Question: please help..no need for detail just answer only ent value factors are provided for use in this problem. esent Value $1 at 8% 0.9259 0.8573

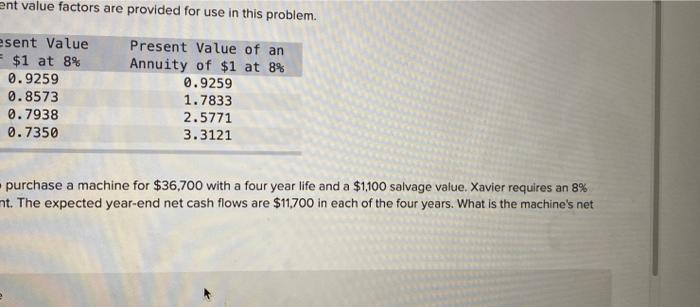

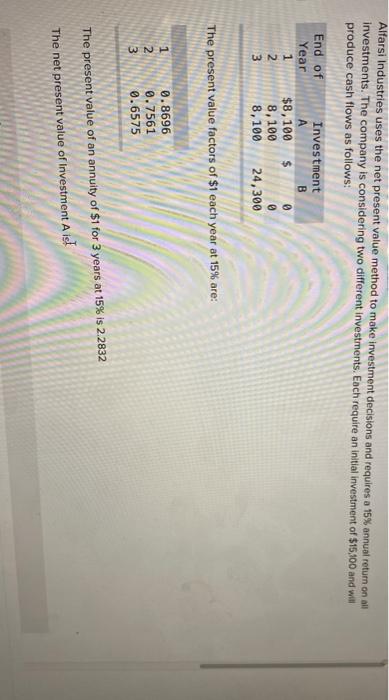

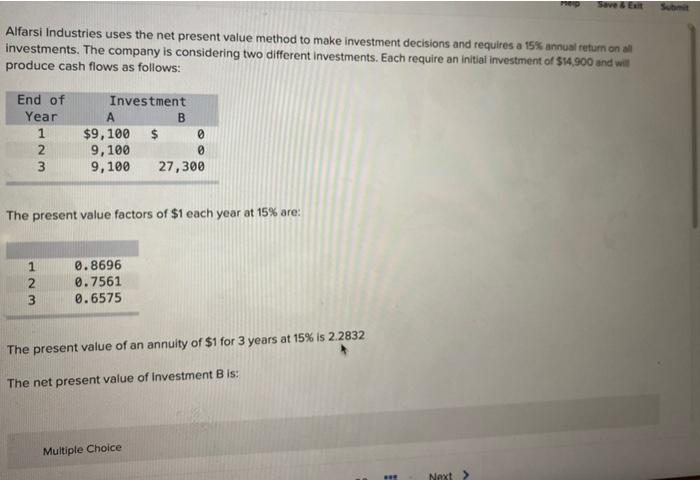

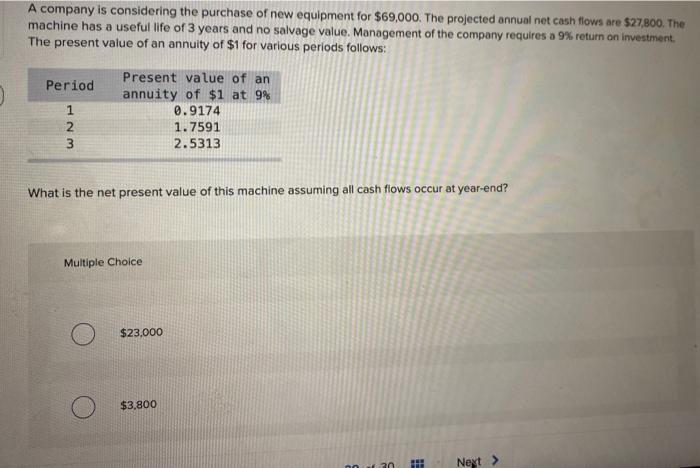

ent value factors are provided for use in this problem. esent Value $1 at 8% 0.9259 0.8573 0.7938 0.7350 Present Value of an Annuity of $1 at 8% 0.9259 1.7833 2.5771 3.3121 purchase a machine for $36,700 with a four year life and a $1,100 salvage value. Xavier requires an 8% nt. The expected year-end net cash flows are $11.700 in each of the four years. What is the machine's net Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments. The company is considering two different investments. Each require an initial investment of $15,000 and will produce cash flows as follows: End of Investment Year B 1 $8,100 $ 8,100 3 8,100 24,300 0 0 2 The present value factors of $1 each year at 15% are: 1 WN 0.8696 0.7561 0.6575 The present value of an annuity of $1 for 3 years at 15% is 2.2832 The net present value of Investment A Aid Save & E Sum Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on al investments. The company is considering two different investments. Each require an initial investment of $14.900 and will produce cash flows as follows: End of Year 1 2 3 Investment A B $9, 100 $ 9,100 0 9, 100 27,300 The present value factors of $1 each year at 15% are: 1 2 3 0.8696 0.7561 0.6575 The present value of an annuity of $1 for 3 years at 15% is 2.2832 The net present value of Investment B is: Multiple Choice 8 Next A company is considering the purchase of new equipment for $69,000. The projected annual net cash flows are $27,800. The machine has a useful life of 3 years and no salvage value. Management of the company requires a 9% return on investment The present value of an annuity of $1 for various periods follows: Period 1 2 3 Present value of an annuity of $1 at 9% 0.9174 1.7591 2.5313 What is the net present value of this machine assuming all cash flows occur at year-end? Multiple Choice $23.000 $3,800 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts