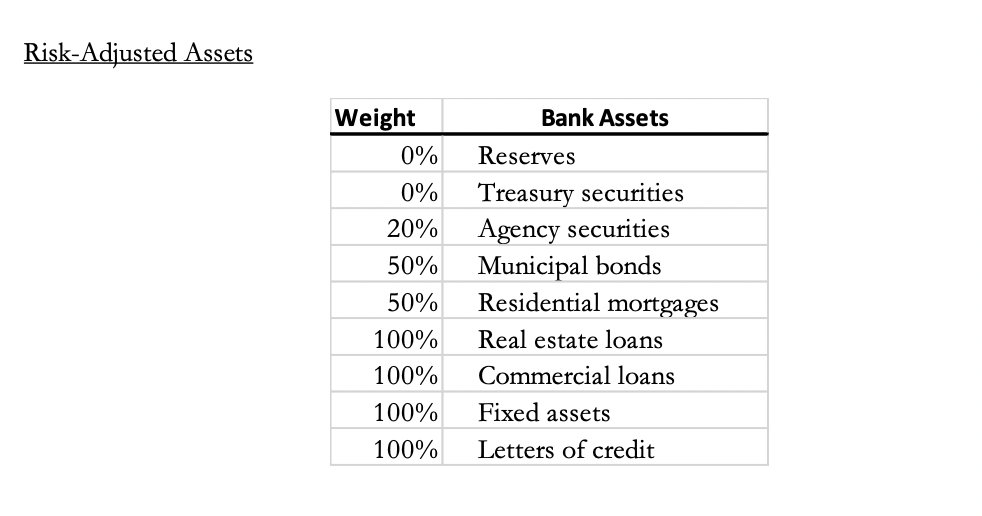

Question: Please helps with the question I will give you a really good rate! Risk-Adjusted Assets Weight 0% 0% 20% 50% 50% 100% 100% 100% 100%

Please helps with the question I will give you a really good rate!

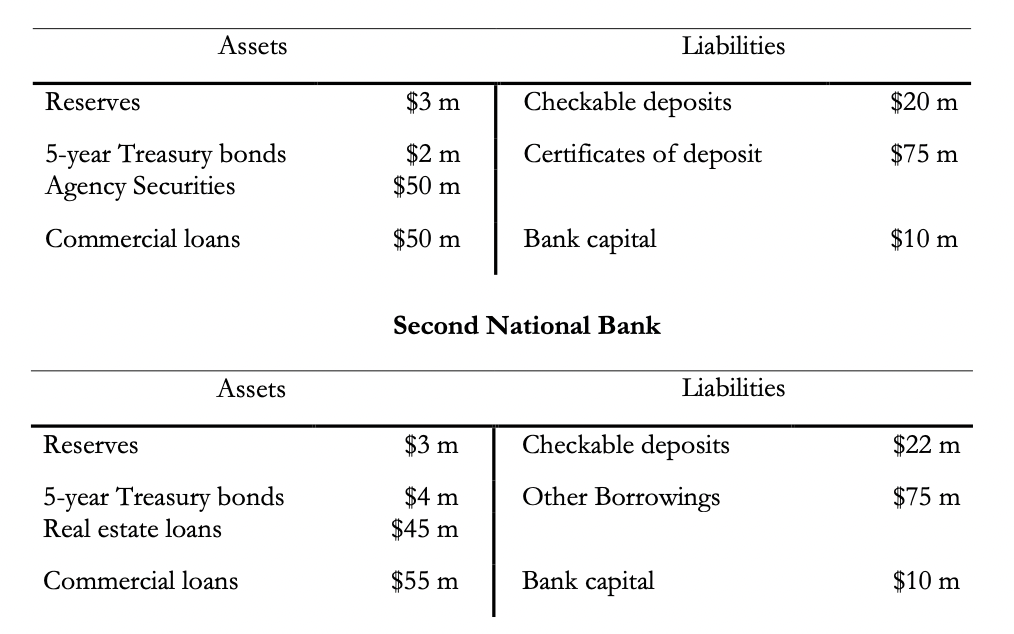

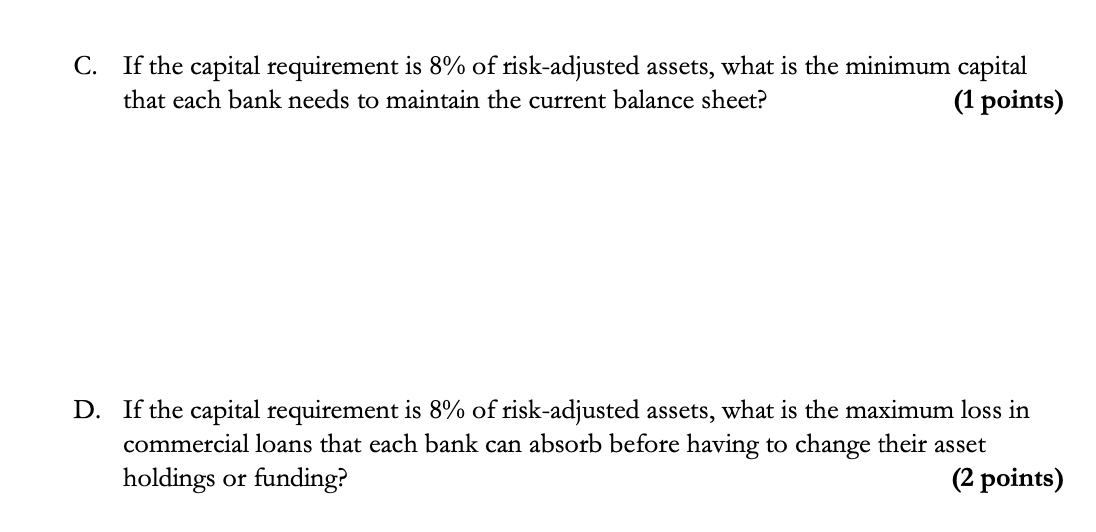

Risk-Adjusted Assets Weight 0% 0% 20% 50% 50% 100% 100% 100% 100% Bank Assets Reserves Treasury securities Agency securities Municipal bonds Residential mortgages Real estate loans Commercial loans Fixed assets Letters of credit Assets Reserves 5-year Treasury bonds Agency Securities Commercial loans Assets Reserves 5-year Treasury bonds Real estate loans Commercial loans Liabilities $3 m Checkable deposits $2 m Certificates of deposit $50 m $50 m Bank capital Second National Bank $3 m $4 m $45 m $55 m Liabilities Checkable deposits Other Borrowings Bank capital $20 m $75 m $10 m $22 m $75 m $10 m C. If the capital requirement is 8% of risk-adjusted assets, what is the minimum capital that each bank needs to maintain the current balance sheet? (1 points) D. If the capital requirement is 8% of risk-adjusted assets, what is the maximum loss in commercial loans that each bank can absorb before having to change their asset holdings or funding? (2 points) Risk-Adjusted Assets Weight 0% 0% 20% 50% 50% 100% 100% 100% 100% Bank Assets Reserves Treasury securities Agency securities Municipal bonds Residential mortgages Real estate loans Commercial loans Fixed assets Letters of credit Assets Reserves 5-year Treasury bonds Agency Securities Commercial loans Assets Reserves 5-year Treasury bonds Real estate loans Commercial loans Liabilities $3 m Checkable deposits $2 m Certificates of deposit $50 m $50 m Bank capital Second National Bank $3 m $4 m $45 m $55 m Liabilities Checkable deposits Other Borrowings Bank capital $20 m $75 m $10 m $22 m $75 m $10 m C. If the capital requirement is 8% of risk-adjusted assets, what is the minimum capital that each bank needs to maintain the current balance sheet? (1 points) D. If the capital requirement is 8% of risk-adjusted assets, what is the maximum loss in commercial loans that each bank can absorb before having to change their asset holdings or funding? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts