Question: please I need all the requirements done Comparative financial statement data of Carlton Optical Mart follow (Click on the icon to view the income statements.)

please I need all the requirements done

please I need all the requirements done

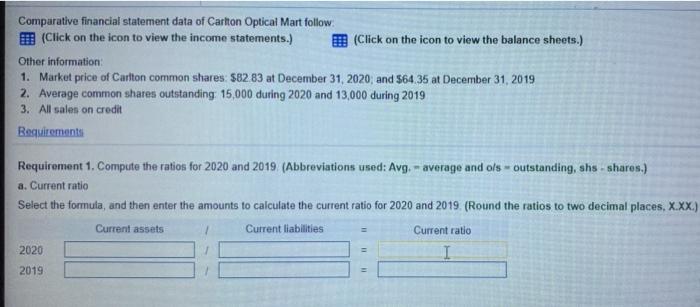

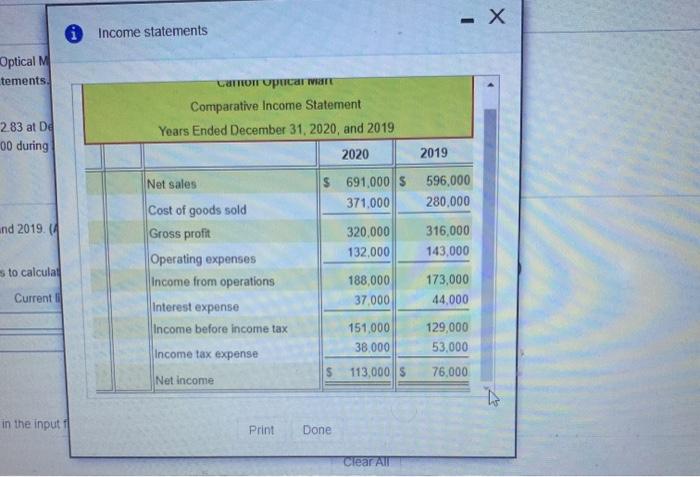

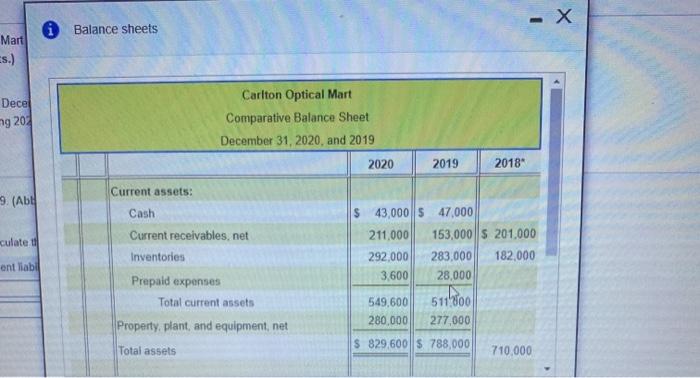

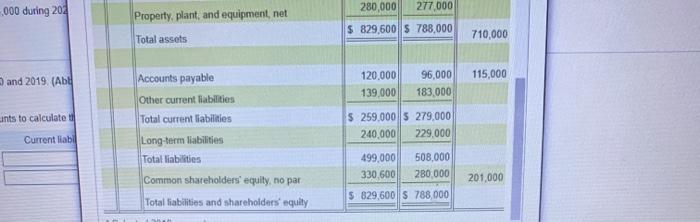

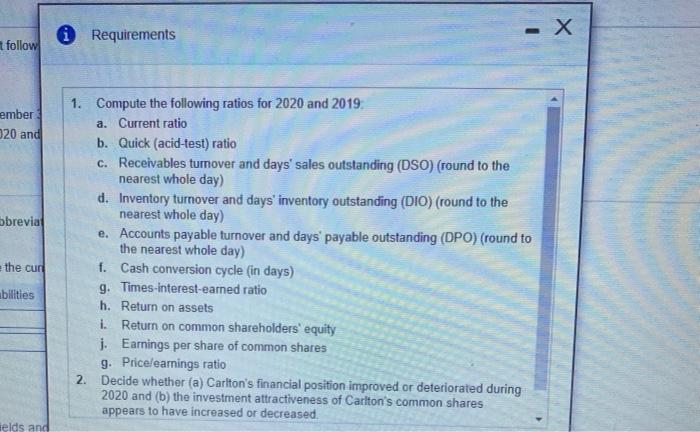

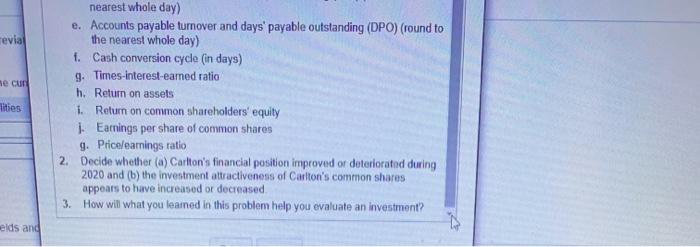

Comparative financial statement data of Carlton Optical Mart follow (Click on the icon to view the income statements.) (Click on the icon to view the balance sheets.) Other information: 1. Market price of Carlton common shares $82 83 at December 31, 2020; and $64.35 at December 31, 2019 2. Average common shares outstanding: 15,000 during 2020 and 13,000 during 2019 3. All sales on credit Requirements Requirement 1. Compute the ratios for 2020 and 2019 (Abbreviations used: Avg. - average and ols - outstanding, shs - shares.) a. Current ratio Select the formula, and then enter the amounts to calculate the current ratio for 2020 and 2019. (Round the ratios to two decimal places, X.XX.) Current assets Current liabilities Current ratio 2020 I 2019 - i Income statements Optical M tements LOTTO UPC Comparative Income Statement Years Ended December 31, 2020, and 2019 2.83 at De 00 during 2020 2019 $ 691,000 S 371.000 596,000 280,000 nd 2019. 320,000 132,000 316,000 143,000 sto calculat Net sales Cost of goods sold Gross profit Operating expenses Income from operations interest expense Income before income tax Income tax expense Net income 188,000 37 000 173,000 44,000 Current 151,000 38.000 129,000 53,000 113,000 $ 76,000 in the input i Print Done Clear All Balance sheets Mart s.) Decel ng 20 Carlton Optical Mart Comparative Balance Sheet December 31, 2020, and 2019 2020 2019 2018 Current assets: 9. (A culatett Cash Current receivables, net Inventories Prepaid expenses Total current assets Property, plant, and equipment, net $ 43,000 $ 47,000 211,000 153,000||$ 201,000 292,000 283,000 182,000 3.600 28,000 ont liab 549,600 280,000 511800 277,000 Total assets $ 829,600 $ 788,000 710,000 000 during 203 Property, plant, and equipment, net 280,000 277.000 $ 829,600 $ 788,000 Total assets 710,000 115,000 and 2019. (Aby 120,000 139,000 96,000 183,000 unts to calculate $ 259.000 5 279.000 240,000 229,000 Current liabil Accounts payable Other current liabilities Total current liabilities Long-term liabilities Total liabilities Common shareholders' equity, no par Total liabilities and shareholders' equity 499,000 330,600 508.000 280.000 201,000 $ 829,600 S 788,000 - i Requirements - t follow ember 20 and bbrevia 1. Compute the following ratios for 2020 and 2019. a. Current ratio b. Quick (acid-test) ratio c. Receivables turnover and days' sales outstanding (DSO) (round to the nearest whole day) d. Inventory turnover and days' inventory outstanding (DIO) (round to the nearest whole day) e. Accounts payable turnover and days' payable outstanding (DPO) (round to the nearest whole day) f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assets i. Return on common shareholders' equity j. Earnings per share of common shares g. Pricelearnings ratio 2. Decide whether (a) Carlton's financial position improved or deteriorated during 2020 and (b) the investment attractiveness of Carlton's common shares appears to have increased or decreased the cur abilities delds and revia e cur lities nearest whole day) e. Accounts payable tumover and days' payable outstanding (DPO) (round to the nearest whole day) 1. Cash conversion cycle (in days) 9. Times-interest-eared ratio h. Return on assets i. Return on common shareholders' equity 1. Earnings per share of common shares 9. Prior/earnings ratio 2. Decide whether (a) Carlton's financial position improved or deteriorated during 2020 and (b) the investment attractiveness of Carlton's common shares appears to have increased or decreased 3. How will what you leared in this problem help you evaluate an investment? elds and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts