Question: please help You are considering a project that has an initial cost of $3,250,000. If you take the project, it will produce net cash flows

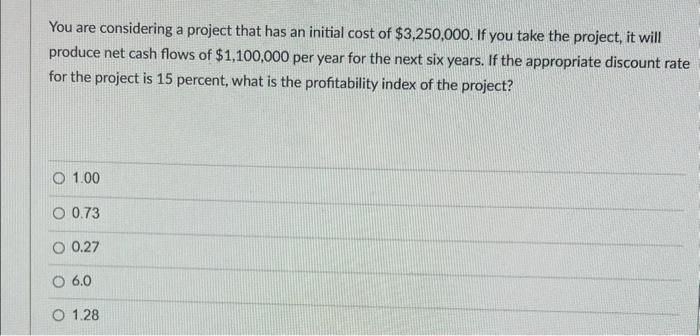

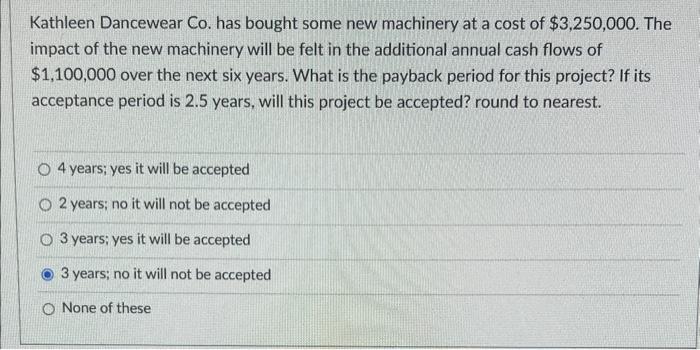

You are considering a project that has an initial cost of $3,250,000. If you take the project, it will produce net cash flows of $1,100,000 per year for the next six years. If the appropriate discount rate for the project is 15 percent, what is the profitability index of the project? 1.00 0.73 0.27 6.0 1.28 Kathleen Dancewear Co. has bought some new machinery at a cost of $3,250,000. The impact of the new machinery will be felt in the additional annual cash flows of $1,100,000 over the next six years. What is the payback period for this project? If its acceptance period is 2.5 years, will this project be accepted? round to nearest. 4 years; yes it will be accepted 2 years; no it will not be accepted 3 years; yes it will be accepted 3 years; no it will not be accepted None of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts