Question: please help You are considering mutually exclusive projects: Burnout and Longlasting. Burnout requires an initial investment of $36, has a 3 year life, and will

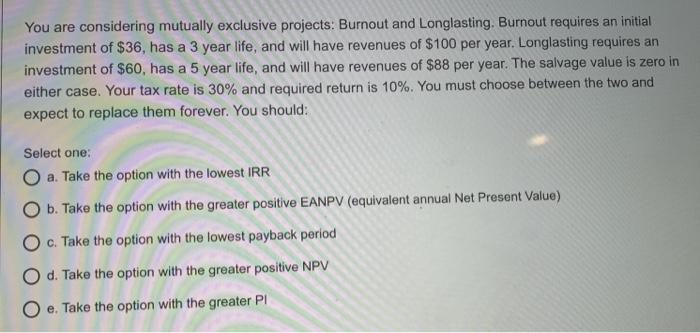

You are considering mutually exclusive projects: Burnout and Longlasting. Burnout requires an initial investment of $36, has a 3 year life, and will have revenues of $100 per year. Longlasting requires an investment of $60, has a 5 year life, and will have revenues of $88 per year. The salvage value is zero in either case. Your tax rate is 30% and required return is 10%. You must choose between the two and expect to replace them forever. You should: Select one: O a. Take the option with the lowest IRR O b. Take the option with the greater positive EANPV (equivalent annual Net Present Value) O c. Take the option with the lowest payback period O d. Take the option with the greater positive NPV O e. Take the option with the greater PL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts