Question: PLEASE help.Thanks and please show the solution so I know how to do it next time. Thanks Instructions 1. Calculate the depreciation expense for Johnson

PLEASE help.Thanks and please show the solution so I know how to do it next time. Thanks

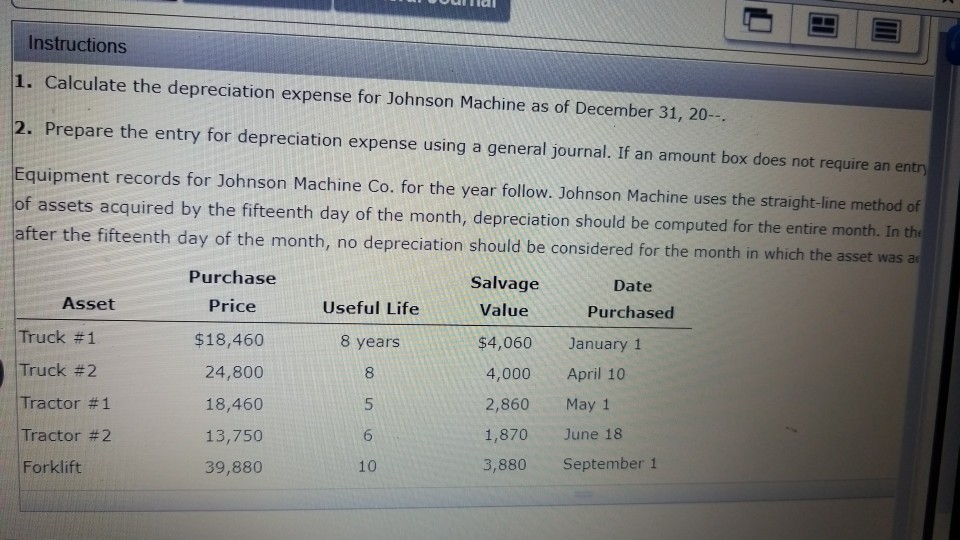

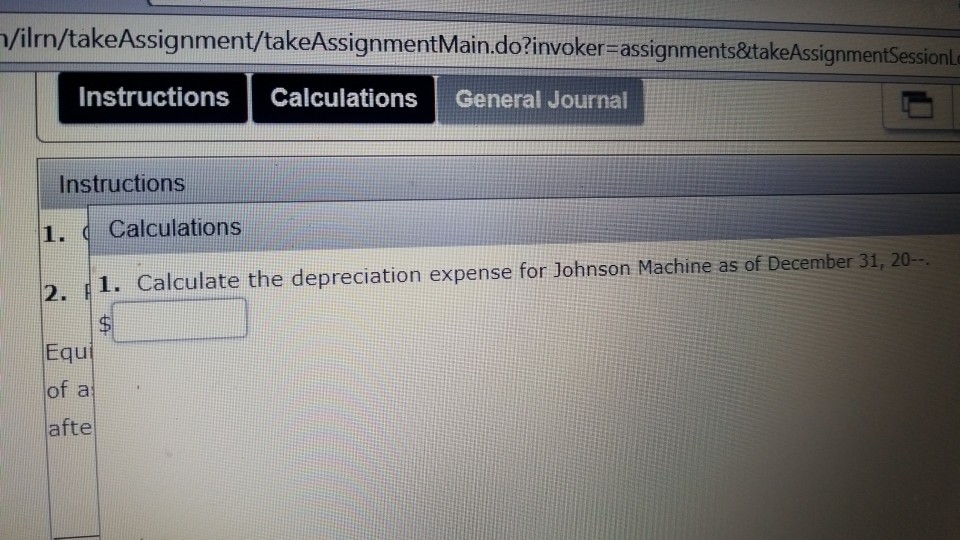

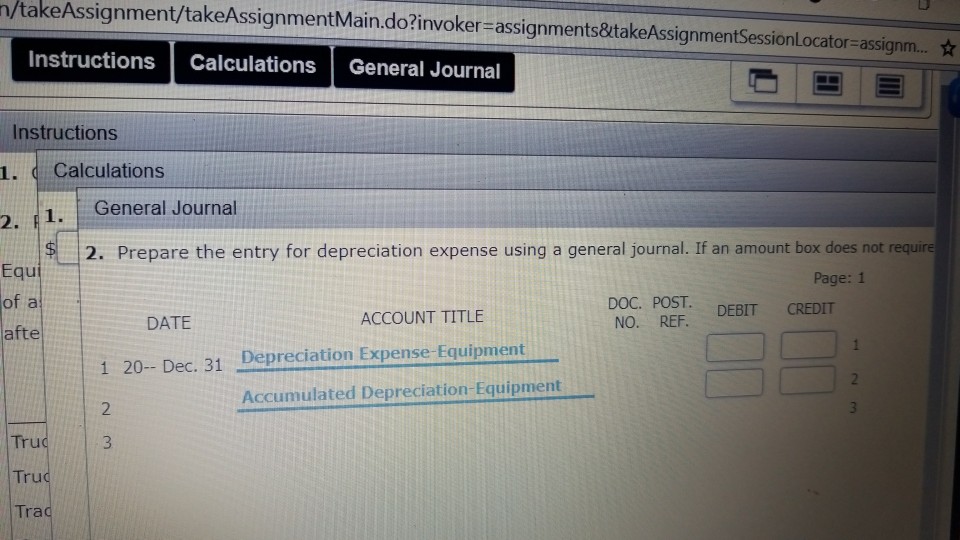

Instructions 1. Calculate the depreciation expense for Johnson Machine as of December 31, 20- 2. Prepare the entry for depreciation expense using a general journal. If an amount box does not require an entr Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the er the fifteenth day of the month, no depreciation should be considered for the month in which the asset was a Purchase Price $18,460 24,800 18,460 13,750 39,880 Salvage Date Asset Useful Life 8 years 8 Value $4,060January 1 4,000 April 10 2,860 May 1 1,870 June 18 3,880 September 1 Purchased Truck #1 Truck #2 Tractor #1 Tractor #2 Forklift 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts