Question: please help * Your answer is incorrect. Sandhill Corporation purchased a special tractor on December 31, 2020. The purchase agreement stipulated that Sandhill should pay

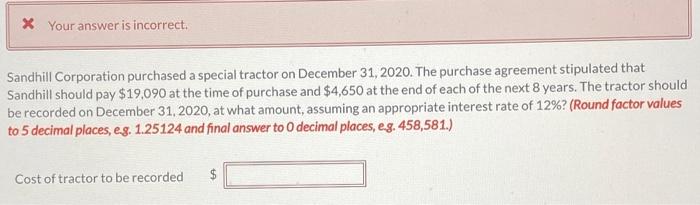

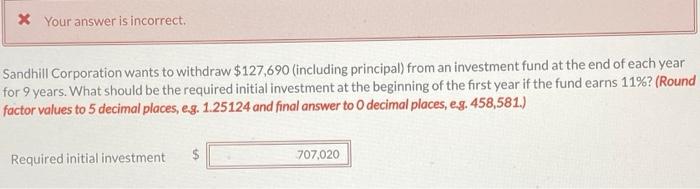

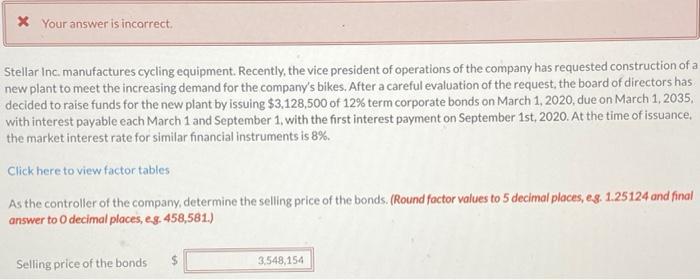

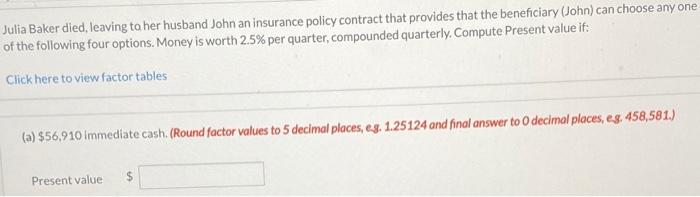

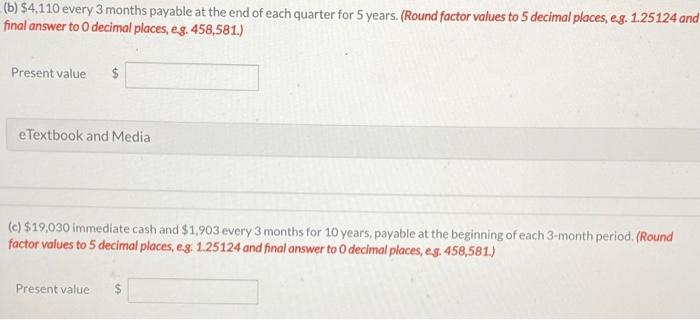

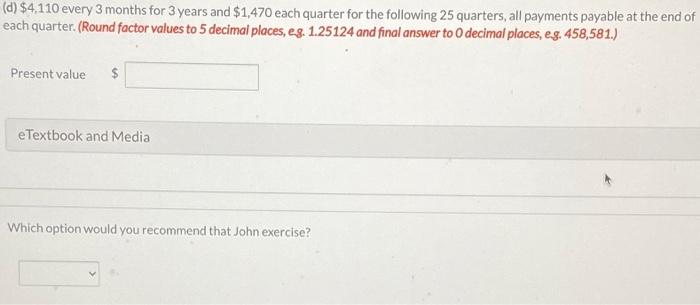

* Your answer is incorrect. Sandhill Corporation purchased a special tractor on December 31, 2020. The purchase agreement stipulated that Sandhill should pay $19,090 at the time of purchase and $4,650 at the end of each of the next 8 years. The tractor should be recorded on December 31, 2020, at what amount, assuming an appropriate interest rate of 12%? (Round factor values to 5 decimal places, eg. 1.25124 and final answer to O decimal places, eg. 458,581.) Cost of tractor to be recorded $ * Your answer is incorrect, Sandhill Corporation wants to withdraw $127,690 (including principal) from an investment fund at the end of each year for 9 years. What should be the required initial investment at the beginning of the first year if the fund earns 11%? (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, e.g. 458,581.) Required initial investment 707,020 * Your answer is incorrect. Stellar Inc. manufactures cycling equipment. Recently, the vice president of operations of the company has requested construction of a new plant to meet the increasing demand for the company's bikes. After a careful evaluation of the request, the board of directors has decided to raise funds for the new plant by issuing $3,128,500 of 12% term corporate bonds on March 1, 2020, due on March 1, 2035, with interest payable each March 1 and September 1, with the first interest payment on September 1st, 2020. At the time of issuance. the market interest rate for similar financial instruments is 8%. Click here to view factor tables As the controller of the company, determine the selling price of the bonds. (Round factor values to 5 decimal places, eg, 1.25 124 and final answer to O decimal places, eg. 458,581) Selling price of the bonds $ 3.548,154 Julia Baker died, leaving to her husband John an insurance policy contract that provides that the beneficiary (John) can choose any one of the following four options. Money is worth 2.5% per quarter, compounded quarterly, Compute Present value if: Click here to view factor tables (a) $56,910 Immediate cash. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, eg. 458,581.) Present value $ (b) $4,110 every 3 months payable at the end of each quarter for 5 years. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, eg. 458,581.) Present value $ e Textbook and Media (c) $19,030 immediate cash and $1,903 every 3 months for 10 years, payable at the beginning of each 3-month period. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, eg. 458,581.) Present value $ (d) $4,110 every 3 months for 3 years and $1,470 each quarter for the following 25 quarters, all payments payable at the end of each quarter. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to decimal places, eg. 458,581.) Present value $ e Textbook and Media Which option would you recommend that hn exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts