Question: please I need complete answer for all months. Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May,

please I need complete answer for all months.

please I need complete answer for all months.

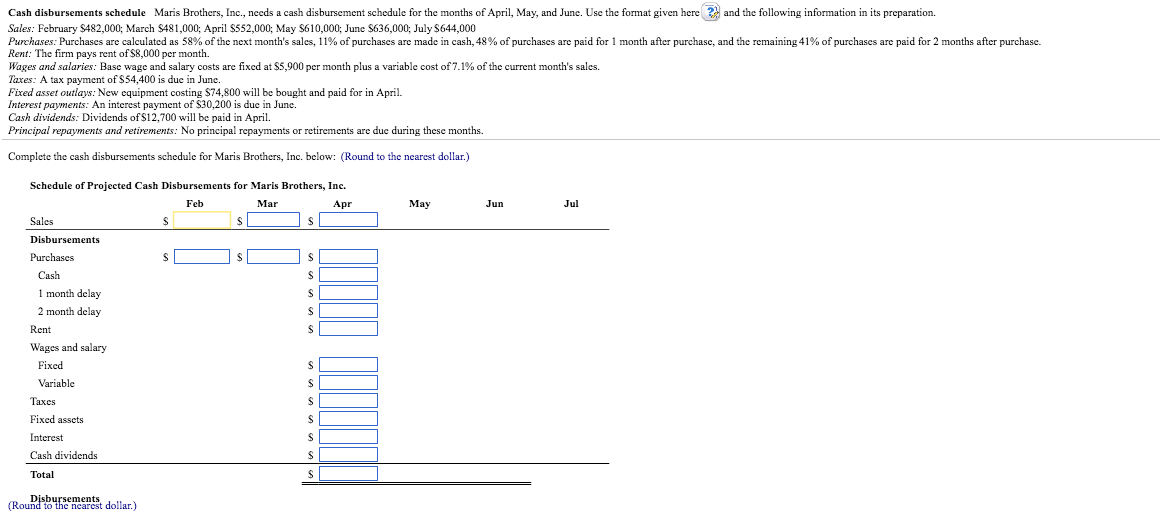

Cash disbursements schedule Maris Brothers, Inc., needs a cash disbursement schedule for the months of April, May, and June. Use the format given here and the following information in its preparation. Sales: February $482,000: March $481,000; April $552,000: May $610, 000: June $636,000: July $644,000 Purchases: Purchases are calculated as 58% of the next month's sales, 11% of purchases arc made in cash, 48% of purchases are paid for 1 month after purchase, and the remaining 41% of purchases are paid for 2 months after purchase. Rent: The firm pays rent of $8,000 per month. Wages and salaries: Base wage and salary costs are fixed at $5,900 per month plus a variable cost of 7.1% of the current month's sales. Taxes: A tax payment of S 54.400 is due in June. Fixed asset outlays: New equipment costing S74.800 will be bought and paid for in April. Interest payments: An interest payment of $30.200 is due in June. Cash dividends: Dividends of $12,700 will be paid in April. Principal repayments and retirements: No principal repayments or retirements are due during these months. Complete the cash disbursements schedule for Maris Brothers, Inc. below: (Round to the nearest dollar.) Schedule of Projected Cash Disbursements for Maris Brothers, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts