Question: Please I need a help in m project. Do you think you can help me with it? What I need pretty much is the calculations

Please I need a help in m project. Do you think you can help me with it?

What I need pretty much is the calculations

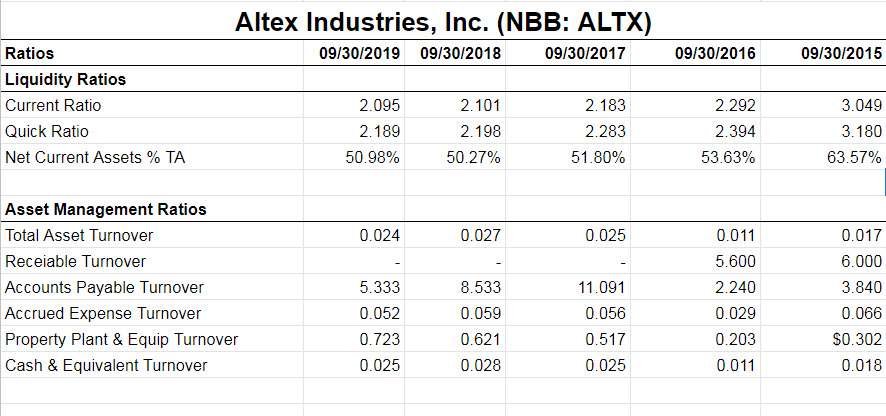

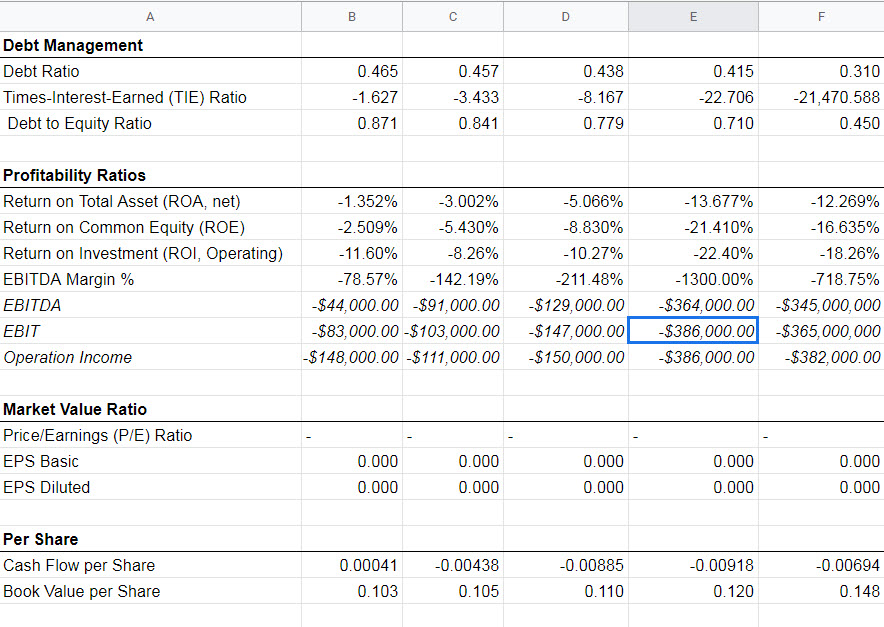

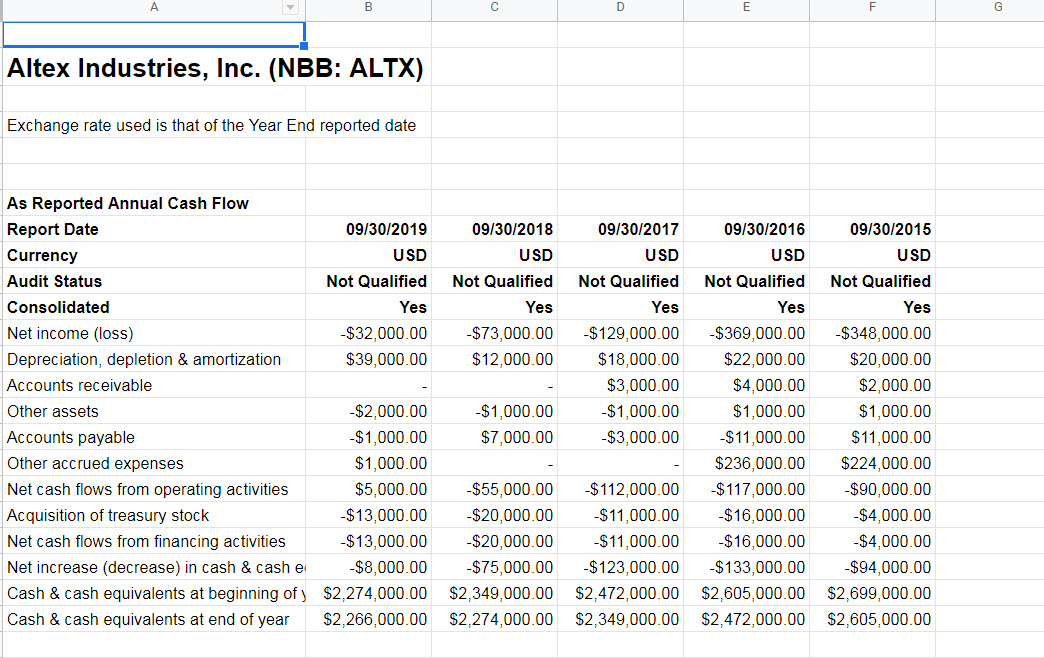

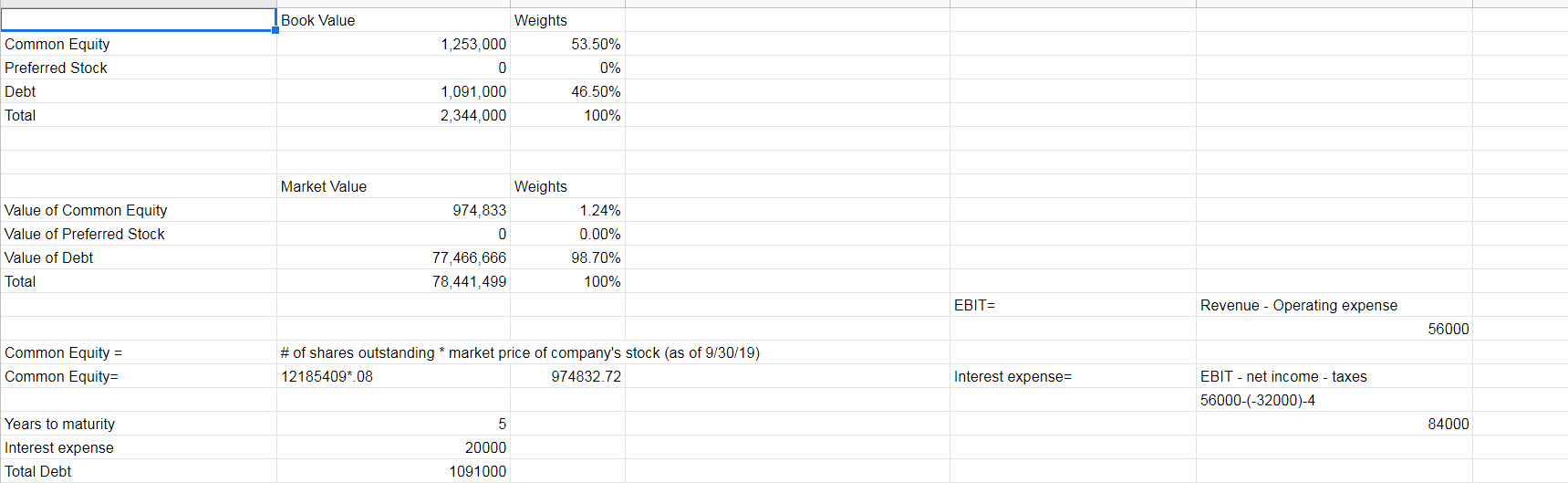

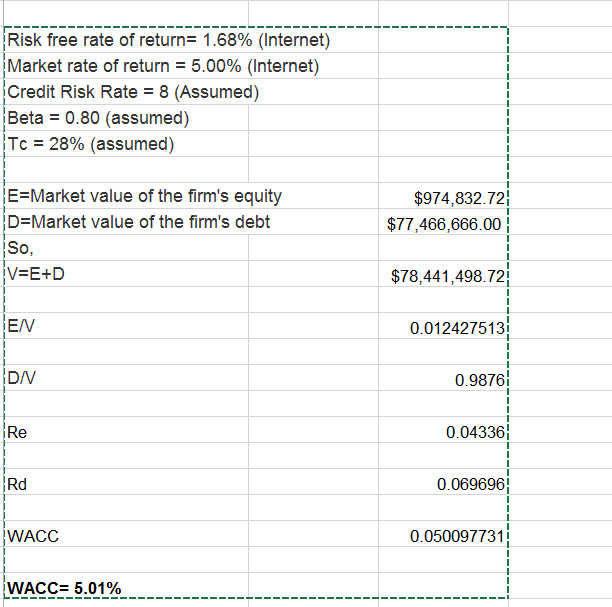

Altex Industries, Inc. (NBB: ALTX) Ratios 09/30/2019 09/30/2018 09/30/2017 09/30/2016 09/30/2015 Liquidity Ratios Current Ratio 2.095 2.101 2.183 2.292 3.049 Quick Ratio 2.189 2.198 2.283 2.394 3.180 Net Current Assets % TA 50.98% 50.27% 51.80% 53.63% 63.57% Asset Management Ratios Total Asset Turnover 0.024 0.027 0.025 0.011 0.017 Receiable Turnover 5.600 6.000 Accounts Payable Turnover 5.333 8.533 11.091 2.240 3.840 Accrued Expense Turnover 0.052 0.059 0.056 0.029 0.066 Property Plant & Equip Turnover 0.723 0.621 0.517 0.203 $0.302 Cash & Equivalent Turnover 0.025 0.028 0.025 0.011 0.018A B C D E F Debt Management Debt Ratio 0.465 0.457 0.438 0.415 0.310 Times-Interest-Earned (TIE) Ratio -1.627 -3.433 -8.167 -22.706 -21,470.588 Debt to Equity Ratio 0.871 0.841 0.779 0.710 0.450 Profitability Ratios Return on Total Asset (ROA, net) -1.352% -3.002% -5.066% -13.677% -12.269% Return on Common Equity (ROE) -2.509% -5.430% -8.830% -21.410% -16.635% Return on Investment (ROI, Operating) -11.60% -8.26% -10.27% 22.40% -18.26% EBITDA Margin % -78.57% -142.19% 211.48% -1300.00% 718.75% EBITDA -$44,000.00 -$91,000.00 -$129,000.00 $364,000.00 -$345,000,000 EBIT -$83, 000.00 -$103,000.00 -$147,000.00 -$386,000.00 -$365,000, 000 Operation Income $148,000.00 -$111,000.00 -$150,000.00 -$386,000.00 -$382,000.00 Market Value Ratio Price/Earnings (P/E) Ratio EPS Basic 0.000 0.000 0.000 0.000 0.000 EPS Diluted 0.000 0.000 0.000 0.000 0.000 Per Share Cash Flow per Share 0.00041 0.00438 -0.00885 -0.00918 -0.00694 Book Value per Share 0. 103 0. 105 0.110 0.120 0.148A B C D E F G Altex Industries, Inc. (NBB: ALTX) Exchange rate used is that of the Year End reported date As Reported Annual Cash Flow Report Date 09/30/2019 09/30/2018 09/30/2017 09/30/2016 09/30/2015 Currency USD USD USD USD USD Audit Status Not Qualified Not Qualified Not Qualified Not Qualified Not Qualified Consolidated Yes Yes Yes Yes Yes Net income (loss) -$32,000.00 -$73,000.00 -$129,000.00 -$369,000.00 -$348,000.00 Depreciation, depletion & amortization $39,000.00 $12,000.00 $18,000.00 $22,000.00 $20,000.00 Accounts receivable $3,000.00 $4,000.00 $2,000.00 Other assets -$2,000.00 -$1,000.00 -$1,000.00 $1,000.00 $1,000.00 Accounts payable -$1,000.00 $7,000.00 -$3,000.00 -$11,000.00 $11,000.00 Other accrued expenses $1,000.00 $236,000.00 $224,000.00 Net cash flows from operating activities $5,000.00 $55,000.00 -$112,000.00 -$117,000.00 -$90,000.00 Acquisition of treasury stock -$13,000.00 -$20,000.00 -$11,000.00 -$16,000.00 -$4,000.00 Net cash flows from financing activities -$13,000.00 -$20,000.00 -$11,000.00 -$16,000.00 -$4,000.00 Net increase (decrease) in cash & cash e -$8,000.00 -$75,000.00 -$123,000.00 -$133,000.00 -$94,000.00 Cash & cash equivalents at beginning of ) $2,274,000.00 $2,349,000.00 $2,472,000.00 $2,605,000.00 $2,699,000.00 Cash & cash equivalents at end of year $2,266,000.00 $2,274,000.00 $2,349,000.00 $2,472,000.00 $2,605,000.00Book Value Weights Common Equity 1,253,000 53.50% Preferred Stock 0% Debt 1,091,000 46.50% Total 2,344,000 100% Market Value Weights Value of Common Equity 974,833 1.24% Value of Preferred Stock 0.00% Value of Debt 77,466,666 98.70% Total 78,441,499 100% EBIT= Revenue - Operating expense 56000 Common Equity = # of shares outstanding * market price of company's stock (as of 9/30/19) Common Equity= 12185409* 08 974832.72 Interest expense= EBIT - net income - taxes 56000-(-32000)-4 Years to maturity 5 84000 Interest expense 20000 Total Debt 1091000Risk free rate of return= 1.68% (Internet) Market rate of return = 5.00% (Internet) Credit Risk Rate = 8 (Assumed) Beta = 0.80 (assumed) Tc = 28% (assumed) E=Market value of the firm's equity $974,832.72; D=Market value of the firm's debt $77 466,666.00 So, V=E+D $78,441,498.72 E/ 0.012427513 D/V 0.9876 iRe 0.04336; Rd 0.069696! WACC 0.050097731 WACC= 5.01%