Question: Please help X Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel 0 X File Home Insert Page Layout Formulas Data Review View x 2 AutoSum 11

Please help![Please help X Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel 0 X](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7e62362094_33866f7e622abd57.jpg)

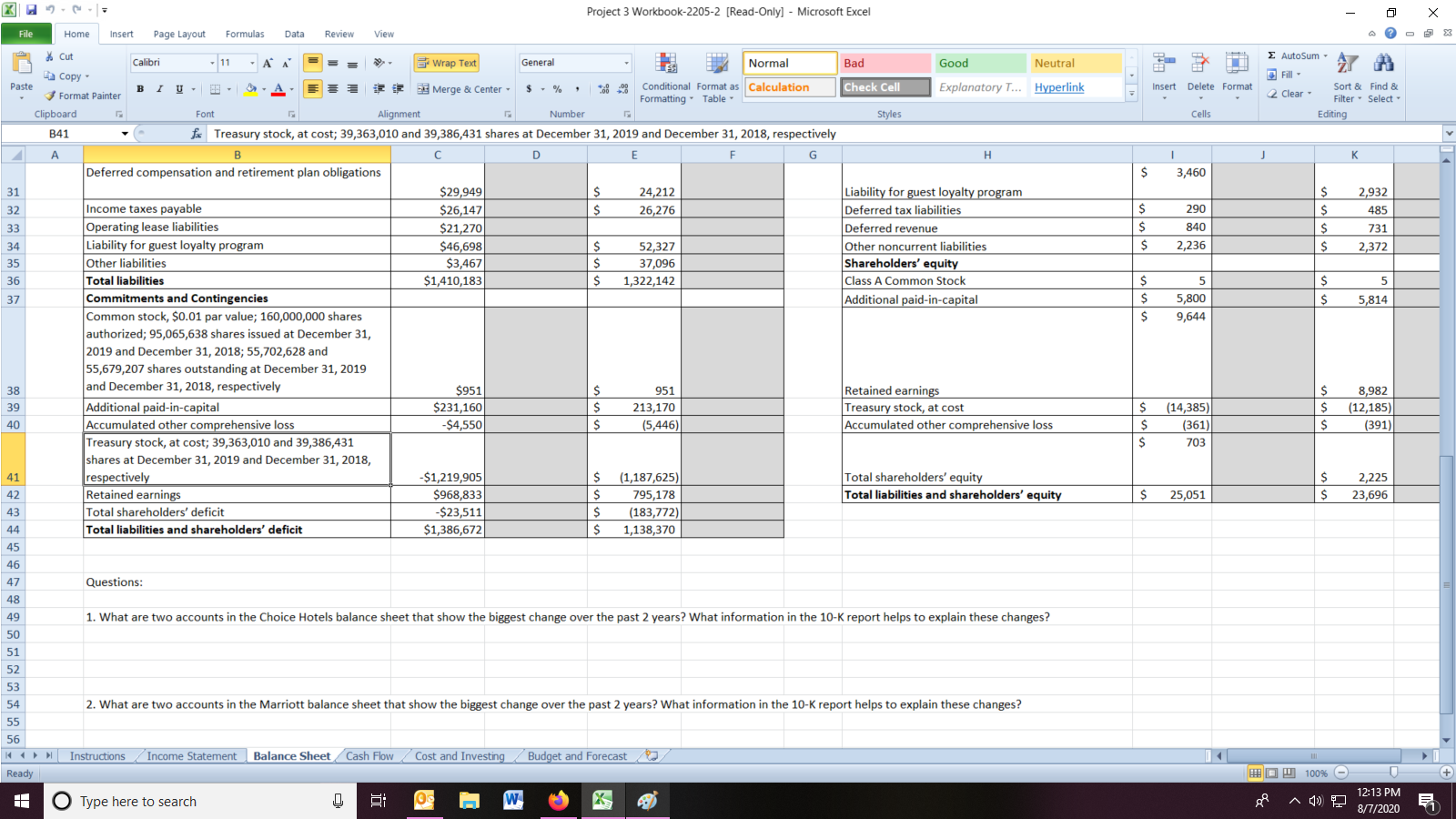

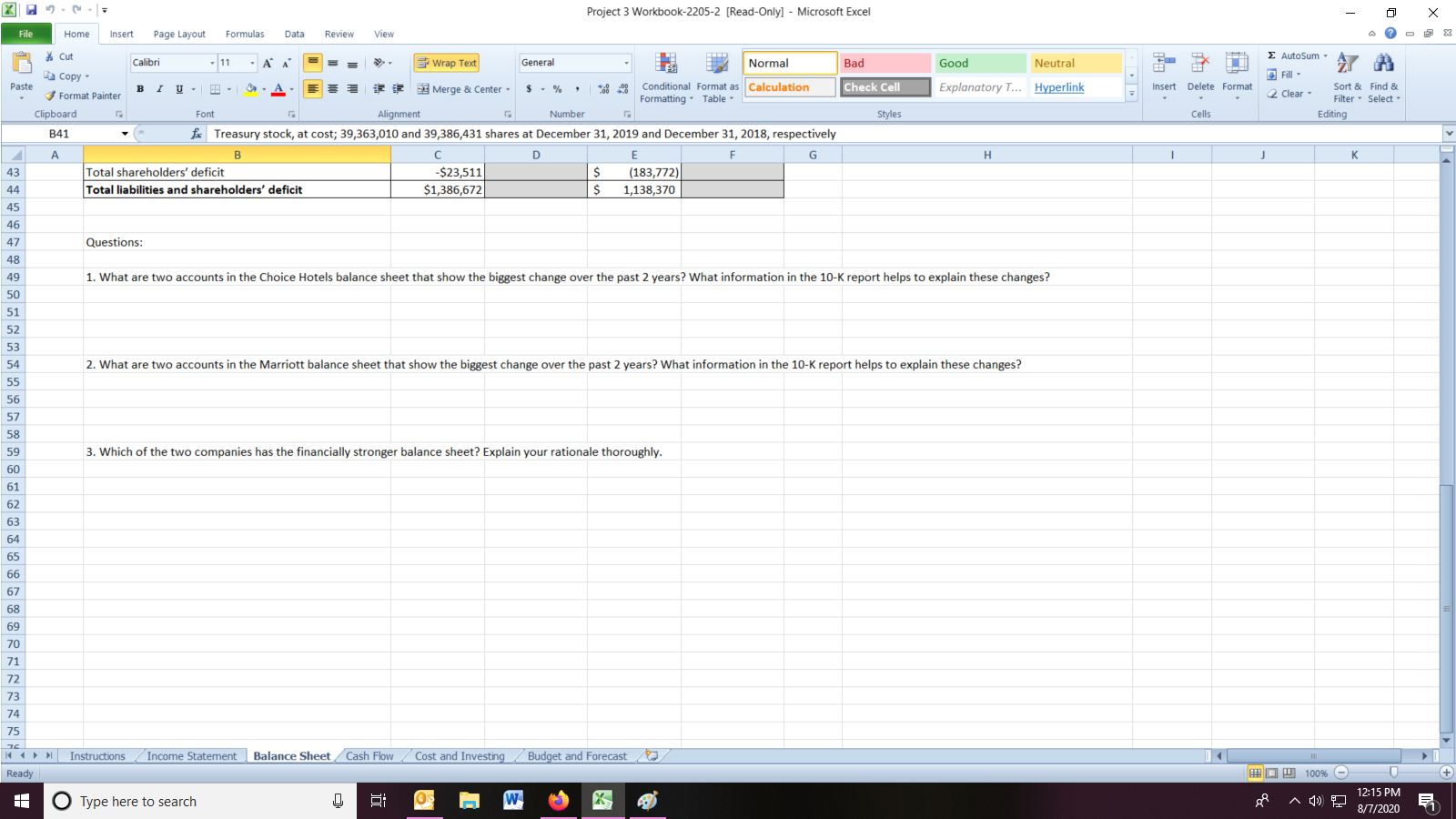

X Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel 0 X File Home Insert Page Layout Formulas Data Review View x 2 AutoSum 11 Bad Fill Good Neutral Explanatory T... Hyperlink Check Cell % Cut Copy - Paste Format Painter Clipboard B41 Insert Delete Format Clear - Calibri - AA Wrap Text General Normal BIU Merge & Center - $ -% , . Conditional Format as Calculation Formatting Table Font Alignment Number fa Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, respectively B D E F G Sort & Find & Filter - Select Editing Styles Cells A H -- J K 1 2 3 Common Size Balance Sheets Consolidated Balance Sheets - USD ($) $ in Thousands Dec. 31, 2019 12 Months Ended % of Total assets Dec. 31, 2018 Common Size Balance Sheets 12 Months Ended Consolidated Balance Sheets - USD ($) $ in Millions Dec. 31, 2019 % of Total assets Dec. 31, 2018 % of Tot % of Total assets 4 5 Current assets 6 $ 26,642 Cash and equivalents $ 316 $ $ 225 2,395 7 $ 2,133 249 8 S 9 $ 8 138,018 10,122 36,759 32,243 243,784 127,535 10 $ 11 $ 12 13 14 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Current assets Cash and cash equivalents $33,766 Receivables (net of allowance for doubtful accounts of $18,482 and $15,905, respectively) $141,566 Income taxes receivable $11,126 Notes receivable, net of allowances $25,404 Other current assets $24,727 Total current assets $236,589 Property and equipment, at cost, net $351,502 Operating lease right-of-use assets $24,088 Goodwill $159,196 Intangible assets, net $290,421 Notes receivable, net of allowances $103,054 Investments, employee benefit plans, at fair value $24,978 Investments in unconsolidated entities $78,655 Deferred income taxes $20,747 Other assets $97,442 Total assets $1,386,672 Current liabilities Accounts payable $73,449 Accrued expenses and other current liabilities $90,364 Current portion $71,594 Liability for guest loyalty program $82,970 Current portion of long-term debt $7,511 Total current liabilities $325,888 Long-term debt $844,102 Long-term portion $112,662 Deferred compensation and retirement plan obligations Instructions Income Statement Balance Sheet Cash Flow Cost and Investing 252 255 3,127 1,904 8,641 5,954 2,687 9,048 17,689 577 117 15 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 168,996 271,188 83,440 19,398 109,016 30,613 84,400 1,138,370 16 17 18 Accounts and notes receivable, net Prepaid expenses and other Assets held for sale Total current assets Property and equipment, net Intangible assets Brands Contract acquisition costs and other Goodwill Goodwill and intangible assets, net, total Equity method investments Notes receivable, net Deferred tax assets Operating lease assets Other noncurrent assets Total assets Current liabilities Current portion of long-term debt Accounts payable Accrued payroll and benefits Liability for guest loyalty program Accrued expenses and other Total current liabilities Long-term debt 2,706 1,956 8,380 5,790 2,590 9,039 17,419 732 125 171 $ $ $ $ $ $ $ $ $ $ 19 154 20 21 22 888 595 25,051 587 23,696 23 24 $ 833 25 $ 767 26 $ $ $ $ $ $ $ $ 73,511 92,651 67,614 83,566 1,097 318,439 753,514 110,278 27 $ $ $ $ $ $ $ $ 977 720 1,339 2,258 1,383 6,677 9,963 3,460 $ $ $ 28 1,345 2,529 963 6,437 8,514 29 $ 30 $ Budget and Forecast Ready 100% Type here to search w 12:12 PM 8/7/2020 X- Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel 0 File Home Insert Page Layout Formulas Data Review View AutoSum- LA ER Fill - Insert Delete Format Clear - Sort & Find & Filter Select Editing Cells - J K $ 3,460 $ $ $ 290 840 2,236 $ $ $ $ 2,932 485 731 2,372 $3,467 5 5 * Cut Calibri 11 -R 9 Wrap Text General Normal Bad Good Neutral La Copy Paste BIU Merge & Center - $ - % , Conditional Format as Calculation Format Painter Check Cell Explanatory T... Hyperlink Formatting Table Clipboard Font Alignment Number Styles B41 fic Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, respectively A B D E F G H Deferred compensation and retirement plan obligations 31 $29,949 $ 24,212 Liability for guest loyalty program 32 Income taxes payable $26,147 $ 26,276 Deferred tax liabilities 33 Operating lease liabilities $21,270 Deferred revenue 34 Liability for guest loyalty program $46,698 $ 52,327 Other noncurrent liabilities 35 Other liabilities $ 37,096 Shareholders' equity 36 Total liabilities $1,410,183 $ 1,322,142 Class A Common Stock 37 Commitments and Contingencies Additional paid-in-capital Common stock, $0.01 par value; 160,000,000 shares authorized; 95,065,638 shares issued at December 31, 2019 and December 31, 2018; 55,702,628 and 55,679,207 shares outstanding at December 31, 2019 38 and December 31, 2018, respectively $951 $ 951 Retained earnings 39 Additional paid-in-capital $231,160 $ 213,170 Treasury stock, at cost 40 Accumulated other comprehensive loss -$4,550 $ Accumulated other comprehensive loss Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, 41 respectively -$1,219,905 $ (1,187,625) Total shareholders' equity 42 Retained earnings $968,833 $ 795,178 Total liabilities and shareholders' equity 43 Total shareholders' deficit -$23,511 $ (183,772) 44 Total liabilities and shareholders' deficit $1,386,672 $ 1,138,370 45 $ $ $ $ $ 5,814 5,800 9,644 $ $ $ $ $ $ (14,385) (361) 703 (5,446) 8,982 (12,185) (391) $ $ 2,225 23,696 $ 25,051 46 47 Questions: 48 1. What are two accounts in the Choice Hotels balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 49 50 51 52 53 54 2. What are two accounts in the Marriott balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 55 56 H Ready Instructions Income Statement Balance Sheet Cash Flow Cost and Investing Budget and Forecast HE 100% + H O Type here to search w X ga 12:13 PM 8/7/2020 0 AutoSum- Good Neutral ER Fill - Explanatory T... Hyperlink Insert Delete Format Clear X- Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel File Home Insert Page Layout Formulas Data Review View * Cut Calibri - 11 - AA 9- Wrap Text General Normal Bad La Copy Paste BIU Merge & Center - $ - % , Conditional Format as Calculation Format Painter Check Cell Formatting Table - Clipboard Font Alignment Number Styles B41 fic Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, respectively A B c D E F G 43 Total shareholders' deficit -$23,511 $ (183,772) 44 Total liabilities and shareholders' deficit $1,386,672 $ 1,138,370 45 Sort & Find & Filter - Select Editing Cells H 1 K 46 47 Questions: 48 49 50 1. What are two accounts in the Choice Hotels balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 51 52 53 2. What are two accounts in the Marriott balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 54 55 56 57 58 59 3. Which of the two companies has the financially stronger balance sheet? Explain your rationale thoroughly. 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 2 Instructions Income Statement Balance Sheet Cash Flow Cost and Investing Budget and Forecast Ready HE 100% + H O Type here to search w X ge A 4 12:15 PM 8/7/2020 X Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel 0 X File Home Insert Page Layout Formulas Data Review View x 2 AutoSum 11 Bad Fill Good Neutral Explanatory T... Hyperlink Check Cell % Cut Copy - Paste Format Painter Clipboard B41 Insert Delete Format Clear - Calibri - AA Wrap Text General Normal BIU Merge & Center - $ -% , . Conditional Format as Calculation Formatting Table Font Alignment Number fa Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, respectively B D E F G Sort & Find & Filter - Select Editing Styles Cells A H -- J K 1 2 3 Common Size Balance Sheets Consolidated Balance Sheets - USD ($) $ in Thousands Dec. 31, 2019 12 Months Ended % of Total assets Dec. 31, 2018 Common Size Balance Sheets 12 Months Ended Consolidated Balance Sheets - USD ($) $ in Millions Dec. 31, 2019 % of Total assets Dec. 31, 2018 % of Tot % of Total assets 4 5 Current assets 6 $ 26,642 Cash and equivalents $ 316 $ $ 225 2,395 7 $ 2,133 249 8 S 9 $ 8 138,018 10,122 36,759 32,243 243,784 127,535 10 $ 11 $ 12 13 14 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Current assets Cash and cash equivalents $33,766 Receivables (net of allowance for doubtful accounts of $18,482 and $15,905, respectively) $141,566 Income taxes receivable $11,126 Notes receivable, net of allowances $25,404 Other current assets $24,727 Total current assets $236,589 Property and equipment, at cost, net $351,502 Operating lease right-of-use assets $24,088 Goodwill $159,196 Intangible assets, net $290,421 Notes receivable, net of allowances $103,054 Investments, employee benefit plans, at fair value $24,978 Investments in unconsolidated entities $78,655 Deferred income taxes $20,747 Other assets $97,442 Total assets $1,386,672 Current liabilities Accounts payable $73,449 Accrued expenses and other current liabilities $90,364 Current portion $71,594 Liability for guest loyalty program $82,970 Current portion of long-term debt $7,511 Total current liabilities $325,888 Long-term debt $844,102 Long-term portion $112,662 Deferred compensation and retirement plan obligations Instructions Income Statement Balance Sheet Cash Flow Cost and Investing 252 255 3,127 1,904 8,641 5,954 2,687 9,048 17,689 577 117 15 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 168,996 271,188 83,440 19,398 109,016 30,613 84,400 1,138,370 16 17 18 Accounts and notes receivable, net Prepaid expenses and other Assets held for sale Total current assets Property and equipment, net Intangible assets Brands Contract acquisition costs and other Goodwill Goodwill and intangible assets, net, total Equity method investments Notes receivable, net Deferred tax assets Operating lease assets Other noncurrent assets Total assets Current liabilities Current portion of long-term debt Accounts payable Accrued payroll and benefits Liability for guest loyalty program Accrued expenses and other Total current liabilities Long-term debt 2,706 1,956 8,380 5,790 2,590 9,039 17,419 732 125 171 $ $ $ $ $ $ $ $ $ $ 19 154 20 21 22 888 595 25,051 587 23,696 23 24 $ 833 25 $ 767 26 $ $ $ $ $ $ $ $ 73,511 92,651 67,614 83,566 1,097 318,439 753,514 110,278 27 $ $ $ $ $ $ $ $ 977 720 1,339 2,258 1,383 6,677 9,963 3,460 $ $ $ 28 1,345 2,529 963 6,437 8,514 29 $ 30 $ Budget and Forecast Ready 100% Type here to search w 12:12 PM 8/7/2020 X- Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel 0 File Home Insert Page Layout Formulas Data Review View AutoSum- LA ER Fill - Insert Delete Format Clear - Sort & Find & Filter Select Editing Cells - J K $ 3,460 $ $ $ 290 840 2,236 $ $ $ $ 2,932 485 731 2,372 $3,467 5 5 * Cut Calibri 11 -R 9 Wrap Text General Normal Bad Good Neutral La Copy Paste BIU Merge & Center - $ - % , Conditional Format as Calculation Format Painter Check Cell Explanatory T... Hyperlink Formatting Table Clipboard Font Alignment Number Styles B41 fic Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, respectively A B D E F G H Deferred compensation and retirement plan obligations 31 $29,949 $ 24,212 Liability for guest loyalty program 32 Income taxes payable $26,147 $ 26,276 Deferred tax liabilities 33 Operating lease liabilities $21,270 Deferred revenue 34 Liability for guest loyalty program $46,698 $ 52,327 Other noncurrent liabilities 35 Other liabilities $ 37,096 Shareholders' equity 36 Total liabilities $1,410,183 $ 1,322,142 Class A Common Stock 37 Commitments and Contingencies Additional paid-in-capital Common stock, $0.01 par value; 160,000,000 shares authorized; 95,065,638 shares issued at December 31, 2019 and December 31, 2018; 55,702,628 and 55,679,207 shares outstanding at December 31, 2019 38 and December 31, 2018, respectively $951 $ 951 Retained earnings 39 Additional paid-in-capital $231,160 $ 213,170 Treasury stock, at cost 40 Accumulated other comprehensive loss -$4,550 $ Accumulated other comprehensive loss Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, 41 respectively -$1,219,905 $ (1,187,625) Total shareholders' equity 42 Retained earnings $968,833 $ 795,178 Total liabilities and shareholders' equity 43 Total shareholders' deficit -$23,511 $ (183,772) 44 Total liabilities and shareholders' deficit $1,386,672 $ 1,138,370 45 $ $ $ $ $ 5,814 5,800 9,644 $ $ $ $ $ $ (14,385) (361) 703 (5,446) 8,982 (12,185) (391) $ $ 2,225 23,696 $ 25,051 46 47 Questions: 48 1. What are two accounts in the Choice Hotels balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 49 50 51 52 53 54 2. What are two accounts in the Marriott balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 55 56 H Ready Instructions Income Statement Balance Sheet Cash Flow Cost and Investing Budget and Forecast HE 100% + H O Type here to search w X ga 12:13 PM 8/7/2020 0 AutoSum- Good Neutral ER Fill - Explanatory T... Hyperlink Insert Delete Format Clear X- Project 3 Workbook-2205-2 [Read-Only] - Microsoft Excel File Home Insert Page Layout Formulas Data Review View * Cut Calibri - 11 - AA 9- Wrap Text General Normal Bad La Copy Paste BIU Merge & Center - $ - % , Conditional Format as Calculation Format Painter Check Cell Formatting Table - Clipboard Font Alignment Number Styles B41 fic Treasury stock, at cost; 39,363,010 and 39,386,431 shares at December 31, 2019 and December 31, 2018, respectively A B c D E F G 43 Total shareholders' deficit -$23,511 $ (183,772) 44 Total liabilities and shareholders' deficit $1,386,672 $ 1,138,370 45 Sort & Find & Filter - Select Editing Cells H 1 K 46 47 Questions: 48 49 50 1. What are two accounts in the Choice Hotels balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 51 52 53 2. What are two accounts in the Marriott balance sheet that show the biggest change over the past 2 years? What information in the 10-K report helps to explain these changes? 54 55 56 57 58 59 3. Which of the two companies has the financially stronger balance sheet? Explain your rationale thoroughly. 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 2 Instructions Income Statement Balance Sheet Cash Flow Cost and Investing Budget and Forecast Ready HE 100% + H O Type here to search w X ge A 4 12:15 PM 8/7/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts