Question: Please I just need A, B, C, D. 672 Chapter 14 Financial Statement Analysis LO14-4, L014-5, LO14-7 Shown below is selected information from the financial

Please I just need A, B, C, D.

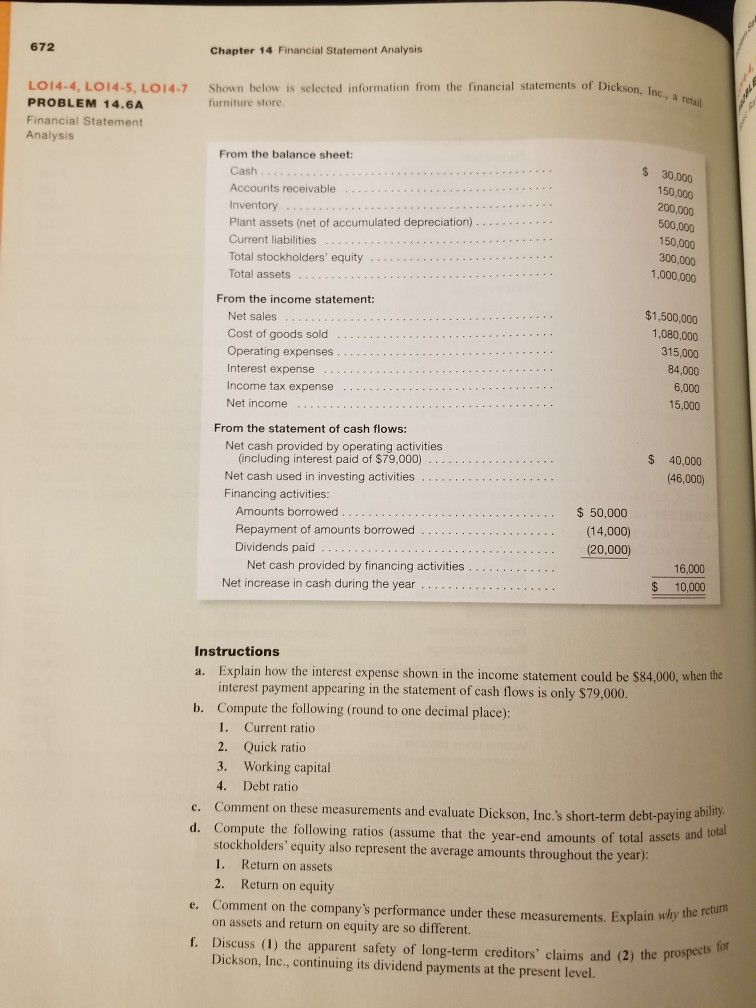

672 Chapter 14 Financial Statement Analysis LO14-4, L014-5, LO14-7 Shown below is selected information from the financial statements of Dickson, furniture store PROBLEM 14.6A Financial Statement Analysis From the balance sheet: Cash Accounts receivable Inventory Plant assets (net of accumulated depreciation) Current liabilities Total stockholders' equity Total assets $ 30,000 150,000 200,000 500,000 150,000 300,000 1,000,000 From the income statement: $1,500,000 1,080,000 315,000 84,000 6,000 15,000 Net sales Cost of goods sold Operating expenses. Interest expense Income tax expense Net income From the statement of cash flows: Net cash provided by operating activities 40,000 (46,000) (including interest paid of $79,000) Net cash used in investing activities Financing activities Amounts borrowed Repayment of amounts borrowed Dividends paid $50,000 (14,000) (20,000) Net cash provided by financing activities Net increase in cash during the year 16,000 $ 10,000 Instructions Explain how the interest expense shown in the income statement could be $84,000, when the interest payment appearing in the statement of cash flows is only $79,000. Compute the following (round to one decimal place): 1. Current ratio 2. Quick ratio 3. Working capital 4. Debt ratio a. b. c. Comment on these measurements and evaluate Dickson, Inc.'s short-term debt-paying ability d. Compute the following ratios (assume that the year-end amounts of total assets and total stockholders' equity also represent the average amounts throughout the year): 1. Return on assets 2. Return on equity e. Comment on the company's performance under these measurements. Explain w why the return on assets and return on equity are so different. f. Discuss (1) the apparent safety of long-term creditors' claims and (2) the prospects Dickson, Inc., continuing its dividend payments at the present level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts