Question: please I need 29 and 30 Question 29 1 pts The book value of a machine was calculated as $13 million at the end of

please I need 29 and 30

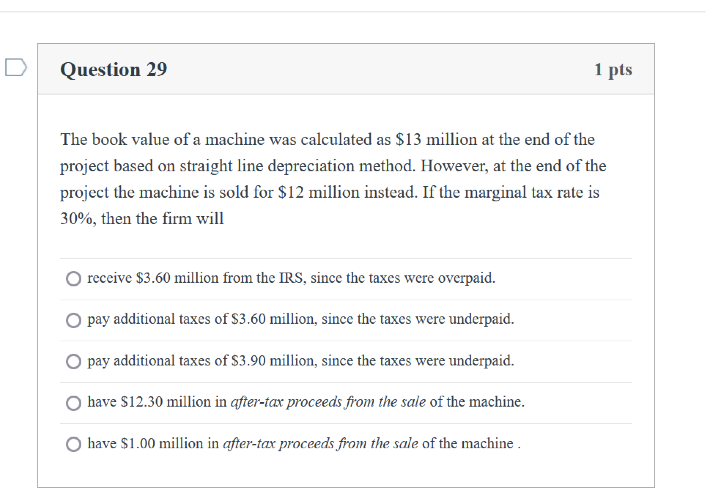

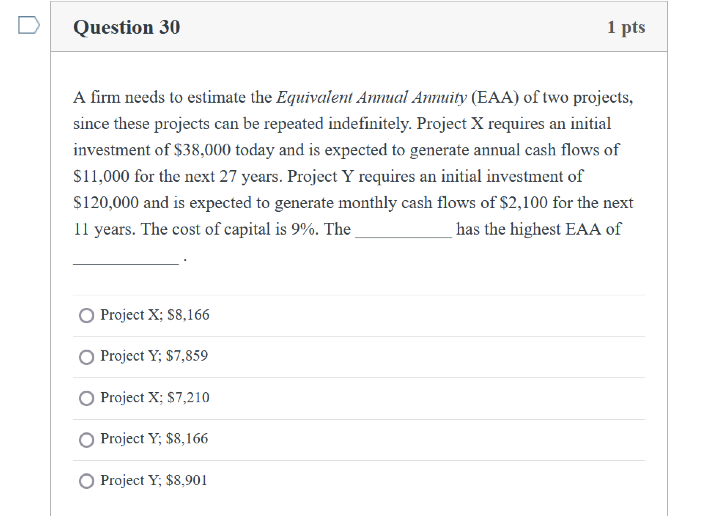

Question 29 1 pts The book value of a machine was calculated as $13 million at the end of the project based on straight line depreciation method. However, at the end of the project the machine is sold for $12 million instead. If the marginal tax rate is 30%, then the firm will receive $3.60 million from the IRS, since the taxes were overpaid. O pay additional taxes of $3.60 million, since the taxes were underpaid. pay additional taxes of $3.90 million, since the taxes were underpaid. have $12.30 million in after-tax proceeds from the sale of the machine. have $1.00 million in after-tax proceeds from the sale of the machine. Question 30 1 pts A firm needs to estimate the Equivalent Annual Annuity (EAA) of two projects, since these projects can be repeated indefinitely. Project X requires an initial investment of $38,000 today and is expected to generate annual cash flows of $11,000 for the next 27 years. Project Y requires an initial investment of $120,000 and is expected to generate monthly cash flows of $2,100 for the next 11 years. The cost of capital is 9%. The has the highest EAA of Project X; $8,166 Project Y; $7,859 Project X; $7,210 Project Y; $8,166 Project Y; $8,901

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts