Question: please help.need correct answer eBook Support Department Cost Allocation-Direct Method Christmas Timber, Inc., produces Christmas trees. The trees are produced through a cutting and pruning

please help.need correct answer

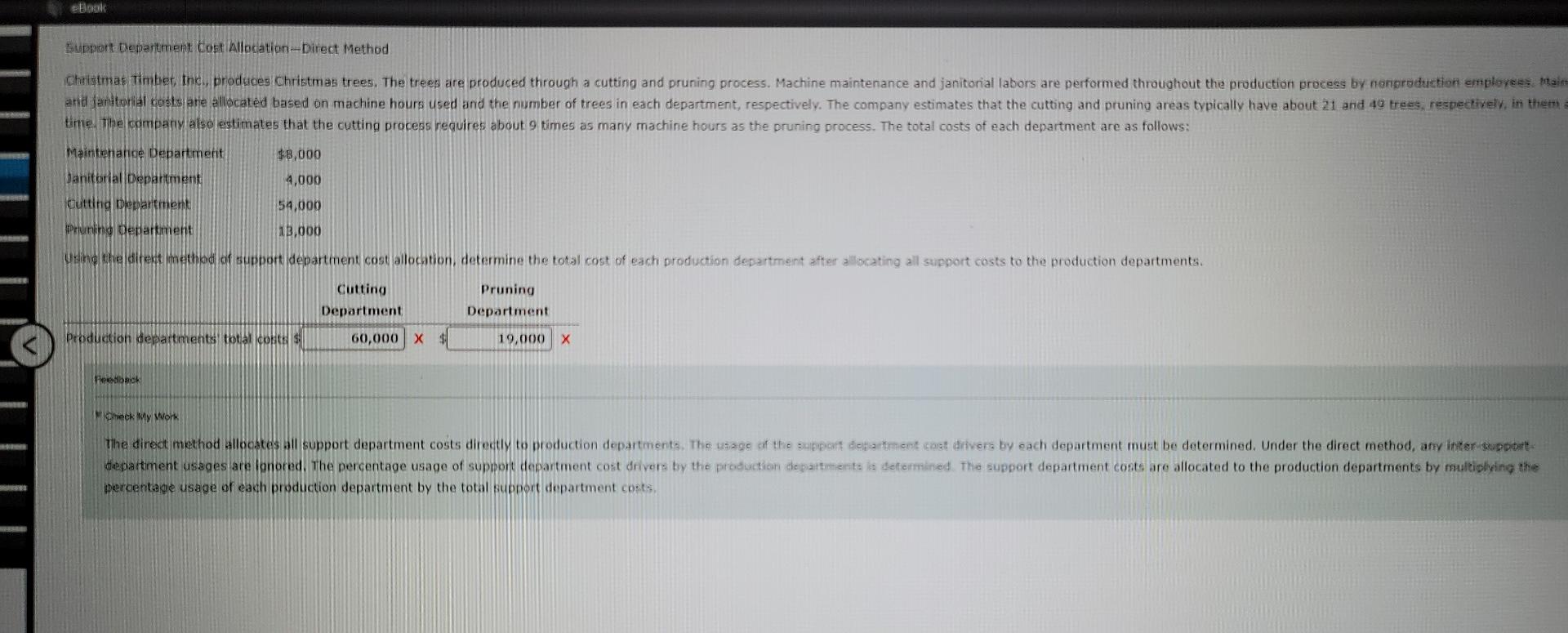

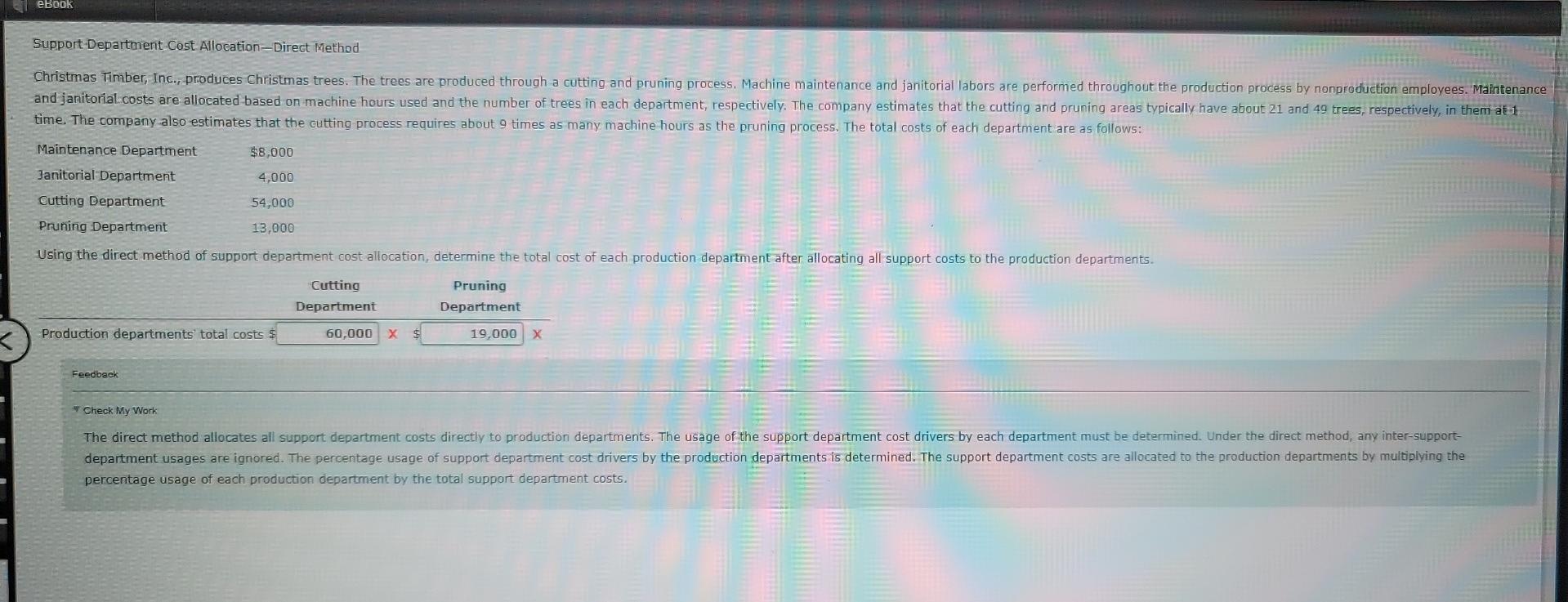

eBook Support Department Cost Allocation-Direct Method Christmas Timber, Inc., produces Christmas trees. The trees are produced through a cutting and pruning process. Machine maintenance and janitorial labors are performed throughout the production process by nonproduction employees. Main and janitorial costs are allocated based on machine hours used and the number of trees in each department, respectively. The company estimates that the cutting and pruning areas typically have about 21 and 40 trees, respectively, in them a time. The company also estimates that the cutting process requires about 9 times as many machine hours as the pruning process. The total costs of each department are as follows: Maintenance Department $8,000 4,000 Janitorial Department Cutting Department 54,000 Pruning Department 13,000 Using the direct method of support department cost allocation, determine the total cost of each production department after allocating all support costs to the production departments. Production departments total costs $ Feedback Check My Work Cutting Department 60,000 X $ Pruning Department 19,000 X The direct method allocates all support department costs directly to production departments. The usage of the support department cost drivers by each department must be determined. Under the direct method, any inter-support- department usages are lonored. The percentage usage of support department cost drivers by the production departments is determined. The support department costs are allocated to the production departments by multiplying the percentage usage of each production department by the total support department costs. eBook Support Department Cost Allocation-Direct Method Christmas Timber, Inc., produces Christmas trees. The trees are produced through a cutting and pruning process. Machine maintenance and janitorial labors are performed throughout the production process by nonproduction employees. Maintenance and janitorial.costs are allocated based on machine hours used and the number of trees in each department, respectively. The company estimates that the cutting and pruning areas typically have about 21 and 49 trees, respectively, in them at 1 time. The company also estimates that the cutting process requires about 9 times as many machine hours as the pruning process. The total costs of each department are as follows: Maintenance Department Janitorial Department $8,000 4,000 54,000 13,000 Cutting Department Pruning Department Using the direct method of support department cost allocation, determine the total cost of each production department after allocating all support costs to the production departments. Production departments total costs $ Feedback Cutting Department 60,000 X $ Pruning Department 19,000 X Check My Work The direct method allocates all support department costs directly to production departments. The usage of the support department cost drivers by each department must be determined. Under the direct method, any inter-support- department usages are ignored. The percentage usage of support department cost drivers by the production departments is determined. The support department costs are allocated to the production departments by multiplying the percentage usage of each production department by the total support department costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts