Question: please I must get the right answer so be 100% confident or if you know don't answer it, it's important hope you understand thanks 80

please I must get the right answer so be 100% confident or if you know don't answer it, it's important hope you understand thanks

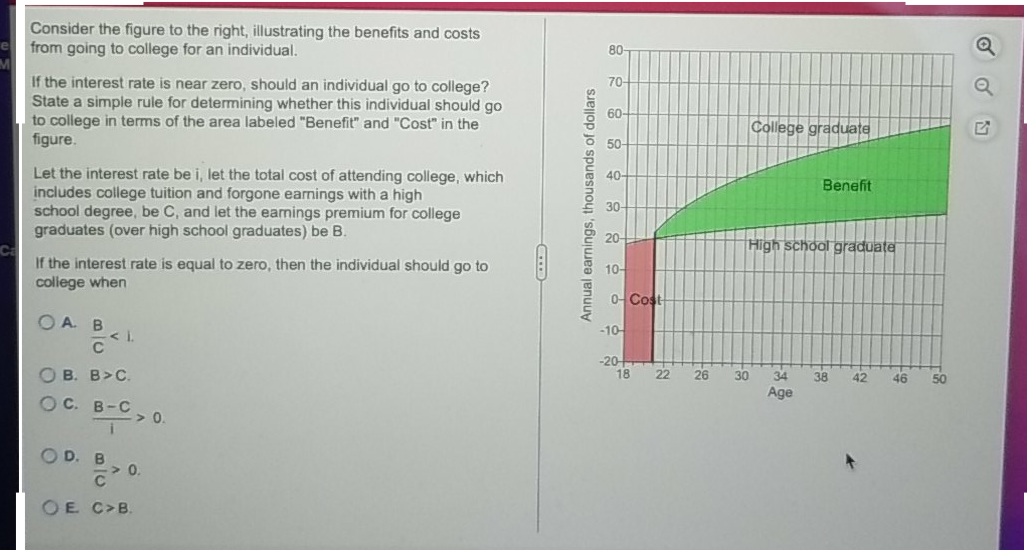

80 Consider the figure to the right, illustrating the benefits and costs from going to college for an individual. If the interest rate is near zero, should an individual go to college? State a simple rule for determining whether this individual should go to college in terms of the area labeled "Benefit" and "Cost" in the figure 70 60 College graduate 50 40 Benefit Let the interest rate be i, let the total cost of attending college, which includes college tuition and forgone earnings with a high school degree, be C, and let the earnings premium for college graduates (over high school graduates) be B. If the interest rate is equal to zero, then the individual should go to college when Annual earnings, thousands of dollars 30 20 High school graduate 10- 0-Cost OA. B - 10 -20 OB. B>C 18 22 26 30 38 42 46 50 34 Age OC. B-C > O. i OD. B -> 0 O E C>B If all the coal in the ground, Q, is to be consumed in two years and the demand for coal is -E Q = A (PL) in each year t where e is a constant demand elasticity, what is the price of coal each year? Let the interest rate be i. The price of coal in the first year is P1 A. B. E such that Q=A = A (P4) +A(P1(1+i)) and the price in the second year is P2 = P1(1+i). such that Q=A A (P1) and the price in the second year is P2 such that Q=A (P2) O C. such that p1 = P2(1 + i) and the price in the second year is P2 such that Q=A A(P2) +A(P2(1 + i)) and the price of coal in the second year is P2 such that Q=A = A (P2) +A (P2(1+i)) E. such that Q=A (P1(1+i)) and the price in the second year is P2 =P (1+i). E D. O TE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts