Question: please help Your company is evaluating whether to purchase an equipment or not. The initial cost is $40,380. According to your estimate, the equipment can

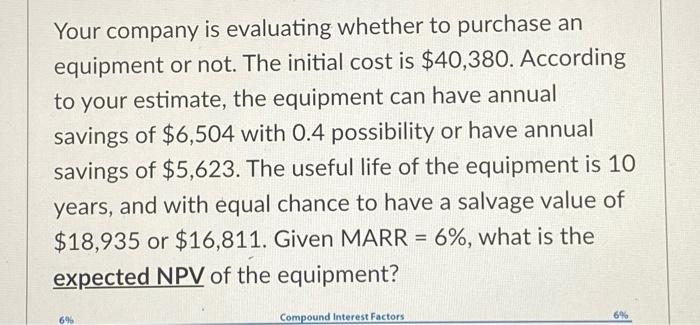

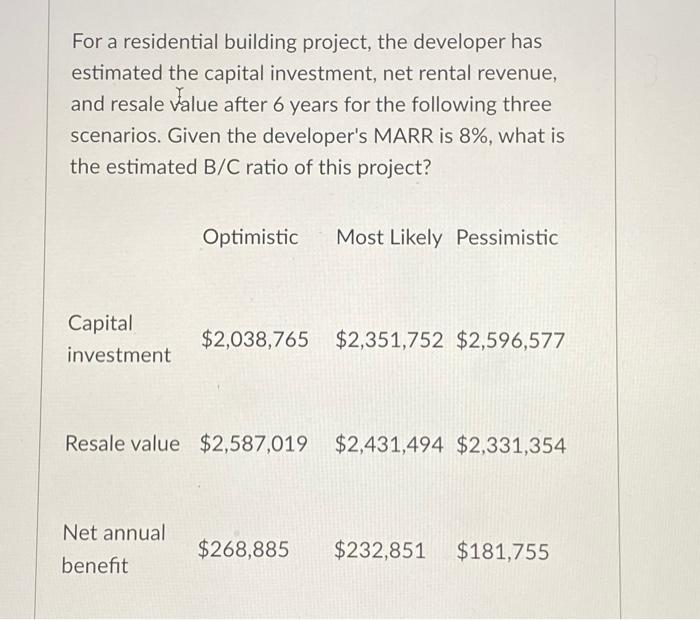

Your company is evaluating whether to purchase an equipment or not. The initial cost is $40,380. According to your estimate, the equipment can have annual savings of $6,504 with 0.4 possibility or have annual savings of $5,623. The useful life of the equipment is 10 years, and with equal chance to have a salvage value of $18,935 or $16,811. Given MARR =6%, what is the expected NPV of the equipment? For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after 6 years for the following three scenarios. Given the developer's MARR is 8%, what is the estimated B/C ratio of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts