Question: please i need answer for this asp. Calculator A machine with a useful life of 6 years and a residual value of $3,000 was purchased

please i need answer for this asp.

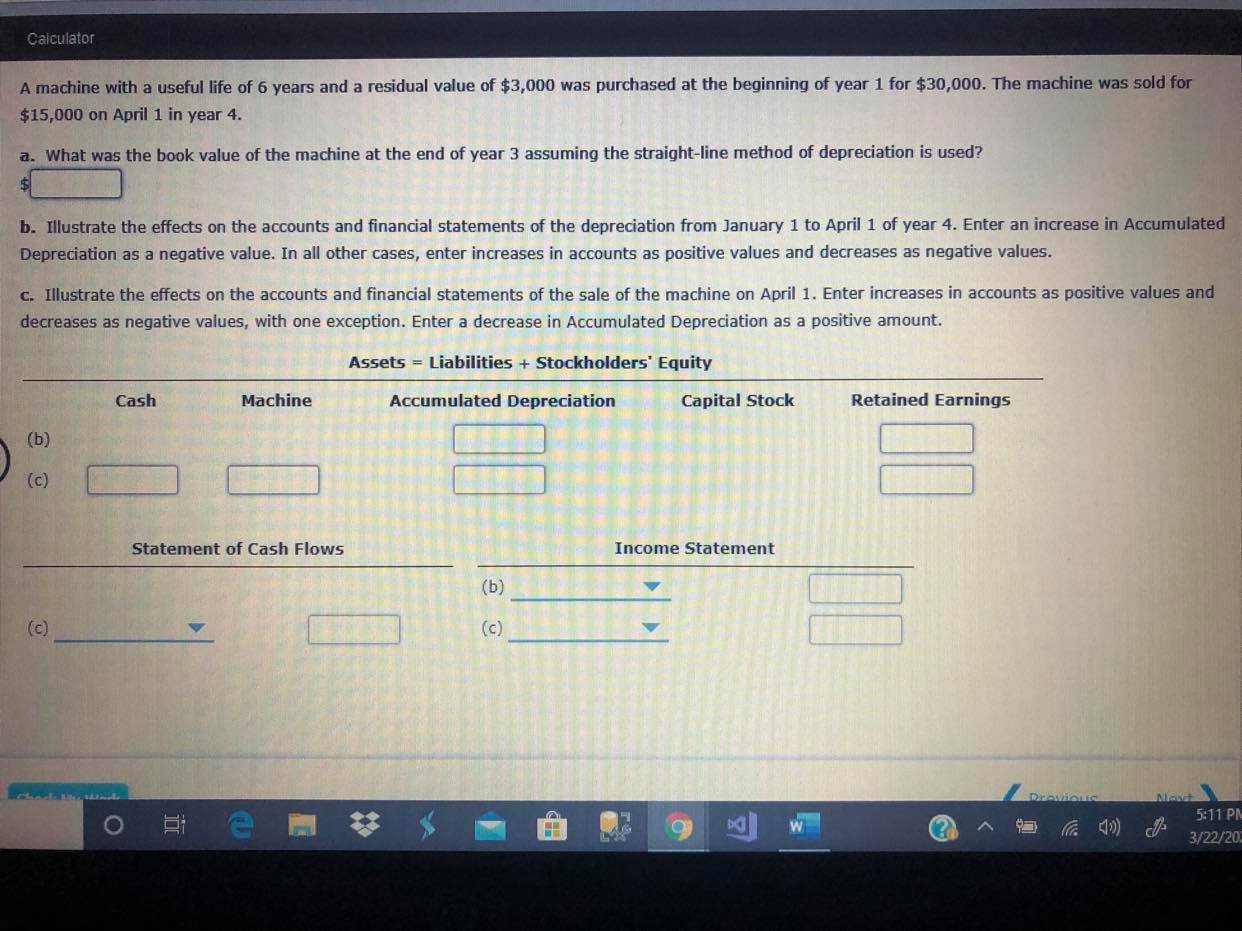

Calculator A machine with a useful life of 6 years and a residual value of $3,000 was purchased at the beginning of year 1 for $30,000. The machine was sold for $15,000 on April 1 in year 4. a. What was the book value of the machine at the end of year 3 assuming the straight-line method of depreciation is used? $ b. Illustrate the effects on the accounts and financial statements of the depreciation from January 1 to April 1 of year 4. Enter an increase in Accumulated Depreciation as a negative value. In all other cases, enter increases in accounts as positive values and decreases as negative values. c. Illustrate the effects on the accounts and financial statements of the sale of the machine on April 1. Enter increases in accounts as positive values and decreases as negative values, with one exception. Enter a decrease in Accumulated Depreciation as a positive amount. Assets = Liabilities + Stockholders' Equity Cash Machine Accumulated Depreciation Capital Stock Retained Earnings (b) (C) Statement of Cash Flows Income Statement (b) (c) (c ) O Fi e W 5:11 P 3/22/20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts