one year. The discount rate for both bonds and stock is 15% and the tax rate is zero. The predicted cash flows for the firm without the new project are $4,500 in a good economy, $3,000 in an average economy and $1,000 in a poor economy. Each economic outcome is equally likely. The promised debt repayment is $3,000 in one year. Both the firm and the the new project are assumed to have one year life. Should the company take the new project if we ignore agency cost? Do you think the equity holder will take the new project? {hint: What is the value of firm and its components before and after the project addition? }

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts