Question: please i need great answer and long clear answer. 7:58 Assignment 3 FIN101.docx Assignment 3 FIN101 Coune Name: Principles of Finance Student's Name Course Code:

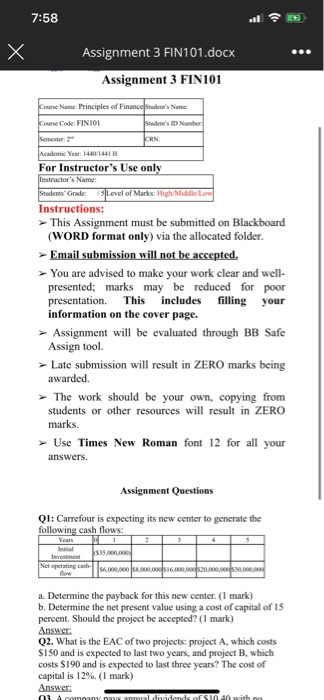

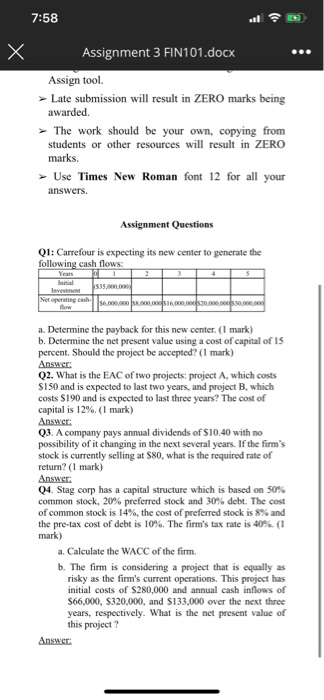

7:58 Assignment 3 FIN101.docx Assignment 3 FIN101 Coune Name: Principles of Finance Student's Name Course Code: FINIO Student's ID Number Semester 2 KRN Academic Year: 1440/1441 H For Instructor's Use only Instructor's Name: Students' Grade: Level of Marks: High Middle Low Instructions: This Assignment must be submitted on Blackboard (WORD format only) via the allocated folder. Email submission will not be accepted. You are advised to make your work clear and well- presented; marks may be reduced for poor presentation. This includes filling your information on the cover page. Assignment will be evaluated through BB Safe Assign tool. Late submission will result in ZERO marks being awarded. The work should be your own, copying from students or other resources will result in ZERO marks. Use Times New Roman font 12 for all your answers. Assignment Questions Q1: Carrefour is expecting its new center to generate the following cash flows: $35.000000 Net operating calls.co.000 S.000.000 16.000.000.000.000.000.00 a. Determine the payback for this new center. (1 mark) b. Determine the net present value using a cost of capital of 15 percent. Should the project be accepted? (1 mark) Answer: Q2. What is the EAC of two projects: project A, which costs S150 and is expected to last two years, and project B, which costs $190 and is expected to last three years? The cost of capital is 12%. (1 mark) Answer: 03 A man annual dividends of an with 7:58 Assignment 3 FIN101.docx Assign tool. > Late submission will result in ZERO marks being awarded. The work should be your own, copying from students or other resources will result in ZERO marks. > Use Times New Roman font 12 for all your answers. Assignment Questions Q1: Carrefour is expecting its new center to generate the following cash flows: Years 1234L 535,000,000 Net operating cash 6.000.000 .000.000 .000.000 . 0 a. Determine the payback for this new center. (1 mark) b. Determine the net present value using a cost of capital of 15 percent. Should the project be accepted? (1 mark) Answer: Q2. What is the EAC of two projects: project A, which costs $150 and is expected to last two years, and project B, which costs $190 and is expected to last three years? The cost of capital is 12% (1 mark) Answer: Q3. A company pays annual dividends of $10.40 with no possibility of it changing in the next several years. If the firm's stock is currently selling at $80, what is the required rate of return? (1 mark) Answer: Q4. Stag corp has a capital structure which is based on 50% common stock, 20% preferred stock and 30% debt. The cost of common stock is 14%, the cost of preferred stock is 8% and the pre-tax cost of debt is 10%. The firm's tax rate is 40% (1 mark) a. Calculate the WACC of the firm, b. The firm is considering a project that is equally as risky as the firm's current operations. This project has initial costs of $280,000 and annual cash inflows of $66.000, S320,000, and $133,000 over the next three years, respectively. What is the net present value of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts