Question: Please Helpppp, Idk what I'm doing wrong Calculating Depletion, Depreciation, and Ending Inventory Aerial Company acquired land containing natural resources that it planned to extract

Please Helpppp, Idk what I'm doing wrong

Please Helpppp, Idk what I'm doing wrong

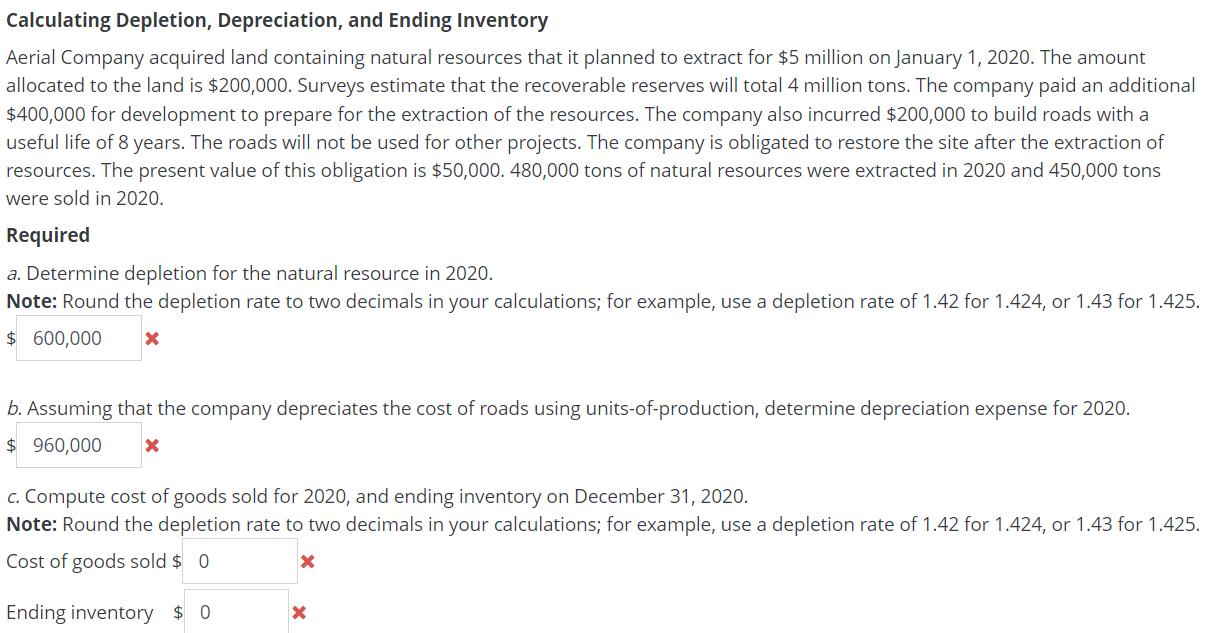

Calculating Depletion, Depreciation, and Ending Inventory Aerial Company acquired land containing natural resources that it planned to extract for $5 million on January 1, 2020. The amount allocated to the land is $200,000. Surveys estimate that the recoverable reserves will total 4 million tons. The company paid an additional $400,000 for development to prepare for the extraction of the resources. The company also incurred $200,000 to build roads with a useful life of 8 years. The roads will not be used for other projects. The company is obligated to restore the site after the extraction of resources. The present value of this obligation is $50,000. 480,000 tons of natural resources were extracted in 2020 and 450,000 tons were sold in 2020. Required a. Determine depletion for the natural resource in 2020. Note: Round the depletion rate to two decimals in your calculations; for example, use a depletion rate of 1.42 for 1.424, or 1.43 for 1.425. $ 600,000 b. Assuming that the company depreciates the cost of roads using units-of-production, determine depreciation expense for 2020. $ 960,000 X c. Compute cost of goods sold for 2020, and ending inventory on December 31, 2020. Note: Round the depletion rate to two decimals in your calculations; for example, use a depletion rate of 1.42 for 1.424, or 1.43 for 1.425. Cost of goods sold $ 0 X Ending inventory $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts