Question: please help! XO Group compensates top management using stock options. On January 1 Year 1, XO issued 36,000 options to purchase $1 par value common

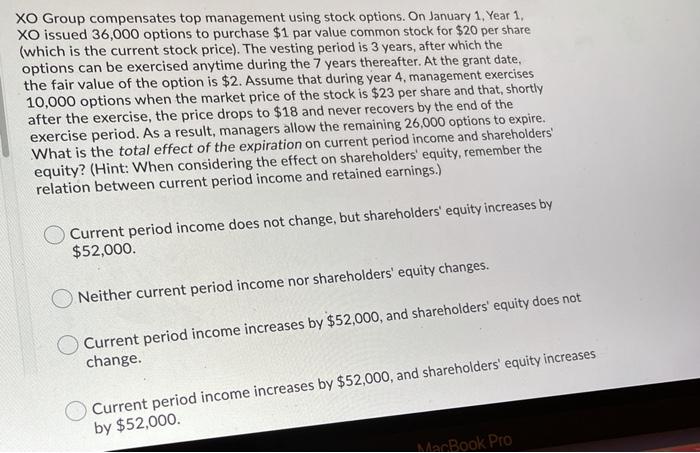

XO Group compensates top management using stock options. On January 1 Year 1, XO issued 36,000 options to purchase $1 par value common stock for $20 per share (which is the current stock price). The vesting period is 3 years, after which the options can be exercised anytime during the 7 years thereafter. At the grant date, the fair value of the option is $2. Assume that during year 4, management exercises 10,000 options when the market price of the stock is $23 per share and that, shortly after the exercise, the price drops to $18 and never recovers by the end of the exercise period. As a result, managers allow the remaining 26,000 options to expire. What is the total effect of the expiration on current period income and shareholders' equity? (Hint: When considering the effect on shareholders' equity, remember the relation between current period income and retained earnings.) Current period income does not change, but shareholders' equity increases by $52,000. Neither current period income nor shareholders' equity changes. Current period income increases by $52,000, and shareholders' equity does not change. Current period income increases by $52,000, and shareholders' equity increases by $52,000. MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts