Question: Please help.Thank you. 1. 2. 3. Question 5 1 pts Consider the following information on Stocks A, B, C and their returns (in decimals) in

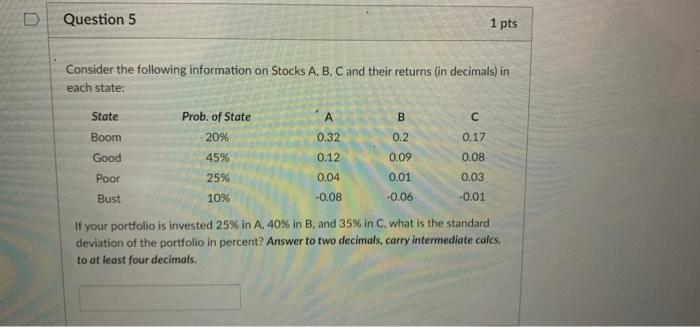

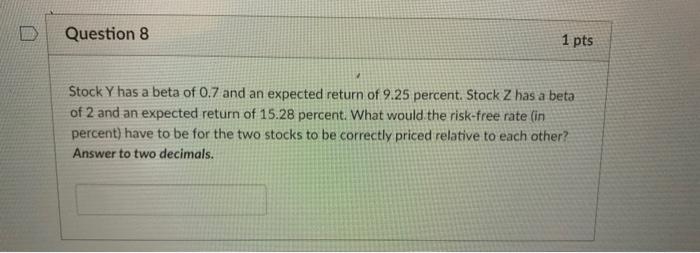

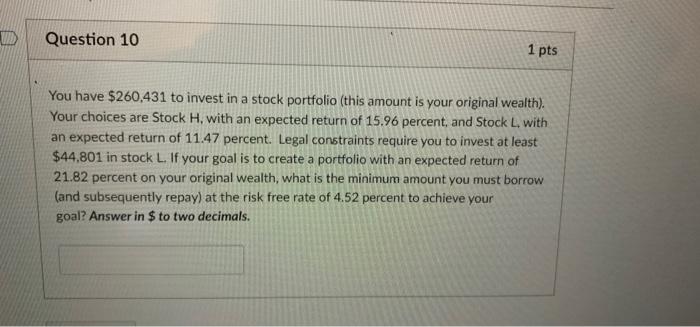

Question 5 1 pts Consider the following information on Stocks A, B, C and their returns (in decimals) in each state: State Prob. of State A B C Boom 20% 0.32 0.2 0.17 Good 45% 0.12 0.09 0.08 Poor 25% 0.04 0.01 0.03 Bust 10% -0.08 -0.06 -0.01 If your portfolio is invested 25% in A, 40% in B, and 35% in C. what is the standard deviation of the portfolio in percent? Answer to two decimals, carry intermediate calcs. to at least four decimals. D Question 8 1 pts Stock Y has a beta of 0.7 and an expected return of 9.25 percent. Stock Z has a beta of 2 and an expected return of 15.28 percent. What would the risk-free rate (in percent) have to be for the two stocks to be correctly priced relative to each other? Answer to two decimals. W Question 10 1 pts You have $260,431 to invest in a stock portfolio (this amount is your original wealth). Your choices are Stock H, with an expected return of 15.96 percent, and Stock L. with an expected return of 11.47 percent. Legal constraints require you to invest at least $44,801 in stock L. If your goal is to create a portfolio with an expected return of 21.82 percent on your original wealth, what is the minimum amount you must borrow (and subsequently repay) at the risk free rate of 4.52 percent to achieve your goal? Answer in $ to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts