Question: please help X Times New... 12 ' ' Aa v A B I U vab x x ~ ~ Av Ar Paste V Paragraph Styles

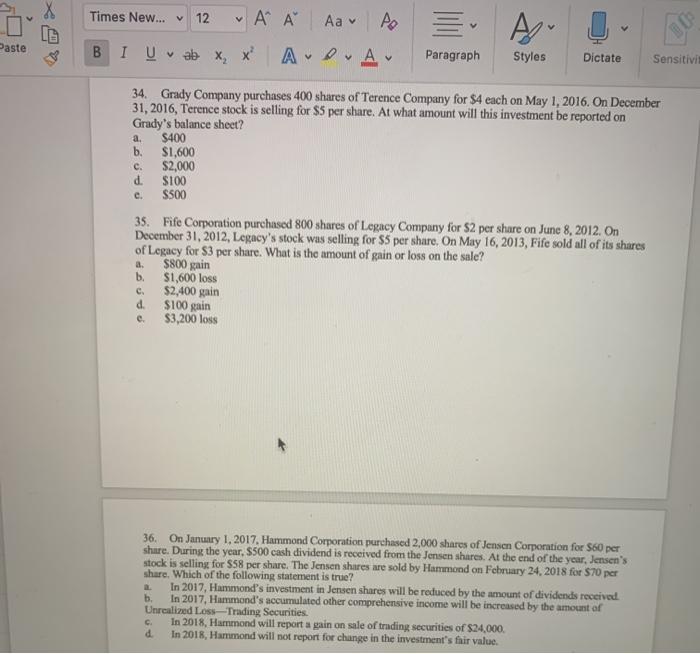

X Times New... 12 ' ' Aa v A B I U vab x x ~ ~ Av Ar Paste V Paragraph Styles Dictate Sensitivi a. 34. Grady Company purchases 400 shares of Terence Company for S4 each on May 1, 2016. On December 31, 2016, Terence stock is selling for $5 per share. At what amount will this investment be reported on Grady's balance sheet? $400 b. $1,600 $2,000 d. $100 $500 c. e. 35. Fife Corporation purchased 800 shares of Legacy Company for $2 per share on June 8, 2012. On December 31, 2012, Legacy's stock was selling for $5 per share. On May 16, 2013, Fife sold all of its shares of Legacy for S3 per share. What is the amount of gain or loss on the sale? $800 gain $1,600 loss $2,400 gain d. $100 gain e $3,200 loss a. b. c. 36. On January 1, 2017, Hammond Corporation purchased 2,000 shares of Jensen Corporation for $60 per share. During the year, S500 cash dividend is received from the Jensen shares. At the end of the year, Jensen's stock is selling for $58 per share. The Jensen shares are sold by Hammond on February 24, 2018 for $70 per share. Which of the following statement is true? In 2017, Hammond's investment in Jensen shares will be reduced by the amount of dividends received b. In 2017, Hammond's accumulated other comprehensive income will be increased by the amount of Unrealized Loss Trading Securities In 2018, Hammond will report a gain on sale of trading securities of $24,000 d In 2016, Hammond will not report for change in the investment's fair value. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts