Question: please help! Your answer: Question 16 (CHAPTER 10) Your company's boss asked you to estimate the cash flows relevant to a new investment project. In

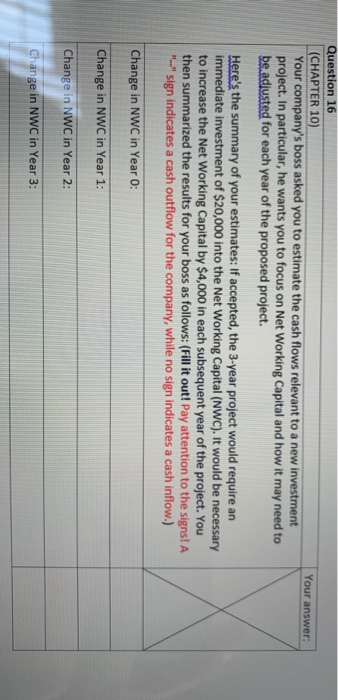

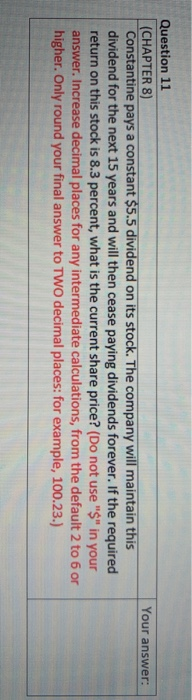

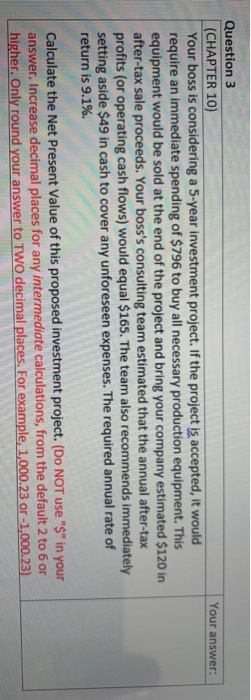

Your answer: Question 16 (CHAPTER 10) Your company's boss asked you to estimate the cash flows relevant to a new investment project. In particular, he wants you to focus on Net Working Capital and how it may need to be adjusted for each year of the proposed project. Here's the summary of your estimates: If accepted, the 3-year project would require an immediate investment of $20,000 into the Net Working Capital (NWC). It would be necessary to increase the Net Working Capital by $4,000 in each subsequent year of the project. You then summarized the results for your boss as follows: (Fill it out! Pay attention to the signs! A "" sign indicates a cash outflow for the company, while no sign indicates a cash inflow.) Change in NWC in Year 0: Change in NWC in Year 1: Change in NWC in Year 2: Change in NWC in Year 3: Your answer: Question 11 (CHAPTER 8) Constantine pays a constant $5.5 dividend on its stock. The company will maintain this dividend for the next 15 years and will then cease paying dividends forever. If the required return on this stock is 8.3 percent, what is the current share price? (Do not use "$" in your answer. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 100.23.) Your answer: Question 3 (CHAPTER 10) Your boss is considering a 5-year investment project. If the project is accepted, it would require an immediate spending of $796 to buy all necessary production equipment. This equipment would be sold at the end of the project and bring your company estimated $120 in after-tax sale proceeds. Your boss's consulting team estimated that the annual after-tax profits (or operating cash flows) would equal $165. The team also recommends immediately setting aside $49 in cash to cover any unforeseen expenses. The required annual rate of return is 9.1%. Calculate the Net Present Value of this proposed investment project. (Do NOT use "$" in your answer. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your answer to TWO decimal places. For example, 1,000.23 or -1,000.23)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts