Question: please i need both 34 and 35 Question 34 1 pts A firm needs to decide between two mutually exclusive projects. Project Alpha requires an

please i need both 34 and 35

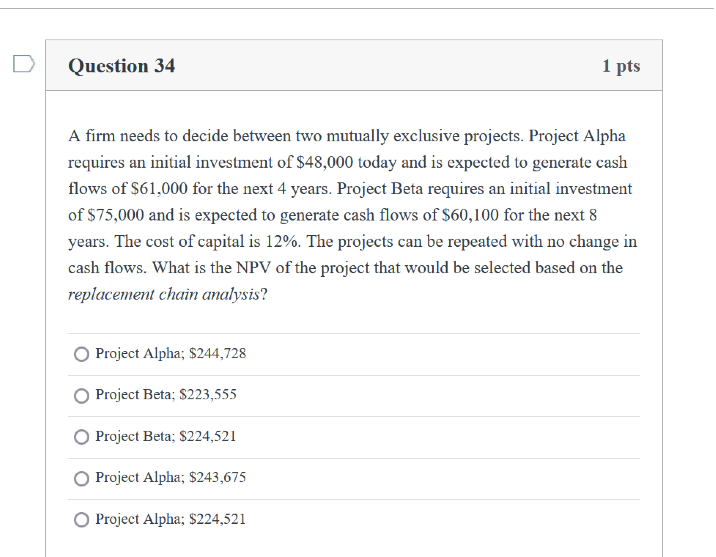

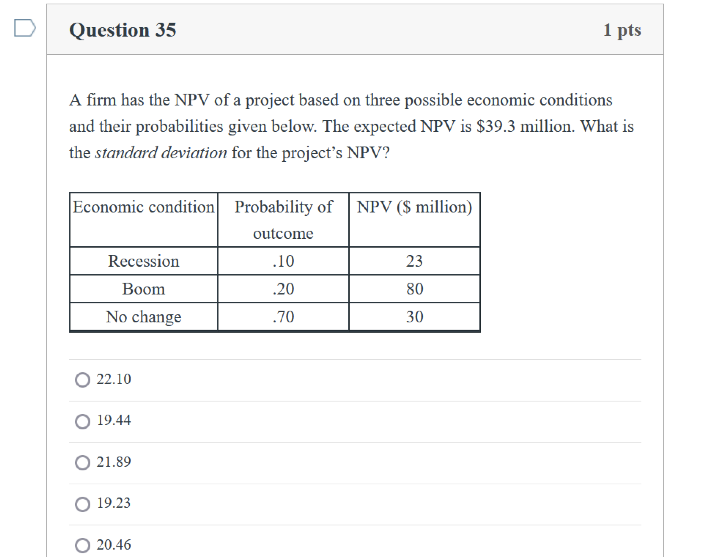

Question 34 1 pts A firm needs to decide between two mutually exclusive projects. Project Alpha requires an initial investment of $48,000 today and is expected to generate cash flows of $61,000 for the next 4 years. Project Beta requires an initial investment of $75,000 and is expected to generate cash flows of $60,100 for the next 8 years. The cost of capital is 12%. The projects can be repeated with no change in cash flows. What is the NPV of the project that would be selected based on the replacement chain analysis? Project Alpha; $244,728 Project Beta; $223,555 Project Beta: $224,521 Project Alpha; $243,675 Project Alpha; $224,521 Question 35 1 pts A firm has the NPV of a project based on three possible economic conditions and their probabilities given below. The expected NPV is $39.3 million. What is the standard deviation for the project's NPV? Economic condition Probability of NPV ($ million) outcome Recession .10 23 Boom .20 80 No change .70 30 22.10 O 19.44 O 21.89 19.23 O 20.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts