Question: please hurry!!! Question 1 (16 points) A machine was acquired on January 1, 2018, at a cost of $150,000. The machine was originally estimated to

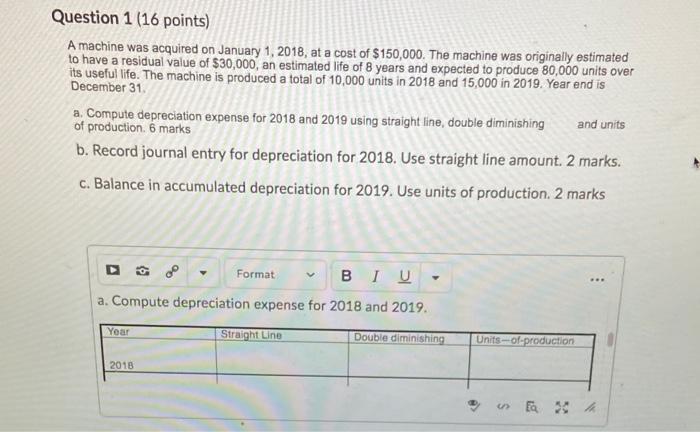

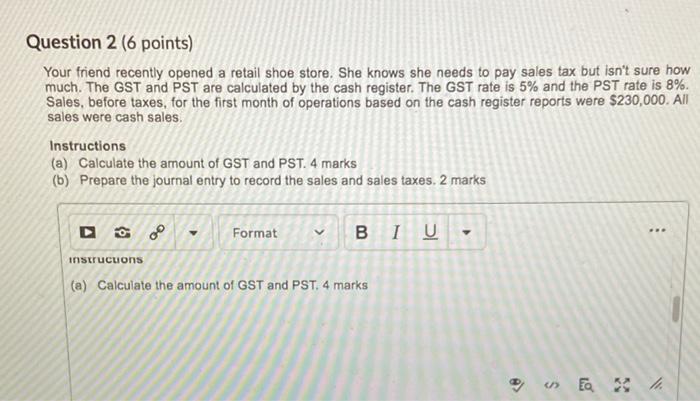

Question 1 (16 points) A machine was acquired on January 1, 2018, at a cost of $150,000. The machine was originally estimated to have a residual value of $30,000, an estimated life of 8 years and expected to produce 80,000 units over its useful life. The machine is produced a total of 10,000 units in 2018 and 15,000 in 2019. Year end is December 31 a. Compute depreciation expense for 2018 and 2019 using straight line, double diminishing and units of production. 6 marks b. Record journal entry for depreciation for 2018. Use straight line amount 2 marks. c. Balance in accumulated depreciation for 2019. Use units of production. 2 marks y Format BLU- a. Compute depreciation expense for 2018 and 2019. Year Straight Line Double diminishing Units-of-production 2018 fa 3 Question 2 (6 points) Your friend recently opened a retail shoe store. She knows she needs to pay sales tax but isn't sure how much. The GST and PST are calculated by the cash register. The GST rate is 5% and the PST rate is 8%. Sales, before taxes, for the first month of operations based on the cash register reports were $230,000. All sales were cash sales. Instructions (a) Calculate the amount of GST and PST. 4 marks (b) Prepare the journal entry to record the sales and sales taxes, 2 marks D C Format BI U ... instructions (a) Calculate the amount of GST and PST. 4 marks Ea 30 h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts