Question: please helppp 14 Required information Problem 7-7A Compute depreciation, amortization, and book value of long-term assets (LO7-4, 7-5) [The following information applies to the questions

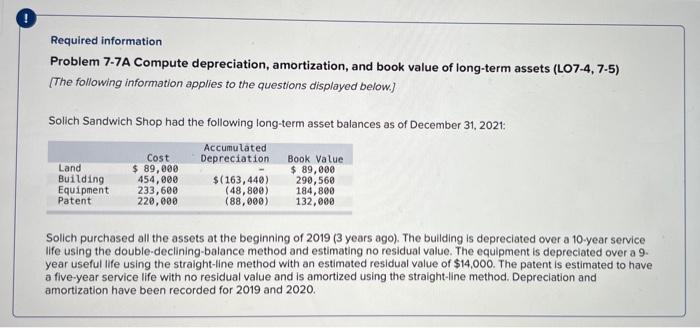

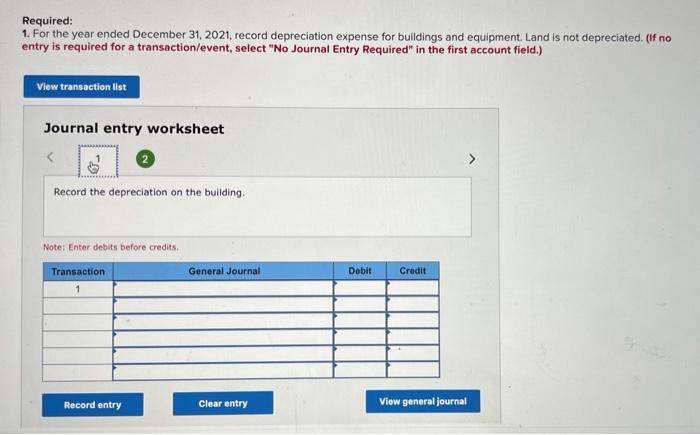

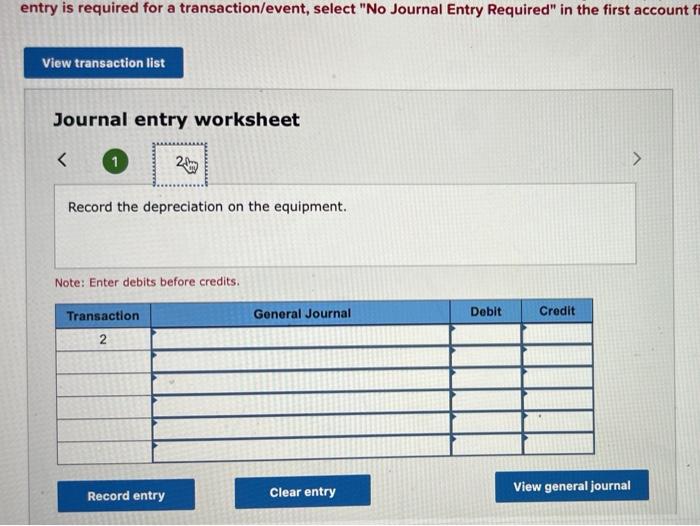

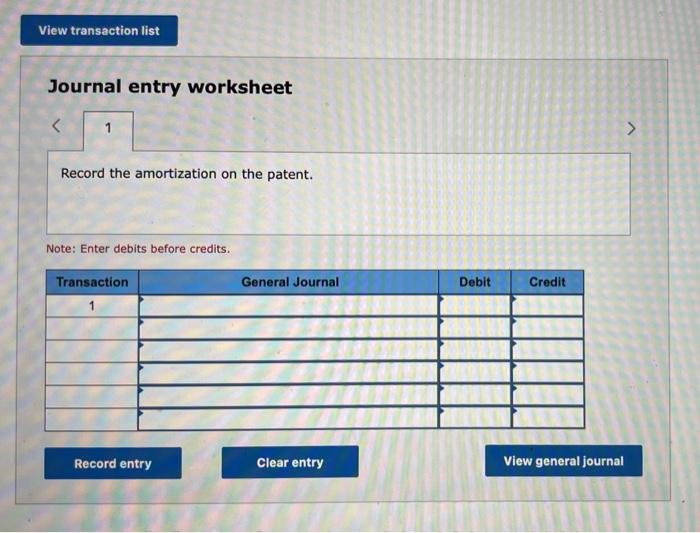

Required information Problem 7-7A Compute depreciation, amortization, and book value of long-term assets (LO7-4, 7-5) [The following information applies to the questions displayed below.) Solich Sandwich Shop had the following long-term asset balances as of December 31, 2021: Accumulated Depreciation. Land Building Equipment Patent Cost $ 89,000 454,000 233,600 220,000 $(163,440) (48,800) (88,000) Book Value $ 89,000 290,560 184,800 132,000 Solich purchased all the assets at the beginning of 2019 (3 years ago). The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual value. The equipment is depreciated over a 9. year useful life using the straight-line method with an estimated residual value of $14,000. The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. Depreciation and amortization have been recorded for 2019 and 2020. Required: 1. For the year ended December 31, 2021, record depreciation expense for buildings and equipment. Land is not depreciated. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3. Calculate the book value for each of the four long-term assets at December 31, 2021. SOLICH SANDWICH SHOP December 31, 2021 Land Building Equipment Patent Book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts