Question: Please help! Your business is thinking about purchasing a new machine that will increase future revenues. The current machine is likely to be operable for

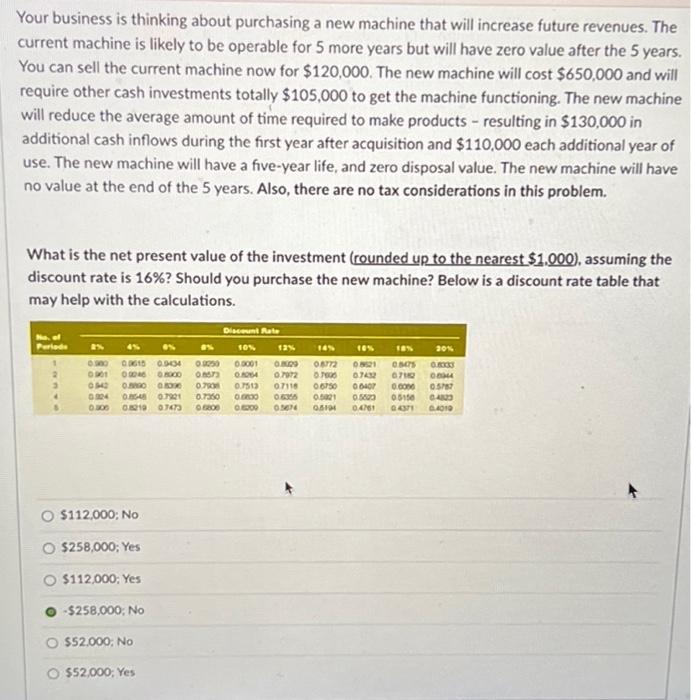

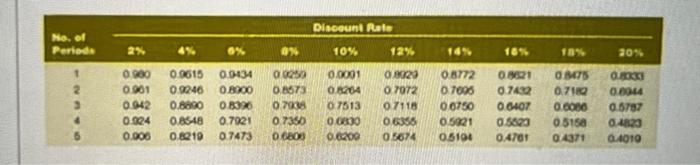

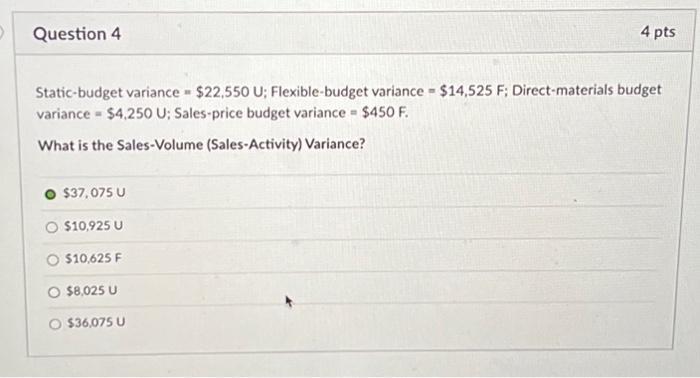

Your business is thinking about purchasing a new machine that will increase future revenues. The current machine is likely to be operable for 5 more years but will have zero value after the 5 years. You can sell the current machine now for $120,000. The new machine will cost $650,000 and will require other cash investments totally $105,000 to get the machine functioning. The new machine will reduce the average amount of time required to make products - resulting in $130,000 in additional cash inflows during the first year after acquisition and $110,000 each additional year of use. The new machine will have a five-year life, and zero disposal value. The new machine will have no value at the end of the 5 years. Also, there are no tax considerations in this problem. What is the net present value of the investment (rounded up to the nearest $1.000), assuming the discount rate is 16%? Should you purchase the new machine? Below is a discount rate table that may help with the calculations. Perlede 10 COS EEN 20 O2 MS 0.00 . 2 3 4 Discount Rate as 10 0.0050 0.0001 KO O. O.RO 0.772 0.71 0.751 07116 0.7200 ODO 003 0.000 ON 03615 0.9404 OOOO 0.00 OU 79 2010 16 0.51 04 DO 06150 0.5021 0.5194 00107 0.500 0.4761 0.000 05150 QOT 1010 $112.000; No O $258,000; Yes O $112,000: Yes -$258,000: No $52,000, No $52,000: Yes Discount Rate No. of Periods O% ON 10% 16% 18% 20% + 2 3 0980 0.001 0.942 0.924 0.006 0.9615 0 9246 0.8890 0.8548 0.8Q10 0.0134 0.8200 0.8320 0.7921 07473 09259 0.8573 07 0.7350 0.680 0.0001 OB204 0.7513 0.0830 0.6.200 OK20 0.7072 07118 0.6356 05674 0.8772 07006 0.0750 0.5021 0.5194 0921 0.742 0.0407 0.5623 0.4781 07 0.71 0.000 05150 0/4371 O.RO 0.0044 0.5787 0.4823 0.4010 Question 4 4 pts Static-budget variance - $22,550 U; Flexible budget variance - $14,525 F; Direct-materials budget variance - $4,250 U; Sales-price budget variance = $450 F. What is the Sales-Volume (Sales Activity) Variance? $37,075 U $10,925 U $10,625 F 0 $8,025 0 036 075 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts